The USD/CAD pair soars above the round-level resistance of 1.3600 in the early New York session on Tuesday.

USD/CAD jumps above 1.3600 as Canadian consumer inflation surprisingly eases in February. BoC’s preferred inflation measure decelerated to 2.1% from 2.4% in January on a year-on-year basis. The market sentiment remains downbeat amid uncertainty ahead of Fed policy. The Loonie asset strengthens as the Canadian Consumer Price Index for February turns out surprisingly softer than expected. The annual headline CPI grew at a slower pace of 2.8% than expectations of 3.1% and the former reading of 2.

The appeal for risk-perceived assets weakens amid uncertainty ahead of the Federal Reserve’s interest rate decision, which will be announced on Wednesday. The Fed is expected to keep interest rates unchanged in the range of 5.25%-5.50%. The US Dollar Index rises to 103.85 as demand for safe-haven assets improves. Apart from the Fed’s policy decision, investors will focus on the dot plot and economic projections.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

USD/CAD Price Analysis: Stabilizes above 1.3500 ahead of Canada Inflation, Fed policyThe USD/CAD pair seems comfortable above the psychological resistance of 1.3500 in the European session on Monday.

USD/CAD Price Analysis: Stabilizes above 1.3500 ahead of Canada Inflation, Fed policyThe USD/CAD pair seems comfortable above the psychological resistance of 1.3500 in the European session on Monday.

続きを読む »

USD/CAD Price Analysis: Rises above 1.3550 ahead of Canadian CPI, Fed policyThe USD/CAD pair jumps to 1.3550 in Tuesday’s European session after breaking above the two-day consolidation formed in a range of 1.3510-1.3550.

USD/CAD Price Analysis: Rises above 1.3550 ahead of Canadian CPI, Fed policyThe USD/CAD pair jumps to 1.3550 in Tuesday’s European session after breaking above the two-day consolidation formed in a range of 1.3510-1.3550.

続きを読む »

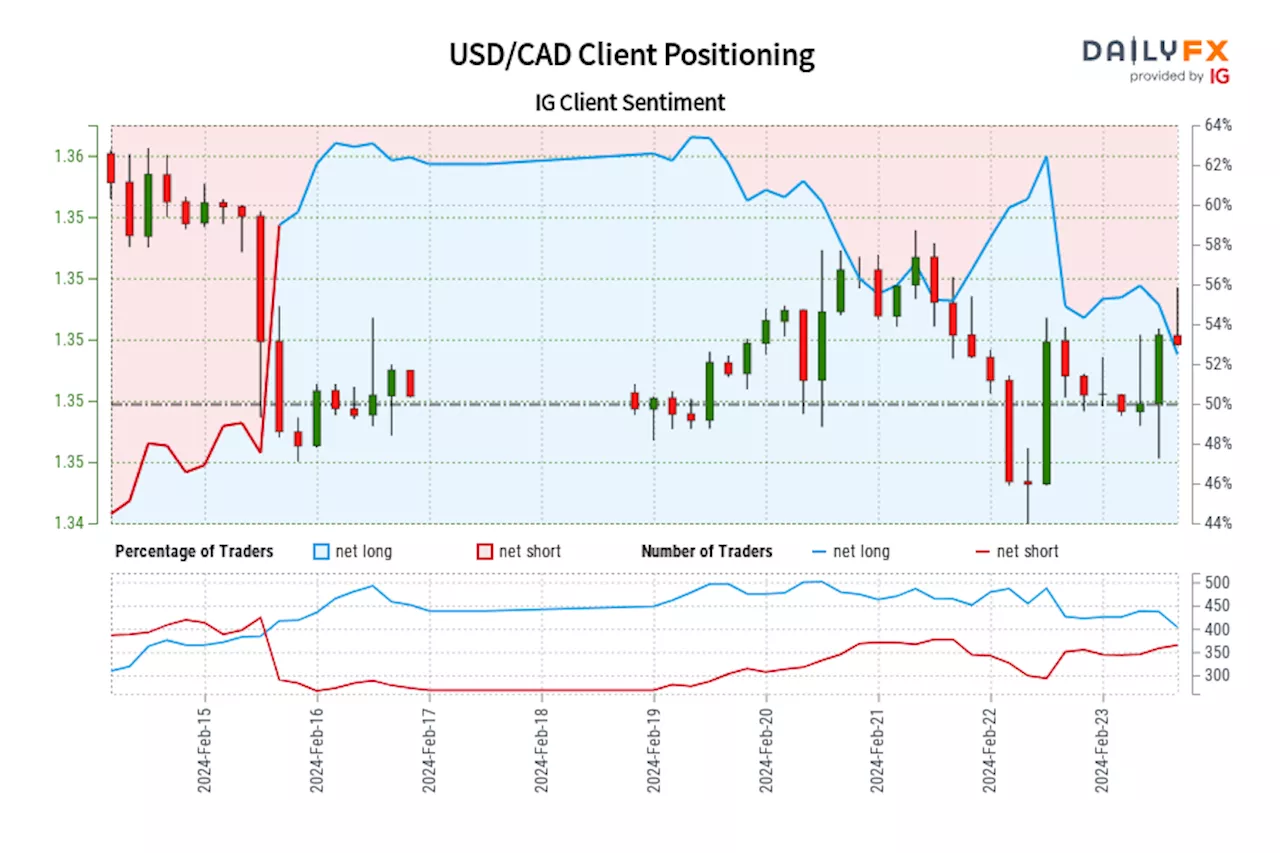

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Feb 15, 2024 14:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Feb 15, 2024 14:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

続きを読む »

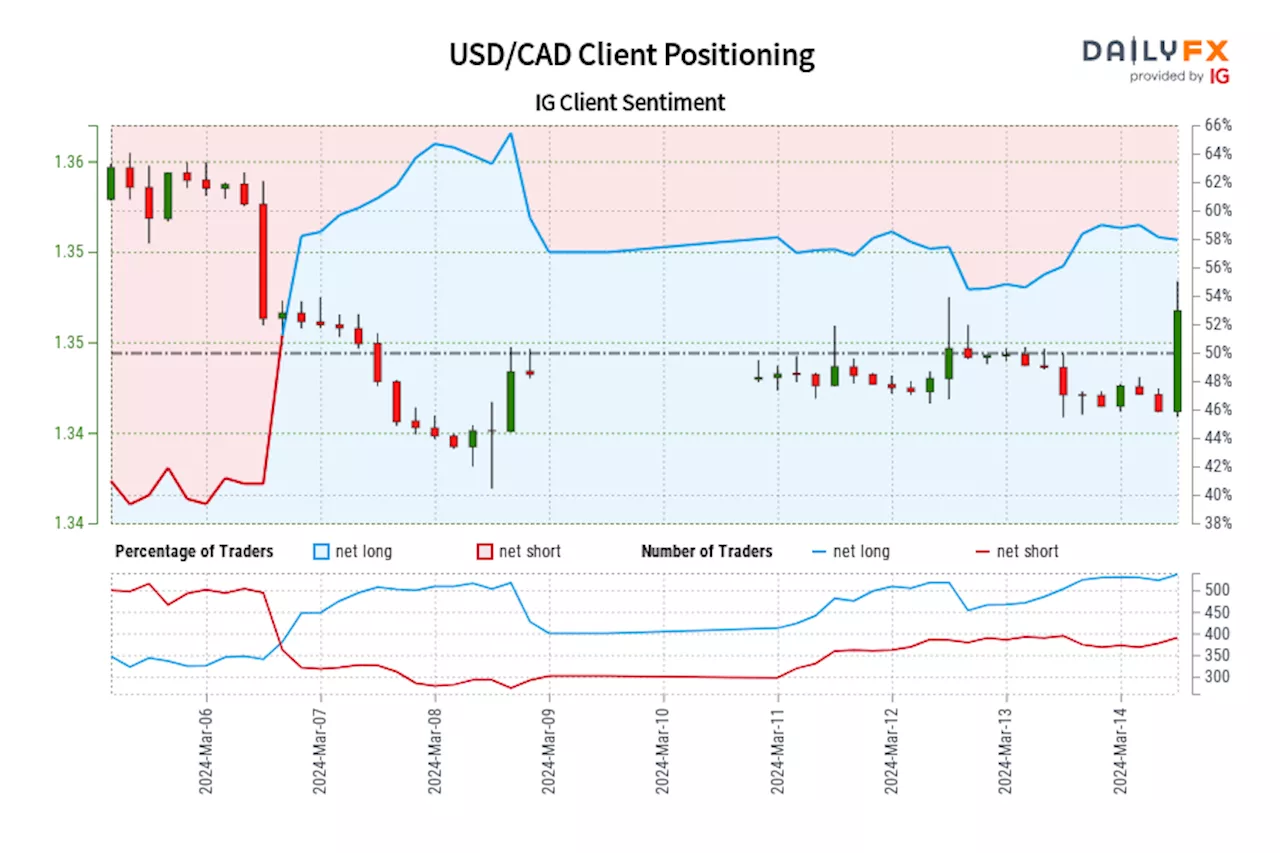

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Mar 06, 2024 15:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Mar 06, 2024 15:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

続きを読む »

USD/CAD inches higher to near 1.3540, focus on Canadian CPI, Fed policyUSD/CAD kicks off the week with its third consecutive day of gains on Monday, inching higher to near 1.3540 during the Asian trading session.

USD/CAD inches higher to near 1.3540, focus on Canadian CPI, Fed policyUSD/CAD kicks off the week with its third consecutive day of gains on Monday, inching higher to near 1.3540 during the Asian trading session.

続きを読む »

US Dollar Subdued Ahead of Fed Minutes; Setups on EUR/USD, USD/JPY, USD/CADThis article focuses on the technical outlook for three popular U.S. dollar pairs: EUR/USD, USD/JPY, and USD/CAD. Throughout the piece, we scrutinize potential scenarios and examine key price levels worth watching in the coming days.

US Dollar Subdued Ahead of Fed Minutes; Setups on EUR/USD, USD/JPY, USD/CADThis article focuses on the technical outlook for three popular U.S. dollar pairs: EUR/USD, USD/JPY, and USD/CAD. Throughout the piece, we scrutinize potential scenarios and examine key price levels worth watching in the coming days.

続きを読む »