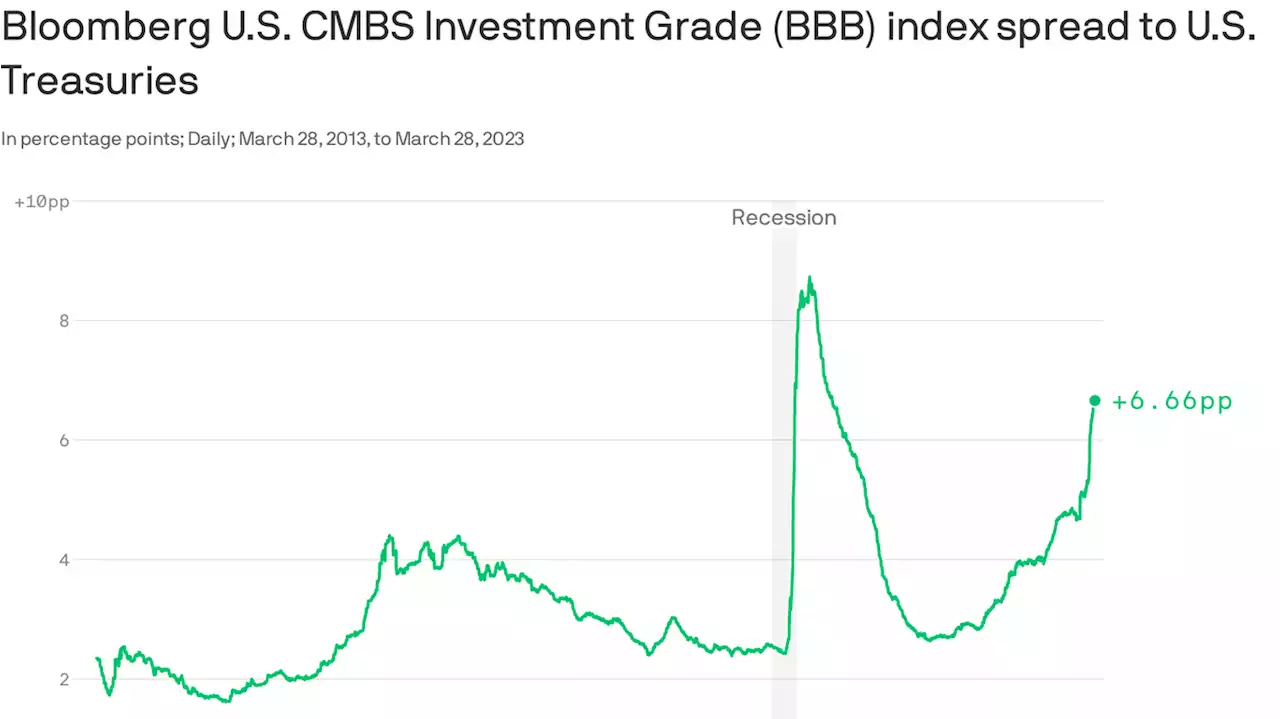

Commercial real estate loans are the next major risk for banks, a top analyst said. Here are the top 20 institutions exposed to property debt.

A string of bank failures, like the real-estate lender Signature, has fueled concerns of contagion.Silicon Valley Bank's historic collapse this month helped trigger the failures of a few other financial institutions and weeks of chaos in the world of finance.

Regional banks like Silicon Valley Bank hold 68% of all commercial-real-estate loans, many tied to struggling sectors, like office buildings. Even more worrisome, a massive $450 billion in commercial-real-estate loans is maturing this year, and most of that is held by banks.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

This Startup Wants to Build Small Commercial EVsHelixx plans a range of electric models that could be built in small factories all over the world.

This Startup Wants to Build Small Commercial EVsHelixx plans a range of electric models that could be built in small factories all over the world.

続きを読む »

Commercial mortgages are a big $3.1 trillion share of bank holdings: Goldman SachsA big slice of U.S. bank liabilities are commercial mortgages and loans to the real-estate industry, according to a Goldman Sachs analysis.

Commercial mortgages are a big $3.1 trillion share of bank holdings: Goldman SachsA big slice of U.S. bank liabilities are commercial mortgages and loans to the real-estate industry, according to a Goldman Sachs analysis.

続きを読む »

Sprawling 'Manvel Mansion' in Houston suburbs bought and converted into commercial propertyJim Youngblood, owner of the Manvel Mansion at 11800 Magnolia Parkway in Manvel, Texas...

続きを読む »

Commercial real estate facing bleak futureHigher interest rates and a loss of confidence in the banking sector have hit commercial real estate especially hard, with both the housing and office sectors poised to feel the chill.

Commercial real estate facing bleak futureHigher interest rates and a loss of confidence in the banking sector have hit commercial real estate especially hard, with both the housing and office sectors poised to feel the chill.

続きを読む »

Signs of stress in commercial propertyEveryone is watching commercial property, given how reliant it is on some of the same regional banks that have been under pressure since the collapse of Silicon Valley Bank.

Signs of stress in commercial propertyEveryone is watching commercial property, given how reliant it is on some of the same regional banks that have been under pressure since the collapse of Silicon Valley Bank.

続きを読む »

Why Commercial Real Estate Could Cause The Next Bank FailuresAnalysts worry that declining commercial real estate values in the office sector could cause more bank closings, especially among small institutions.

Why Commercial Real Estate Could Cause The Next Bank FailuresAnalysts worry that declining commercial real estate values in the office sector could cause more bank closings, especially among small institutions.

続きを読む »