From Breakingviews - Treasury buyers live for the moment, unfortunately

by the House of Representatives on Wednesday, solves the most immediate threat to the government’s creditors. That has been enough to bring investors back to bonds they had temporarily treated with uncharacteristic caution. The 10-year Treasury yield dropped to its lowest level since May 17 on Wednesday. For Treasury bills due just one day after June 5, the day when the government could have defaulted without a political accord, yields fell to 5.

The Federal Reserve’s fight against inflation also stands to knock Treasury prices, while pushing up yields. The central bank has signaled that it won’t cut interest rates. That’s in opposition to the market, which expects rates to start falling in December, according to derivatives pricing tracked by Refinitiv. The longer rates stay high, the longer investors will push for greater returns from Treasuries.

Bondholders have a more existential problem to consider as well. Spending caps and other measures in the debt ceiling deal are projected to save $1.5 trillion over the next decade, the Congressional Budget Office said Tuesday. That’s just 7% of the $20 trillion deficit Uncle Sam is forecasted to run over the same period. Without more comprehensive savings or increased revenue, Washington will continue to spend far more than it brings in and charge toward another next debt-ceiling standoff.

The U.S. House of Representatives voted 314-117 on May 31 to suspend the debt ceiling, a legislative cap on how much the Treasury can borrow that had been set at $31.4 trillion. The legislation now moves to the Senate, where lawmakers are expected to enact the measure and advance it to President Joe Biden’s desk before the default deadline.

The U.S. federal government has run a $925 billion budget deficit in the fiscal year to date, according to the Treasury Department, $565 billion higher than the same period in the previous fiscal year.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

With His Queer Pop Anthems, Mad Tsai Rewrites American Coming-of-Age“The American dream and American coming-of-age isn’t real.' Get to know MadTsai, Gen Z's latest icon who’s reimagining a world where queer Asian and Latinx boys can become the main characters of their own stories. ⬇️

With His Queer Pop Anthems, Mad Tsai Rewrites American Coming-of-Age“The American dream and American coming-of-age isn’t real.' Get to know MadTsai, Gen Z's latest icon who’s reimagining a world where queer Asian and Latinx boys can become the main characters of their own stories. ⬇️

続きを読む »

Breakingviews - Debt deal sacrifices $140 bln return on investmentThe U.S. government could soon shrink one of its most promising investments. The budget deal agreed to by President Joe Biden and top congressional Republican Kevin McCarthy would move $20 billion away from the Internal Revenue Service over the next two years. The change shores up cash for other agencies, but projections suggest the IRS funding would’ve made a significant step toward closing the government’s $925 billion budget gap.

Breakingviews - Debt deal sacrifices $140 bln return on investmentThe U.S. government could soon shrink one of its most promising investments. The budget deal agreed to by President Joe Biden and top congressional Republican Kevin McCarthy would move $20 billion away from the Internal Revenue Service over the next two years. The change shores up cash for other agencies, but projections suggest the IRS funding would’ve made a significant step toward closing the government’s $925 billion budget gap.

続きを読む »

Breakingviews - Debt deal sacrifices $140 bln return on investmentThe U.S. government could soon shrink one of its most promising investments. The budget deal agreed to by President Joe Biden and top congressional Republican Kevin McCarthy would move $20 billion away from the Internal Revenue Service over the next two years. The change shores up cash for other agencies, but projections suggest the IRS funding would’ve made a significant step toward closing the government’s $925 billion budget gap.

Breakingviews - Debt deal sacrifices $140 bln return on investmentThe U.S. government could soon shrink one of its most promising investments. The budget deal agreed to by President Joe Biden and top congressional Republican Kevin McCarthy would move $20 billion away from the Internal Revenue Service over the next two years. The change shores up cash for other agencies, but projections suggest the IRS funding would’ve made a significant step toward closing the government’s $925 billion budget gap.

続きを読む »

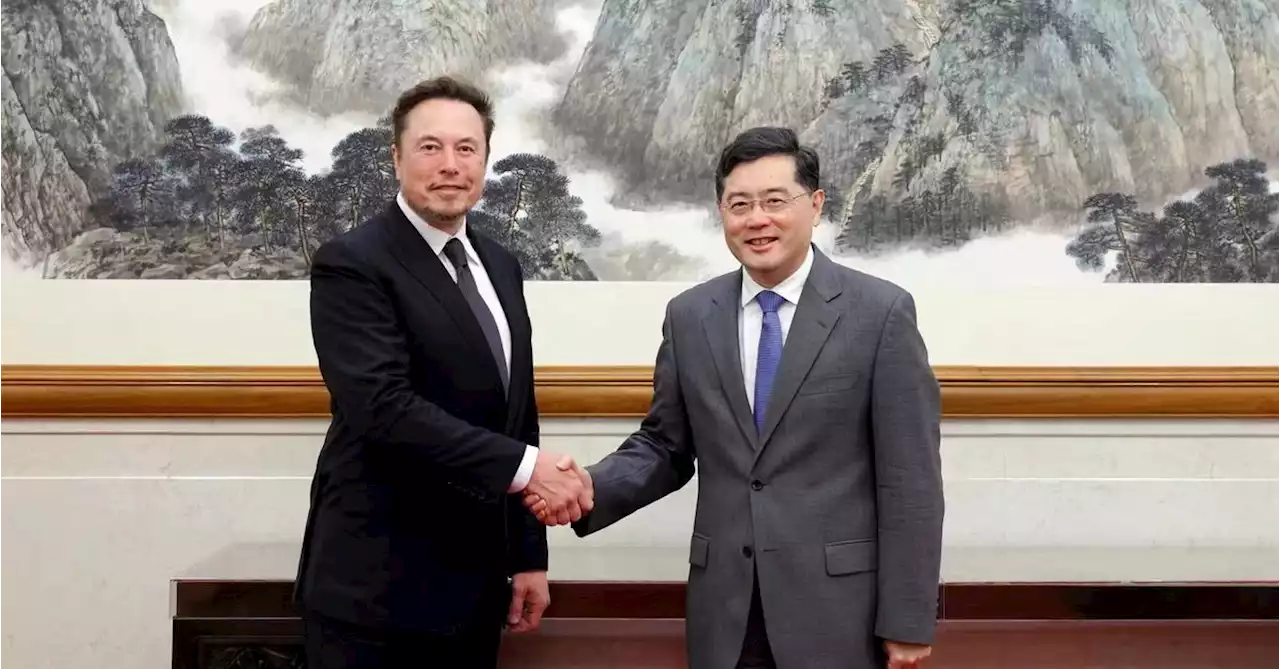

Breakingviews - Elon Musk is Beijing’s ideal foreign investorElon Musk may be China’s most popular American. The obstreperous entrepreneur landed in Beijing on Tuesday for his first visit to the country since 2020 and was immediately ushered into meeting with Foreign Minister Qin Gang. With foreign capitalists questioning the country’s investability, the central government has cause to telegraph its gratitude. Musk has given the Chinese Communist Party everything it could have reasonably expected, and more.

Breakingviews - Elon Musk is Beijing’s ideal foreign investorElon Musk may be China’s most popular American. The obstreperous entrepreneur landed in Beijing on Tuesday for his first visit to the country since 2020 and was immediately ushered into meeting with Foreign Minister Qin Gang. With foreign capitalists questioning the country’s investability, the central government has cause to telegraph its gratitude. Musk has given the Chinese Communist Party everything it could have reasonably expected, and more.

続きを読む »

Breakingviews - Chinese battery cash will fuel Europe’s EV driveChinese cash is set to fuel Europe’s green mobility challenge. More than one in five cars sold in the continent last year was electric, making the region the world’s second largest market for e-vehicles after China. That offers an enticing new opportunity for the battery makers from the People’s Republic, which already supply European brands such as Volkswagen , BMW and Stellantis , as well as globetrotting compatriots like Volvo-owner Geely. Over-reliance on Chinese market leader CATL and its peers could be a risk. But rival European battery groups are still scarce, and global carmakers have more to gain than lose.

Breakingviews - Chinese battery cash will fuel Europe’s EV driveChinese cash is set to fuel Europe’s green mobility challenge. More than one in five cars sold in the continent last year was electric, making the region the world’s second largest market for e-vehicles after China. That offers an enticing new opportunity for the battery makers from the People’s Republic, which already supply European brands such as Volkswagen , BMW and Stellantis , as well as globetrotting compatriots like Volvo-owner Geely. Over-reliance on Chinese market leader CATL and its peers could be a risk. But rival European battery groups are still scarce, and global carmakers have more to gain than lose.

続きを読む »

Breakingviews - Pru CFO exit adds urgent task to new CEO’s agendaAnil Wadhwani's honeymoon period as Prudential’s boss has ended abruptly. Just as he prepares to mark 100 days in the role, his Chief Financial Officer James Turner has unexpectedly resigned after an investigation into “a recent recruitment situation”. The company did not disclose details.

Breakingviews - Pru CFO exit adds urgent task to new CEO’s agendaAnil Wadhwani's honeymoon period as Prudential’s boss has ended abruptly. Just as he prepares to mark 100 days in the role, his Chief Financial Officer James Turner has unexpectedly resigned after an investigation into “a recent recruitment situation”. The company did not disclose details.

続きを読む »