The Consumer Financial Protection Bureau is considering barring credit reporting agencies from including medical debt on credit reports, according to the agency’s director, Rohit Chopra.

“In theory, credit reports are supposed to be an accurate repository of data about whether you have met your obligations on loans you have taken out. This theory is far from reality,” Chopra said during a virtual press conference Tuesday. “To make things worse, credit reports include items like unpaid medical bills, where patients frequently do not know what services will be performed and what they will be charged.

The statements accompany a new report issued by the CFPB estimating that there is $88 billion in medical debt on Americans’ consumer credit records as of June of last year, affecting about 20% of U.S. households. Meanwhile, the agency said that medical debt entries are less predictive of future payment problems than other sorts of debt in which consumers more knowingly take on.

Chopra called on the nation’s three largest credit reporting agencies — Equifax Inc. EFX, +0.32%, Experian PLC EXPN, +1.75% and TransUnion TRU, +1.16% to not include misleading medical debts on consumer reports and said that the CFPB “will be assessing whether it’s appropriate for unpaid medical billing data to be included on credit reports altogether.”

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

The truth about hair, skin and nails supplementsWant shinier, healthier hair? How about fewer wrinkles and stronger fingernails? What if you could get it from a pill? Well, that’s what some supplements promise.

The truth about hair, skin and nails supplementsWant shinier, healthier hair? How about fewer wrinkles and stronger fingernails? What if you could get it from a pill? Well, that’s what some supplements promise.

続きを読む »

Experian Go Can Generate A Credit Score For Those Without OneExperian, one of the nation’s three main consumer credit bureaus, recently launched an app-based program called Experian Go aimed at helping people without credit or very little credit take the first step towards creating a credit report and credit score. According to Experian’s research, at least 28 million people are credit invisible in the U.S., […]

Experian Go Can Generate A Credit Score For Those Without OneExperian, one of the nation’s three main consumer credit bureaus, recently launched an app-based program called Experian Go aimed at helping people without credit or very little credit take the first step towards creating a credit report and credit score. According to Experian’s research, at least 28 million people are credit invisible in the U.S., […]

続きを読む »

Colorado’s Shambhala Mountain Center files for Chapter 11 bankruptcy protectionThe Shambhala Mountain Center in Larimer County filed for Chapter 11 bankruptcy protection as it restructures debt in the wake of financial struggles brought on by the pandemic, the Shambhala Buddhism sexual misconduct scandal and the Cameron Peak fire.

Colorado’s Shambhala Mountain Center files for Chapter 11 bankruptcy protectionThe Shambhala Mountain Center in Larimer County filed for Chapter 11 bankruptcy protection as it restructures debt in the wake of financial struggles brought on by the pandemic, the Shambhala Buddhism sexual misconduct scandal and the Cameron Peak fire.

続きを読む »

Consumer watchdog fires warning shot to lenders over abusive auto repos as used-car prices soarThe Consumer Finance Protection Bureau issues a warning shot on Monday to lenders and loan servicers who may be 'tempted' to illegally repossess cars as used...

Consumer watchdog fires warning shot to lenders over abusive auto repos as used-car prices soarThe Consumer Finance Protection Bureau issues a warning shot on Monday to lenders and loan servicers who may be 'tempted' to illegally repossess cars as used...

続きを読む »

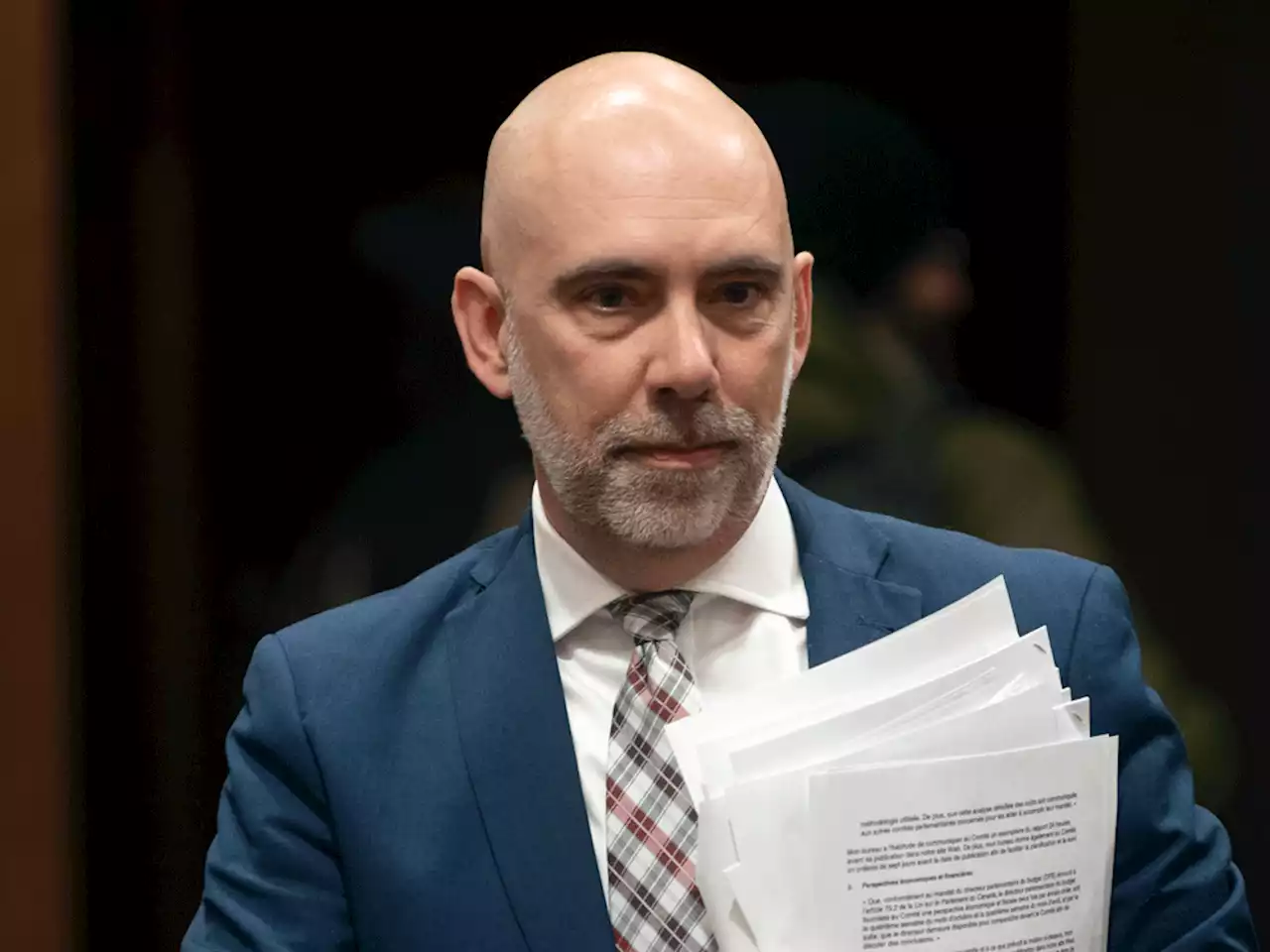

Pre-budget PBO report finds public debt higher than expected amid higher interest ratesThe PBO projects the Bank of Canada will increase its rate to 1% by the end of 2022, and it will then gradually increase until it reaches the \u0027neutral rate\u0027 of…

Pre-budget PBO report finds public debt higher than expected amid higher interest ratesThe PBO projects the Bank of Canada will increase its rate to 1% by the end of 2022, and it will then gradually increase until it reaches the \u0027neutral rate\u0027 of…

続きを読む »

Student-loan borrowers saw their credit scores soar last year, thanks to government debt reliefAmericans’ credit scores improved markedly last year, especially for people paying off student-loan debt. Median credit scores for all income groups had improved as of the third quarter of 2021, but student-loan borrowers saw the sharpest increases.

Student-loan borrowers saw their credit scores soar last year, thanks to government debt reliefAmericans’ credit scores improved markedly last year, especially for people paying off student-loan debt. Median credit scores for all income groups had improved as of the third quarter of 2021, but student-loan borrowers saw the sharpest increases.

続きを読む »