The White House and top congressional Republicans reached a tentative debt-ceiling deal that placates both sides. Yet the compromise only delays the next spending fight and does little to address the government’s growing budget gap, BenWinck explains

U.S. President Joe Biden exits the White House to speak to reporters before boarding Marine One on the South Lawn of the White House in Washington, U.S., May 29, 2023. REUTERS/Bonnie Cash

WASHINGTON, May 30 - The U.S. government could soon shrink one of its most promising investments. The budget deal agreed to by President Joe Biden and top congressional Republican Kevin McCarthy would moveaway from the Internal Revenue Service over the next two years. The change shores up cash for other agencies, but projections suggest the IRS funding would’ve made a significant step toward closing the government’s $925 billion budget gap.

Biden approved $80 billion of new cash for the IRS in 2021, arguing the funding would strengthen enforcement and increase revenue collected by Uncle Sam. The non-partisan Congressional Budget Office backs that assertion. The CBO in 2021 that for every $1 increase to IRS funding the government would recoup $6.40 to $7.10. The $20 billion being diverted from the agency could therefore raise as much as $142 billion through 2031.the deal shouldn’t weaken tax collection. That’s unhelpful. The shift erodes one of the most obvious solutions to the government’s deficit problem: Improving enforcement is akin to, or even better than, raising taxes.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

McCarthy and Biden's debt ceiling deal could impact student-debt relief, food stampsMcCarthy and Biden's debt-ceiling deal could hurt student-loan borrowers and people on food stamps — and cost some Americans their jobs

続きを読む »

Breakingviews - Aussie billionaires’ solar spat enters new phaseThe battle between two of Australia’s richest men for control of bankrupt renewables startup Sun Cable has ended in a whimper. On Friday Mike Cannon-Brookes, co-chief of technology company Atlassian, won the auction for the firm via his Grok Ventures fund, bidding less than A$100 million ($65 million) per an estimate by the Australian Financial Review . Surprisingly absent from the final bout was Squadron Energy, one of Fortescue Metals founder Andrew Forrest’s investment companies. Both were early investors in Sun Cable; their spat over its strategy plunged the firm into administration in January.

Breakingviews - Aussie billionaires’ solar spat enters new phaseThe battle between two of Australia’s richest men for control of bankrupt renewables startup Sun Cable has ended in a whimper. On Friday Mike Cannon-Brookes, co-chief of technology company Atlassian, won the auction for the firm via his Grok Ventures fund, bidding less than A$100 million ($65 million) per an estimate by the Australian Financial Review . Surprisingly absent from the final bout was Squadron Energy, one of Fortescue Metals founder Andrew Forrest’s investment companies. Both were early investors in Sun Cable; their spat over its strategy plunged the firm into administration in January.

続きを読む »

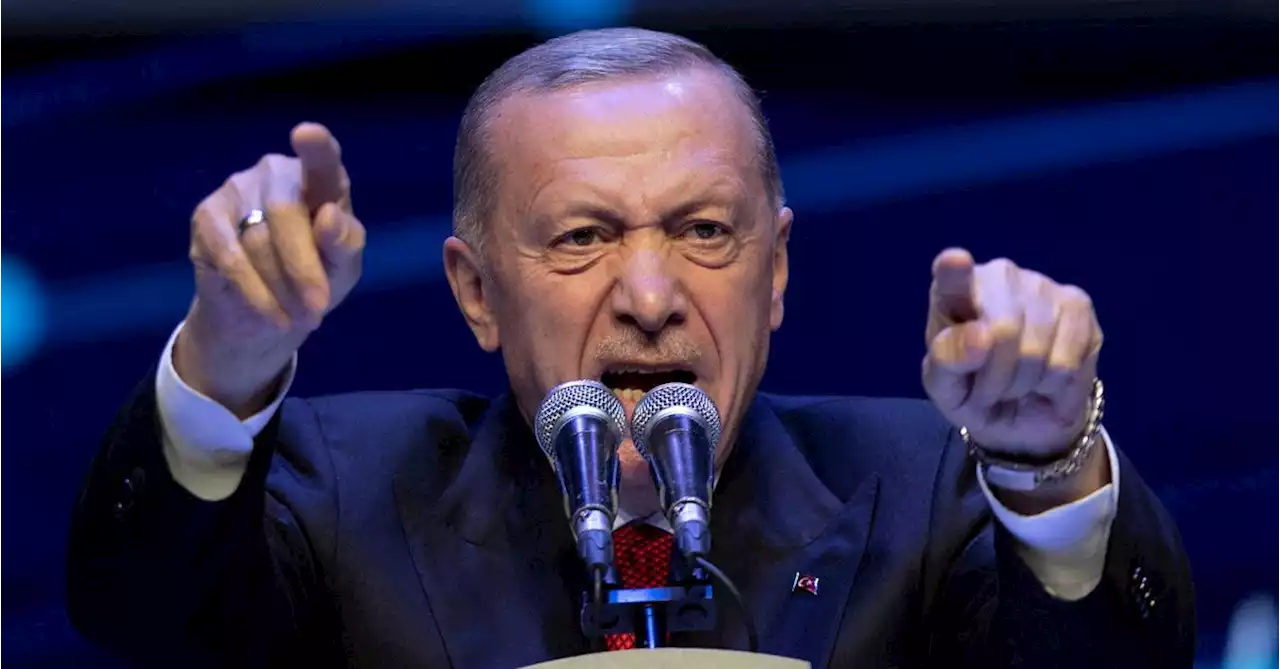

Breakingviews - Erdogan win sends stark note on economy and votesTayyip Erdogan’s re-election in Turkey sends a sharp message to leaders around the world: politics is trumping sound economics.

Breakingviews - Erdogan win sends stark note on economy and votesTayyip Erdogan’s re-election in Turkey sends a sharp message to leaders around the world: politics is trumping sound economics.

続きを読む »

Breakingviews - Saudi is a BRIC in crumbling East-West money wallMiddle East money is the answer to plugging the growing financial gaps created in Asia by Western investment restrictions, or at least that’s the very wishful thinking of the regions’ financiers and governments.

Breakingviews - Saudi is a BRIC in crumbling East-West money wallMiddle East money is the answer to plugging the growing financial gaps created in Asia by Western investment restrictions, or at least that’s the very wishful thinking of the regions’ financiers and governments.

続きを読む »

Breakingviews - How US allies can mitigate Trump 2.0A return to the White House by Donald Trump would create challenges for the world’s other rich democracies. After all, the former President likes Russia's Vladimir Putin, is sceptical about climate change and favours “Make America Great Again” protectionism. The best insurance policy for remaining members of the Group of Seven wealthy nations is to ramp up support for Ukraine, promote free trade and speed up action on global warming.

Breakingviews - How US allies can mitigate Trump 2.0A return to the White House by Donald Trump would create challenges for the world’s other rich democracies. After all, the former President likes Russia's Vladimir Putin, is sceptical about climate change and favours “Make America Great Again” protectionism. The best insurance policy for remaining members of the Group of Seven wealthy nations is to ramp up support for Ukraine, promote free trade and speed up action on global warming.

続きを読む »

Breakingviews - Syngenta’s IPO is more relief than triumphSyngenta’s $9 billion Chinese market listing finally looks ripe. Concerns about its share sale size forced the Switzerland-based agrichemical giant to opt for a last-minute venue change. Sadly, few foreign investors are likely to join its Shanghai debut party.

Breakingviews - Syngenta’s IPO is more relief than triumphSyngenta’s $9 billion Chinese market listing finally looks ripe. Concerns about its share sale size forced the Switzerland-based agrichemical giant to opt for a last-minute venue change. Sadly, few foreign investors are likely to join its Shanghai debut party.

続きを読む »