Credit Suisse, the giant, 167-year-old European bank, was teetering on the brink of failure Wednesday, stoking anxieties about the health of the global financial system.

After the bank’s largest single-day selloff ever, Credit Suisse leaders met with Swiss authorities to discuss options to stabilize the bank. Late in the Swiss day, the central bank and the nation’s financial market regulator issued joint statement saying they would provide a financial lifeline to the bank “if necessary,” citing its importance to the wider financial system. All of that happened around the time Wall Street was getting ready to clock out.

The collapse of Silicon Valley Bank didn’t cause Credit Suisse to stumble, but it did put the Swiss bank under even more intense scrutiny. And it may have super-charged the selloff that brought Credit Suisse to its knees. Meanwhile, European and US banks are dealing with similar macroeconomic environmental factors. After years of ultra-low interest rates, yields on government bonds including Treasuries have shot up, eroding the value of banks’ underlying assets.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

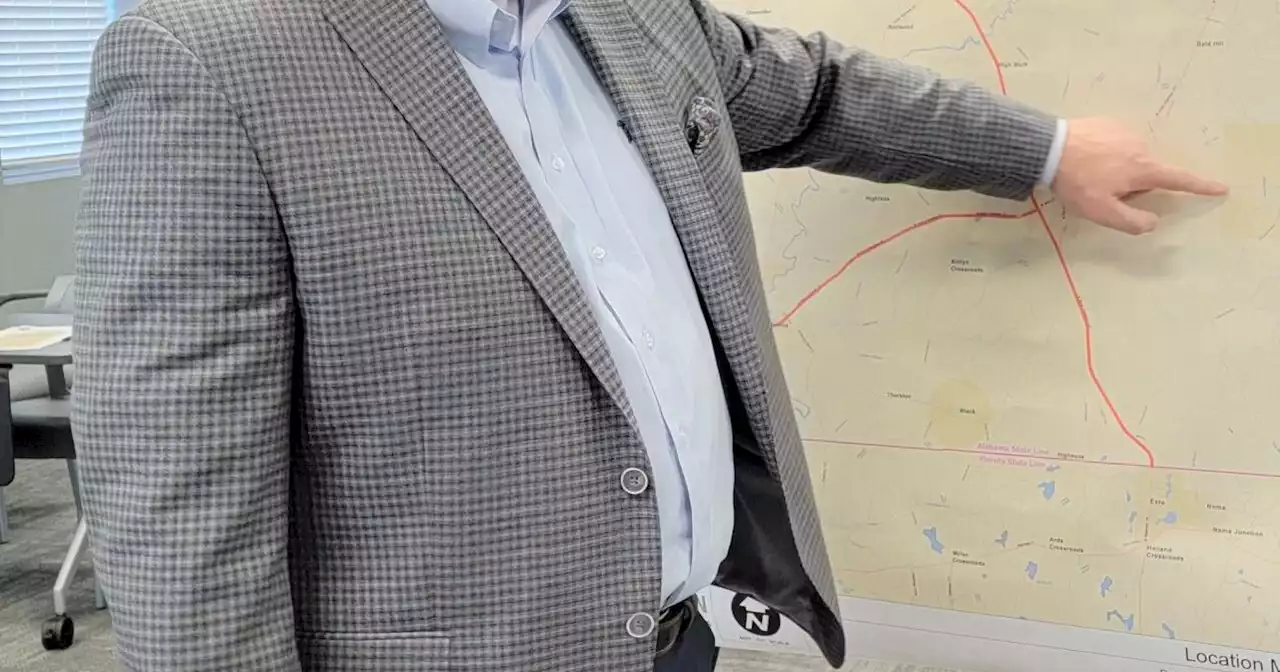

Four-laning SR-167 topic at SEARP&DC public meetingHARTFORD-The second of two public involvement meetings in as many weeks as part of a Southeast Alabama Regional Planning and Development Commission feasibility study was held Tuesday at the Wiregrass

Four-laning SR-167 topic at SEARP&DC public meetingHARTFORD-The second of two public involvement meetings in as many weeks as part of a Southeast Alabama Regional Planning and Development Commission feasibility study was held Tuesday at the Wiregrass

続きを読む »

Credit Suisse shares hit record low as banking giant admits to ‘material weaknesses’Credit Suisse shares hit an all-time low in early Tuesday trading after the Swiss banking giant admitted to discovering “material weaknesses” in its financial reporting over the past two years.

Credit Suisse shares hit record low as banking giant admits to ‘material weaknesses’Credit Suisse shares hit an all-time low in early Tuesday trading after the Swiss banking giant admitted to discovering “material weaknesses” in its financial reporting over the past two years.

続きを読む »

Credit Suisse says outflows have stabilized but not reversedCredit Suisse said customer 'outflows stabilized to much lower levels but had not yet reversed as of the date of this report' in its 2022 annual report published on Tuesday.

Credit Suisse says outflows have stabilized but not reversedCredit Suisse said customer 'outflows stabilized to much lower levels but had not yet reversed as of the date of this report' in its 2022 annual report published on Tuesday.

続きを読む »

Credit Suisse finds 'material weaknesses' in financial reporting, says outflows 'not yet reversed'Credit Suisse said its net asset outflows had 'not yet reversed,' and that 'material weaknesses' were identified in its financial reporting processes.

Credit Suisse finds 'material weaknesses' in financial reporting, says outflows 'not yet reversed'Credit Suisse said its net asset outflows had 'not yet reversed,' and that 'material weaknesses' were identified in its financial reporting processes.

続きを読む »

Credit Suisse publishes delayed annual report in which it admits to financial control weaknessesCredit Suisse on Tuesday published its delayed annual report -- which describes material weaknesses in its financial controls -- as it also announced it...

Credit Suisse publishes delayed annual report in which it admits to financial control weaknessesCredit Suisse on Tuesday published its delayed annual report -- which describes material weaknesses in its financial controls -- as it also announced it...

続きを読む »

Credit Suisse executive board will not receive a bonus for 2022Credit Suisse group's executive board took home 32.2 million Swiss francs ($35.27 million) in fixed compensation while collectively forgoing a bonus for the first time in more than 15 years, the Swiss bank said in its annual report published on Tuesday.

Credit Suisse executive board will not receive a bonus for 2022Credit Suisse group's executive board took home 32.2 million Swiss francs ($35.27 million) in fixed compensation while collectively forgoing a bonus for the first time in more than 15 years, the Swiss bank said in its annual report published on Tuesday.

続きを読む »