USD/JPY: A recipe for Yen weakness is boiling – MUFG USDJPY BOJ Bonds Japan Banks

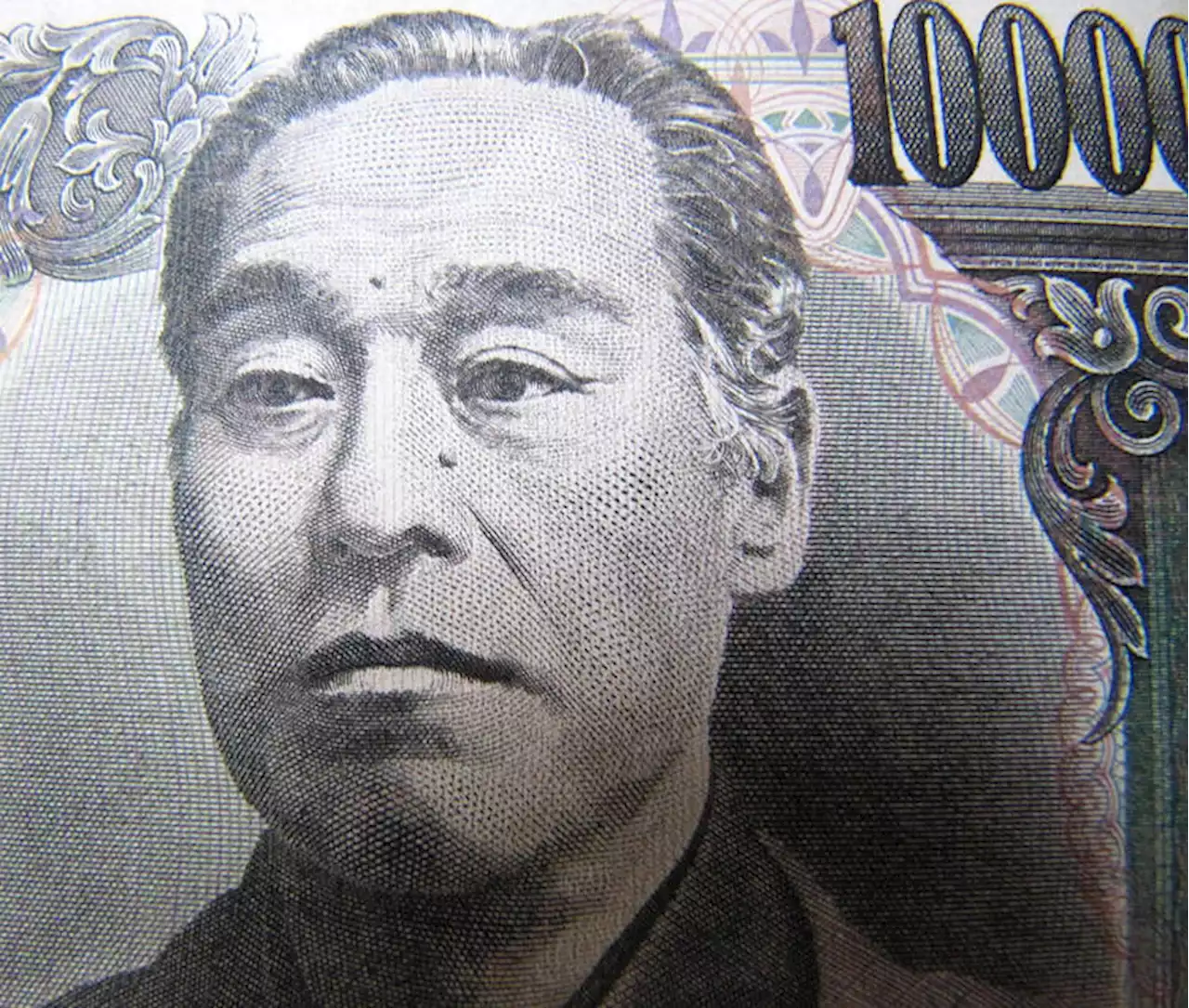

The combination of improving global investor risk sentiment, falling FX volatility and the widening monetary policy divergence between the BoJ and other major central banks is a recipe for Yen weakness. The BoJ’s latest policy update did not disrupt the Yen weakening trend. The BoJ decided to leave their loose monetary policy conditions unchanged.

The widening yield spreads between Japan and overseas alongside lower FX and rates volatility is making Yen-funded carry trades more attractive, and contributing to the Yen becoming more deeply undervalued.Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

USD/JPY resumes upside journey from 141.00 due to dovish BoJ bets, US Retail Sales eyedThe USD/JPY pair has resumed its north-side journey after a pullback move to near 141.00 in the London session. The major is aiming to reclaim its fre

USD/JPY resumes upside journey from 141.00 due to dovish BoJ bets, US Retail Sales eyedThe USD/JPY pair has resumed its north-side journey after a pullback move to near 141.00 in the London session. The major is aiming to reclaim its fre

続きを読む »

USD/JPY eases above 140.00 as traders await BoJ's YCC move, July expectationsUSD/JPY holds lower ground near 140.10-15 as it stays pressured around the intraday low while defending the previous day’s retreat from the yearly top

USD/JPY eases above 140.00 as traders await BoJ's YCC move, July expectationsUSD/JPY holds lower ground near 140.10-15 as it stays pressured around the intraday low while defending the previous day’s retreat from the yearly top

続きを読む »

When is the BoJ Interest Rate Decision and how could it affect USD/JPY?Early on Friday, around 03:00 AM GMT, the Bank of Japan (BoJ) will announce the ordinary monetary policy meeting decisions taken after a two-day brain

When is the BoJ Interest Rate Decision and how could it affect USD/JPY?Early on Friday, around 03:00 AM GMT, the Bank of Japan (BoJ) will announce the ordinary monetary policy meeting decisions taken after a two-day brain

続きを読む »

Breaking: BoJ leaves monetary policy settings unadjusted, USD/JPY advances🚨 BREAKING 🚨 The Bank of Japan (BOJ) decided to leave their current monetary policy settings unchanged, maintaining rates and 10yr JGB yield target at -10bps and 0.00%, respectively

Breaking: BoJ leaves monetary policy settings unadjusted, USD/JPY advances🚨 BREAKING 🚨 The Bank of Japan (BOJ) decided to leave their current monetary policy settings unchanged, maintaining rates and 10yr JGB yield target at -10bps and 0.00%, respectively

続きを読む »

USD/JPY sticks to dovish BoJ-inspired gains, remains below YTD peak touched on ThursdayThe USD/'JPY pair attracts fresh buyers after the Bank of Japan (BoJ) announced its policy decision earlier this Friday and stalls the overnight retra

USD/JPY sticks to dovish BoJ-inspired gains, remains below YTD peak touched on ThursdayThe USD/'JPY pair attracts fresh buyers after the Bank of Japan (BoJ) announced its policy decision earlier this Friday and stalls the overnight retra

続きを読む »

USD/JPY Price Analysis: Climbs firmly above 141.00 as BoJ continues ultra-dovish policy stanceThe USD/JPY pair showed a V-shape recovery from 140.00 after the Bank of Japan (BoJ) Governor Kazuo Ueda announced an unchanged interest rate decision

USD/JPY Price Analysis: Climbs firmly above 141.00 as BoJ continues ultra-dovish policy stanceThe USD/JPY pair showed a V-shape recovery from 140.00 after the Bank of Japan (BoJ) Governor Kazuo Ueda announced an unchanged interest rate decision

続きを読む »