Silicon Valley Bank's swift collapse was predicated more on the whims of venture capitalist influencers than financial reality, writes JenWieczner

Eventually, the panic reached a tipping point, and even people who’d held faith in SVB had to ask for their money back. After all, there was a lot of risk in keeping it in a bank that might fail, but virtually no downside to moving it. “What I heard was universal: try to get out whatever you can,” says Daniel Schmerin, the co-founder and president of Metaversal, a firm that invests in NFTs and Web3 technology.

The original seed of doubt, though, may well have been inadvertently planted by the bank itself. A press release late Wednesday afternoon from Silicon Valley Bank announced, in a bunch of financial mumbo jumbo, a stock offering involving “1/20th interest in a share” and a sale of assets at a $1.8 billion loss. It was difficult to parse and offered no reassurances.It made sense. WHAT they said, WHO the audience was, WHEN they did it, and HOW they framed it.

One major difference between the GameStop and SVB sagas is the winners and losers each produced. With GameStop, Redditors got rich , and the collapse of the investors shorting the stock at least gave them a sense of perceived victory over an adversary. In the case of Silicon Valley Bank, the startups and VCs who perpetrated the collapse have lost an ally.

Erik Anderson, a former VC turned CEO, had managed to raise a fresh round of financing for his company SIQ Basketball, which makes a “smart” basketball with a corresponding app, just two weeks ago. He had deposited all the money, more than a million dollars, into Silicon Valley Bank. He tried to move the money out on Thursday, but the wire transfer still had not come through after SVB failed.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

![]() Silicon Valley Bank spooks Silicon ValleySilicon Valley Bank, long one of the most popular financial institutions among tech and life sciences startups, saw its shares fall more than 60% on Thursday, wiping out a whopping $9.4 billion in market value.

Silicon Valley Bank spooks Silicon ValleySilicon Valley Bank, long one of the most popular financial institutions among tech and life sciences startups, saw its shares fall more than 60% on Thursday, wiping out a whopping $9.4 billion in market value.

続きを読む »

![]() Column: The Silicon Valley Bank collapse is Silicon Valley's problem, not yours'Based on the information that has been made public, the bank unwisely put its eggs in one basket by taking deposits from an insular group of depositors: venture-funded startups.' Column by hiltzikm:

Column: The Silicon Valley Bank collapse is Silicon Valley's problem, not yours'Based on the information that has been made public, the bank unwisely put its eggs in one basket by taking deposits from an insular group of depositors: venture-funded startups.' Column by hiltzikm:

続きを読む »

![]() Why Silicon Valley Bank's crisis is rattling America's biggest banksWith the Fed raising interest rates at a rapid clip, Silicon Valley Bank saw the value of their existing bonds get lower — ultimately selling their assets and taking a $1.8 billion loss.

Why Silicon Valley Bank's crisis is rattling America's biggest banksWith the Fed raising interest rates at a rapid clip, Silicon Valley Bank saw the value of their existing bonds get lower — ultimately selling their assets and taking a $1.8 billion loss.

続きを読む »

![]() A Tale of 2 Banks: Why Silvergate and Silicon Valley Bank Collapsed'[E]very bank in America, whether they’re funding server farms or the literal corn and peas variety, is facing many of the same structural pressures,' CoinDesk Chief Insights Columnist DavidZMorris writes. Opinion for The Node newsletter

A Tale of 2 Banks: Why Silvergate and Silicon Valley Bank Collapsed'[E]very bank in America, whether they’re funding server farms or the literal corn and peas variety, is facing many of the same structural pressures,' CoinDesk Chief Insights Columnist DavidZMorris writes. Opinion for The Node newsletter

続きを読む »

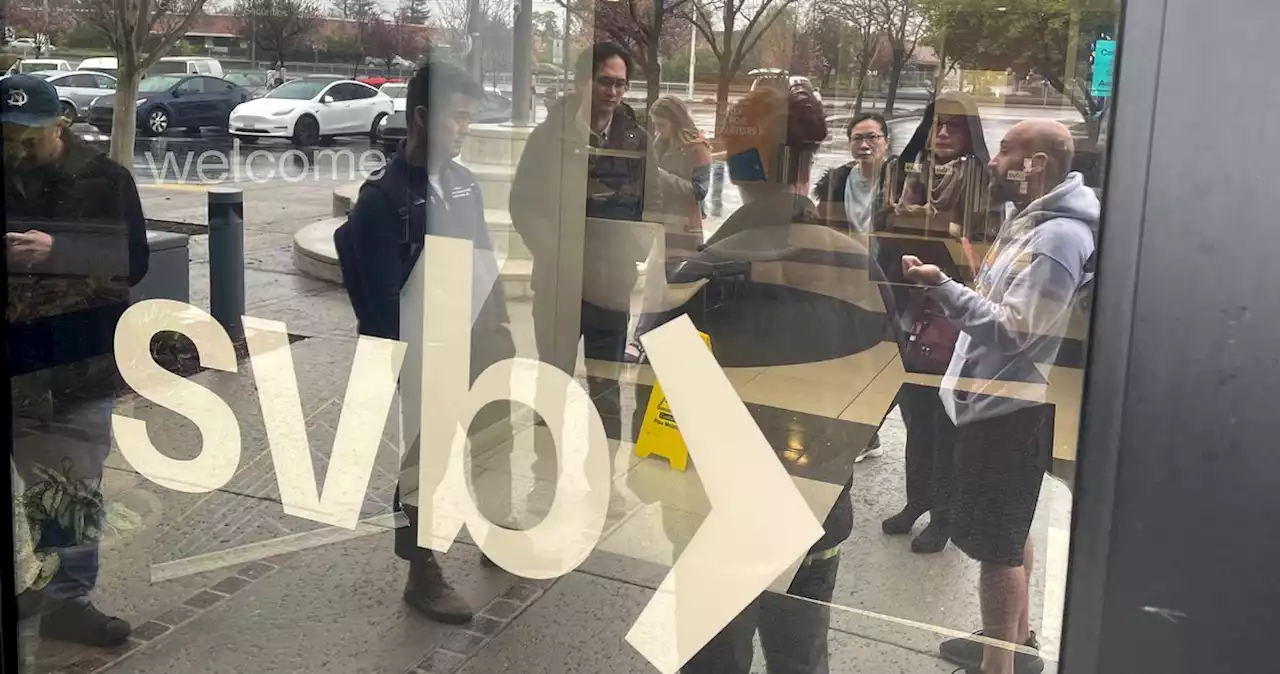

![]() One of Silicon Valley's top banks fails; assets are seizedRegulators have seized the assets of one of Silicon Valley’s top banks, marking the largest failure of a U.S. financial institution since the height of the financial crisis almost 15 years ago

One of Silicon Valley's top banks fails; assets are seizedRegulators have seized the assets of one of Silicon Valley’s top banks, marking the largest failure of a U.S. financial institution since the height of the financial crisis almost 15 years ago

続きを読む »

![]() Silvergate and Silicon Valley Bank show the risks of banks concentrating in one areaCrypto was at an unfortunate confluence of events this week, which could mean heightened regulatory scrutiny. The industry isn't the problem, though.

Silvergate and Silicon Valley Bank show the risks of banks concentrating in one areaCrypto was at an unfortunate confluence of events this week, which could mean heightened regulatory scrutiny. The industry isn't the problem, though.

続きを読む »