U.S. stocks were struggling to stabilize Monday, as investors watch rising Treasury yields.

U.S. stocks were mostly lower Monday, struggling to maintain their footing after a third straight losing week attributed to a surge in bond yields and concerns about China’s economy that have been amplified by worries over the country’s property sector.

What’s driving markets Stock-market bulls were striving to find their footing as Wall Street comes off a three-week losing streak. The tech sector was holding on to gains on Monday, but has led the way lower for stocks in August, off around 7% for the month to date. Rising bond yields can make stocks look less attractive to investors. That can be particularly true for tech stocks, whose lofty valuations are typically based on expected earnings far into the future. The 2023 stock-market rally has been largely led by a small cohort of megacap, tech-oriented shares.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

5 things to know before the stock market opens MondayHere are the most important news items that investors need to start their trading day.

5 things to know before the stock market opens MondayHere are the most important news items that investors need to start their trading day.

続きを読む »

Jim Cramer's top 10 things to watch in the stock market MondayStocks edge up in premarket trading Monday, following three-consecutive weeks of losses, as the market looks to Nvidia's (NVDA) quarterly report.

Jim Cramer's top 10 things to watch in the stock market MondayStocks edge up in premarket trading Monday, following three-consecutive weeks of losses, as the market looks to Nvidia's (NVDA) quarterly report.

続きを読む »

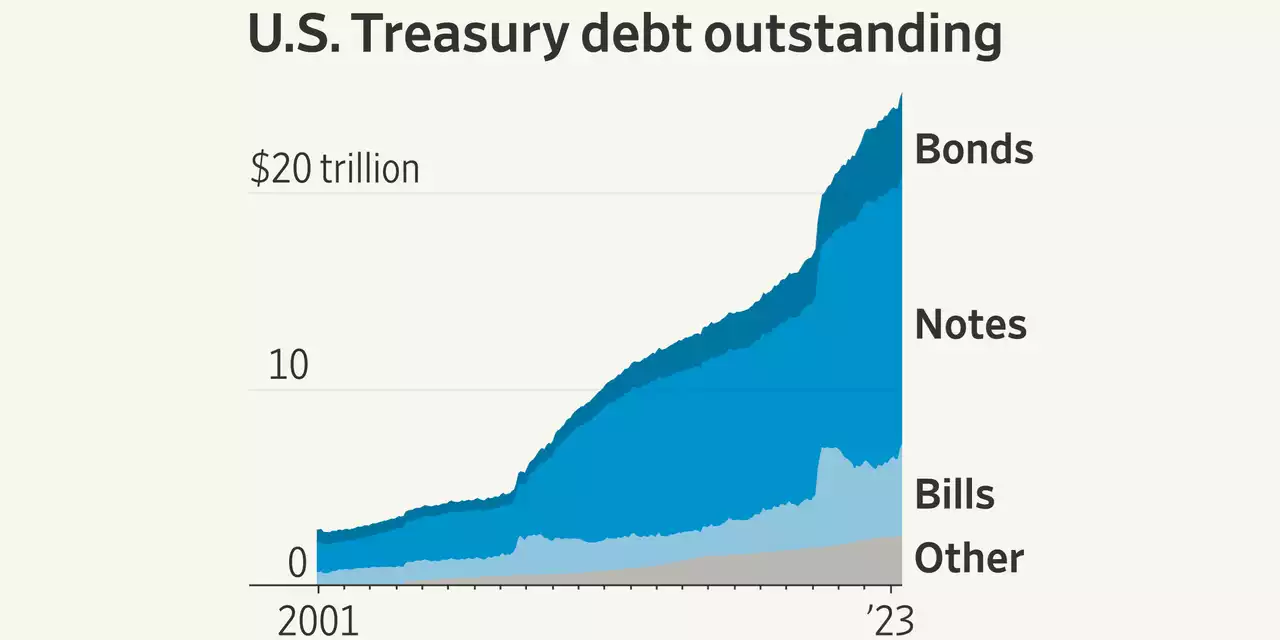

Big Treasury Rout Lures Fresh BuyersBond investors say the summer selloff in U.S. Treasury debt is providing the best buying opportunity in years.

Big Treasury Rout Lures Fresh BuyersBond investors say the summer selloff in U.S. Treasury debt is providing the best buying opportunity in years.

続きを読む »

US Treasury Secretary Says She Didn't Know the Mushrooms She Ate Were PsychedelicUS Treasury Secretary Janet Yellen ate psychedelic mushrooms on a recent trip to China, but did not know they had hallucinogenic properties.

US Treasury Secretary Says She Didn't Know the Mushrooms She Ate Were PsychedelicUS Treasury Secretary Janet Yellen ate psychedelic mushrooms on a recent trip to China, but did not know they had hallucinogenic properties.

続きを読む »

Markets Week Ahead: Gold, US Dollar, Nasdaq 100, Treasury Yields, Jackson Hole, ChinaSurging Treasury yields pushed down gold prices as the US Dollar outperformed and equity markets wobbled. Ahead, all eyes are on the Fed’s Jackson Hole Symposium as markets continue watching economic developments out of China.

Markets Week Ahead: Gold, US Dollar, Nasdaq 100, Treasury Yields, Jackson Hole, ChinaSurging Treasury yields pushed down gold prices as the US Dollar outperformed and equity markets wobbled. Ahead, all eyes are on the Fed’s Jackson Hole Symposium as markets continue watching economic developments out of China.

続きを読む »