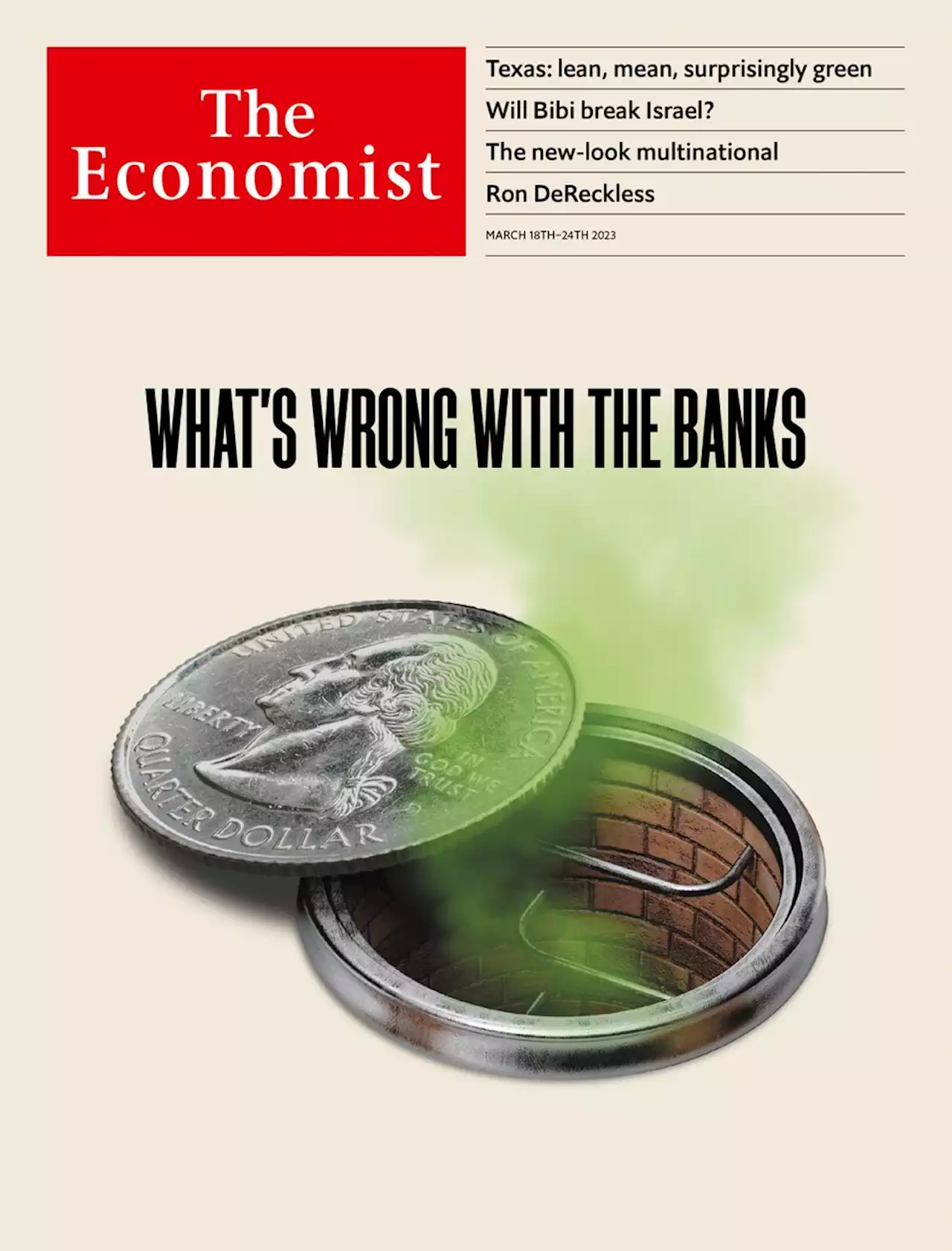

From Silicon Valley to Switzerland, depositors and taxpayers are facing a mighty scare. They should not have to live with the fear and fragility they thought had been consigned to history years ago

days ago you might have thought that the banks had been fixed after the nightmare of the financial crisis in 2007-09. Now it is clear that they still have the power to cause a heart-stopping scare. A ferocious run at Silicon Valley Bank on March 9th saw $42bn in deposits flee in a day.was just one of three American lenders to collapse in the space of a week. Regulators worked frantically over the weekend to devise a rescue. Even so, customers are asking once again if their money is safe.

are vast: $620bn at the end of 2022, equivalent to about a third of the combined capital cushions of America’s banks. Fortunately, other banks are much further away from the brink thanThe financial crisis of 2007-09 was the result of reckless lending and a housing bust. Post-crisis regulations therefore sought to limit credit risk and ensure that banks hold assets that will reliably have buyers.

You might think that unrealised losses don’t matter. One problem is that the bank has bought the bond with someone else’s money, usually a deposit. Holding a bond to maturity requires matching it with deposits and as rates rise, competition for deposits increases. At the largest banks, like JPMorgan Chase or Bank of America, customers are sticky so rising rates tend to boost their earnings, thanks to floating-rate loans.

That alarming prospect explains why the Fed acted so dramatically last weekend. Since March 12th it has stood ready to make loans secured against banks’ bonds. Whereas it used to impose a haircut on the value of the collateral, it will now offer loans up to the bonds’ face value. With some long-term bonds, this can be more than 50% above market value. Given such largesse, it is all but impossible for the unrealised losses on a bank’s bonds to cause a collapse.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

State Pension is rising to £815 next month but more help needed for older peopleCharity calls for more financial help for older people despite State Pension rising to £815 each month

State Pension is rising to £815 next month but more help needed for older peopleCharity calls for more financial help for older people despite State Pension rising to £815 each month

続きを読む »

2023 NFL Draft Consensus Big Board, 4.0: Which prospects are rising up the top 100?In version 4.0 of the 2023 NFL Draft Consensus Big Board, a Northwestern D-lineman moved up 27 spots while an LSU receiver fell 19 spots. amock419 and nickbaumgardner on the top 100 prospects as we move beyond the combine and into the heart of pro days.

2023 NFL Draft Consensus Big Board, 4.0: Which prospects are rising up the top 100?In version 4.0 of the 2023 NFL Draft Consensus Big Board, a Northwestern D-lineman moved up 27 spots while an LSU receiver fell 19 spots. amock419 and nickbaumgardner on the top 100 prospects as we move beyond the combine and into the heart of pro days.

続きを読む »

Attacks on Free Speech Rights Are Rising Across the US, Experts SayFrom censored art exhibits in Idaho, to a Florida bill that would force bloggers to register with the state if they criticize public officials, to bans on books and drag performances across the country, experts are bemoaning threats to free speech.

Attacks on Free Speech Rights Are Rising Across the US, Experts SayFrom censored art exhibits in Idaho, to a Florida bill that would force bloggers to register with the state if they criticize public officials, to bans on books and drag performances across the country, experts are bemoaning threats to free speech.

続きを読む »

Agriculture: NI land prices rise to record highsRising demand is fuelling the increase in prices, with high dairy prices also playing a part.

Agriculture: NI land prices rise to record highsRising demand is fuelling the increase in prices, with high dairy prices also playing a part.

続きを読む »

Maybe Americans Don’t Mind High Prices AnymoreAs inflation keeps rising, economists and companies wonder if U.S. shoppers have become less price-conscious.

Maybe Americans Don’t Mind High Prices AnymoreAs inflation keeps rising, economists and companies wonder if U.S. shoppers have become less price-conscious.

続きを読む »

Agriculture: NI land prices rise to record highsLand across the island of Ireland has broken an average of €12,000 (£10,500) an acre for the first time since the Celtic Tiger years.

Agriculture: NI land prices rise to record highsLand across the island of Ireland has broken an average of €12,000 (£10,500) an acre for the first time since the Celtic Tiger years.

続きを読む »