Central bankers seem prepared for possible discomfort. Yet the risk of inflation no longer stems from loose monetary policy but from politicians in charge of spending

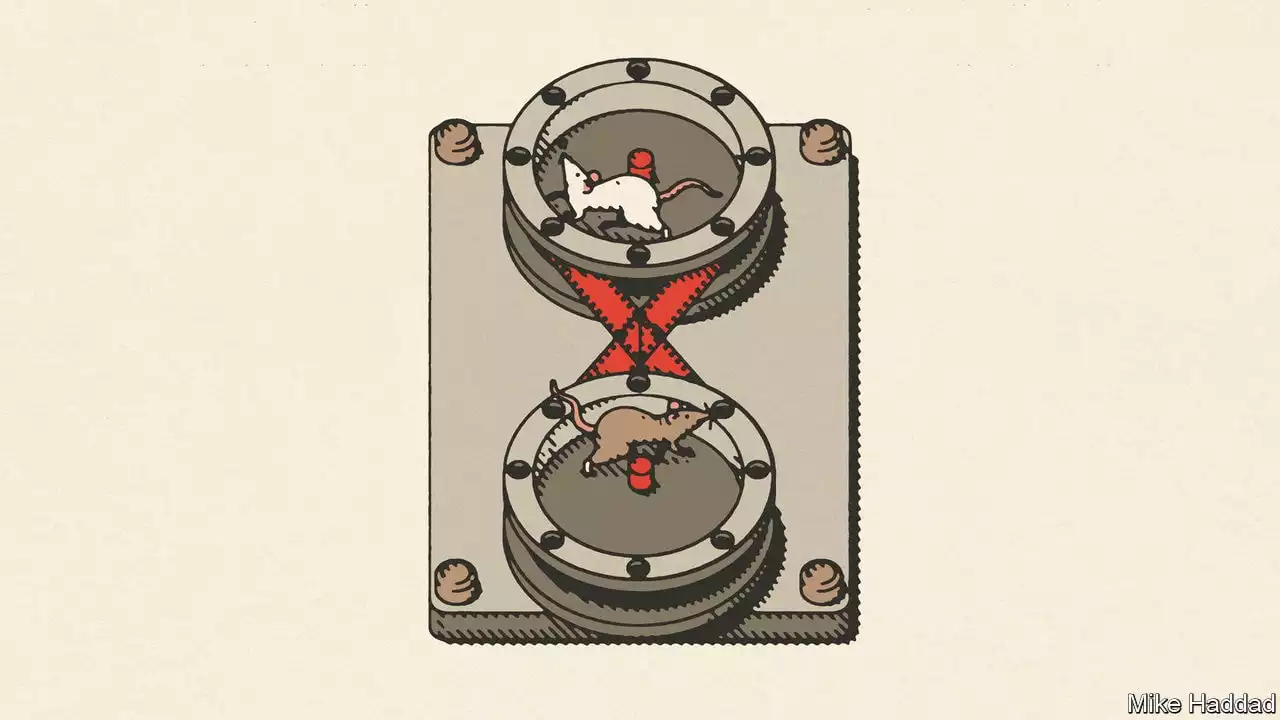

Save time by listening to our audio articles as you multitaskThe world economy is now in the early stages of Friedman’s loop. Inflation has played havoc with central banks’ credibility and crushed consumer confidence. In Europe high gas prices will cause economic turmoil this winter; consumers are more miserable even than during the financial crisis. In Asia, which seemed immune to the inflation bug, dearer oil and falling currencies have forced central banks to raise interest rates.

So long as energy chaos reigns, underlying inflation is hard to gauge. One method is to look at “core” prices excluding energy and food. Yet energy is an input for almost everything else, from restaurant meals on cold winter nights to the ammonia used in fertilisers. Energy prices thus infect even core prices as businesses pass through higher costs. To judge underlying inflation it is better to look at how fast wages are growing relative to workers’ productivity.

In a blog post in June Stephen Cecchetti and Kermit Schoenholtz surveyed ten American disinflationary episodes since the 1950s. A median fall in core inflation of two percentage points was achieved over a 30-month period only with a rise in unemployment of 3.6 percentage points, corresponding today to nearly 6m Americans losing their jobs.

Even where underlying inflation has yet to take off, central bankers have acted. The Bank of Korea has raised interest rates from a low of 0.5% in mid-2020 to 2.5% in August. In an interview withRhee Chang-yong, the bank’s governor, said that there is no need to generate a recession “on purpose”—his objective is mainly to stop imported inflation from setting off a wage-price spiral. The recent global economic slowdown and falling energy prices had made inflation less likely to rise further.

A growing number of economists agree. In a paper presented at Jackson Hole, Francesco Bianchi of Johns Hopkins University and Leonardo Melosi of the Federal Reserve Bank of Chicago revisit America’s disinflation under Paul Volcker in the 1980s and argue that it was “the result of changes in both monetary and fiscal policy”.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Plastic pollution: 2021 'was worst year for marine litter' in Northern IrelandLittering is getting worse, say environmentalists concerned by the effects of pollution in the sea.

Plastic pollution: 2021 'was worst year for marine litter' in Northern IrelandLittering is getting worse, say environmentalists concerned by the effects of pollution in the sea.

続きを読む »

Plastic pollution: 2021 'was worst year for marine litter' in Northern IrelandNorthern Ireland has a plastic problem. 2021 was the worst year for marine litter since records began.

Plastic pollution: 2021 'was worst year for marine litter' in Northern IrelandNorthern Ireland has a plastic problem. 2021 was the worst year for marine litter since records began.

続きを読む »

Concern over school lunches that are 'like feeding animals scrap''They're getting treated worse than in a prison'

Concern over school lunches that are 'like feeding animals scrap''They're getting treated worse than in a prison'

続きを読む »

American Horror Story: NYC shares first disturbing teaser for season 11It's getting spooky in the Big Apple.

American Horror Story: NYC shares first disturbing teaser for season 11It's getting spooky in the Big Apple.

続きを読む »

Full guide to Lizzo UK tour 2023 tickets saleDoing these things may boost your chances of getting tickets to see Lizzo next year

Full guide to Lizzo UK tour 2023 tickets saleDoing these things may boost your chances of getting tickets to see Lizzo next year

続きを読む »