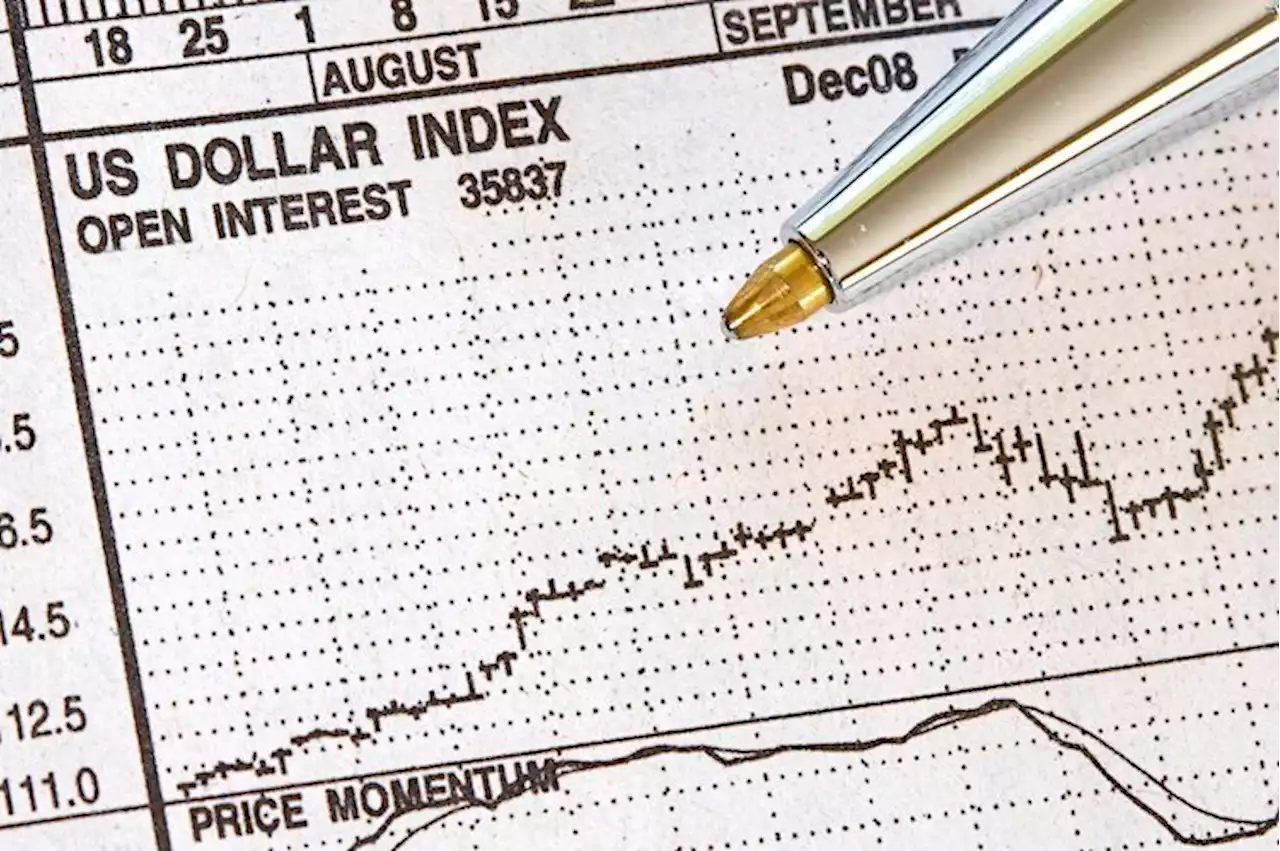

US Dollar Index hovers around 107.80 as investors await US Durable Goods Orders – by Sagar_Dua24 DollarIndex Fed Inflation YieldCurve ApparelDurables

US Treasury yields have sensed interest despite high confidence in a slowdown in Fed’s rate hike pace. has corrected marginally to near 107.80 after struggling to cross the critical hurdle of 108.00. The DXY is displaying signs of exhaustion after a bumper rally amid mixed responses from the risk impulse. S&P500 kicked off the already shortened week on a weak note due to the absence of critical triggers.

have rebounded despite dismal confidence in the continuation of the current rate hike pace by the Federal Reserve .The alpha generated by the US government bonds has been a major victim this month as investors see no continuation of the 75 basis points rate hike regime by the Federal Reserve in its December monetary policy meeting. As per the CME FedWatch tool, the chances of increasing interest rates by 75 bps stand below 20%.

Cleveland Fed Bank President Loretta Mester supported the view that it makes sense to slow down the pace of rate hikes a bit in an interview with CNBC. He further added that “We have had some good news on the inflation front, but need more and sustained good news”. However, he doesn’t see any pause in the rate hike cycle yet.

Also, San Francisco Fed President Mary Daly said on Monday that she is not prepared to say what hike the Fed should do at December Federal Open Market Committee but favored that “it will be right for the Fed to slow its rate hike pace.This week, the US Durable Goods Orders data will remain in the spotlight. As per the projections, the economic data will remain stable at 0.4%.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

USD Index to consolidate between a 107.00-107.50 range – INGThe Dollar is continuing to crawl higher after its sharp sell-off earlier this month. Economists at ING expect USD Index (DXY) to trade a 107.00-107.5

USD Index to consolidate between a 107.00-107.50 range – INGThe Dollar is continuing to crawl higher after its sharp sell-off earlier this month. Economists at ING expect USD Index (DXY) to trade a 107.00-107.5

続きを読む »

How far recovery of USD has to run depends on how large share of trend followers was – CommerzbankEURUSD is back below 1.03, USD Index (DXY) above 107 – The US Dollar is recovering. The extension of the recovery hinges on how large the share of tre

How far recovery of USD has to run depends on how large share of trend followers was – CommerzbankEURUSD is back below 1.03, USD Index (DXY) above 107 – The US Dollar is recovering. The extension of the recovery hinges on how large the share of tre

続きを読む »

New Durable and Inexpensive Catalyst Reduces Carbon FootprintA cheap and chemically durable catalyst to synthesize ammonia. The Haber-Bosch process, which is often used to synthesize ammonia (NH3)—the foundation for synthetic nitrogen fertilizers—by combining hydrogen (H2) and nitrogen (N2) over catalysts at high pressures and temperatures, is one of the mos

New Durable and Inexpensive Catalyst Reduces Carbon FootprintA cheap and chemically durable catalyst to synthesize ammonia. The Haber-Bosch process, which is often used to synthesize ammonia (NH3)—the foundation for synthetic nitrogen fertilizers—by combining hydrogen (H2) and nitrogen (N2) over catalysts at high pressures and temperatures, is one of the mos

続きを読む »

GBPUSD builds cushion around 1.1900 as focus shifts to US Durable Goods Orders dataGBPUSD builds cushion around 1.1900 as focus shifts to US Durable Goods Orders data – by Sagar_Dua24 GBPUSD Fed Inflation ApparelDurables DollarIndex

GBPUSD builds cushion around 1.1900 as focus shifts to US Durable Goods Orders dataGBPUSD builds cushion around 1.1900 as focus shifts to US Durable Goods Orders data – by Sagar_Dua24 GBPUSD Fed Inflation ApparelDurables DollarIndex

続きを読む »

USDCHF faces barricades around a 10-day high at 0.9570 ahead of US Durable Goods OrdersThe USDCHF has advanced gradually to a near 10-day high of around 0.9570 in the Asian session. The asset is struggling to extend gains ahead as invest

USDCHF faces barricades around a 10-day high at 0.9570 ahead of US Durable Goods OrdersThe USDCHF has advanced gradually to a near 10-day high of around 0.9570 in the Asian session. The asset is struggling to extend gains ahead as invest

続きを読む »

US Dollar bulls bounce back to life, eye 50% mean reversion and beyondThe US Dollar, as measured by the DXY index, is up 0.85% at the time of writing. The index, which measures the US Dollar vs. a basket of currencies, i

US Dollar bulls bounce back to life, eye 50% mean reversion and beyondThe US Dollar, as measured by the DXY index, is up 0.85% at the time of writing. The index, which measures the US Dollar vs. a basket of currencies, i

続きを読む »