A new consumer watchdog report highlights challenges borrowers face as student-loan payments resume

Student-loan borrowers calling their servicers are being placed on hold for 16 hours straight, they’re getting quotes for monthly payment amounts that can differ by nearly $3,000 depending on where they check, and are being stymied in their efforts to access debt forgiveness they’re entitled to under the law.

“Many of the challenges highlighted in this report are not new,” Cameron wrote. “Complaints submitted to the CFPB suggest that fundamental problems that have been documented in the student loan program persist.” Scott Buchanan, the executive director of the Student Loan Servicing Alliance, a servicer trade group, said the report provides more of a look back at issues servicers and the government had been anticipating for months. In some cases, those challenges have been largely resolved, he said. He expressed frustration with the lack of information in the report about how many borrowers came forward with each type of complaint.

“After holding the phone for more than an hour, it cuts off,” the borrower wrote. “This happened numerous times.” The borrower goes on to say that they tried to log into their account and received an error message saying that it didn’t recognize their email. “Therefore, I cannot access nor reset my password to enter my account.”

Quoting incorrect payment amount information Borrowers reported receiving differing information about the amount they’d be required to repay depending on what source they check. In the lead up to the return to student-loan payments, the Biden administration announced a new repayment plan called SAVE.

The borrower said they called and messaged their servicer multiple times, but was told the $3,210 number was their monthly payment and if they wanted it to change they had to submit new information documenting their income. That’s even though the borrower isn’t required to submit new income information under the terms of their plan for another six months.

A borrower who said they’ve worked as a public school teacher for 26 years reported trouble accessing the Public Service Loan Forgiveness program. That initiative allows borrowers who work for the government and certain nonprofits to have their federal student debt canceled after 10 years of payments and work in a qualifying field.

Another borrower who was trying to get their payment count updated based on periods of service with the U.S. Army told the CFPB they were struggling to get their servicer to adjust their payments in a timely manner. The borrower said that their loans were transferred to their current servicer in August of 2022. After several months, the borrower called their new servicer to see if they had received their PSLF documentation, which their prior servicer had already approved.

Over the past several months, the consumer watchdog has grown increasingly concerned about student-loan servicers attempting to collect on debt borrowers took on as students that was discharged in bankruptcy. Typically student loans have to clear a high bar in order to be discharged in bankruptcy. To be eligible for this special treatment these debts have to be taken on to attend an accredited institution and be equal to up to the cost of attendance.

“It’s really interesting that the report’s findings mirror the political objectives of the bureau, that they’ve stated months ago, that all the sudden say that they have data that supports that,” he said.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Edgewood ISD mulls over school closures amid declining student enrollmentSAN ANTONIO - Much like San Antonio Independent School District, Edgewood ISD is now considering closing several schools due to declining enrollment.The final

Edgewood ISD mulls over school closures amid declining student enrollmentSAN ANTONIO - Much like San Antonio Independent School District, Edgewood ISD is now considering closing several schools due to declining enrollment.The final

続きを読む »

Family sues Panera Bread after college student who drank Charged Lemonade diesSarah Katz, 21, had a heart condition and wasn’t aware of the drink’s caffeine content, which exceeded that of cans of Red Bull and Monster energy drinks combined, according to a legal filing.

Family sues Panera Bread after college student who drank Charged Lemonade diesSarah Katz, 21, had a heart condition and wasn’t aware of the drink’s caffeine content, which exceeded that of cans of Red Bull and Monster energy drinks combined, according to a legal filing.

続きを読む »

Panera faces lawsuit after UPenn student dies after drinking 'Charged Lemonade' energy drinkThe parents of a University of Pennsylvania student have filed a wrongful death lawsuit against Panera Bread.

Panera faces lawsuit after UPenn student dies after drinking 'Charged Lemonade' energy drinkThe parents of a University of Pennsylvania student have filed a wrongful death lawsuit against Panera Bread.

続きを読む »

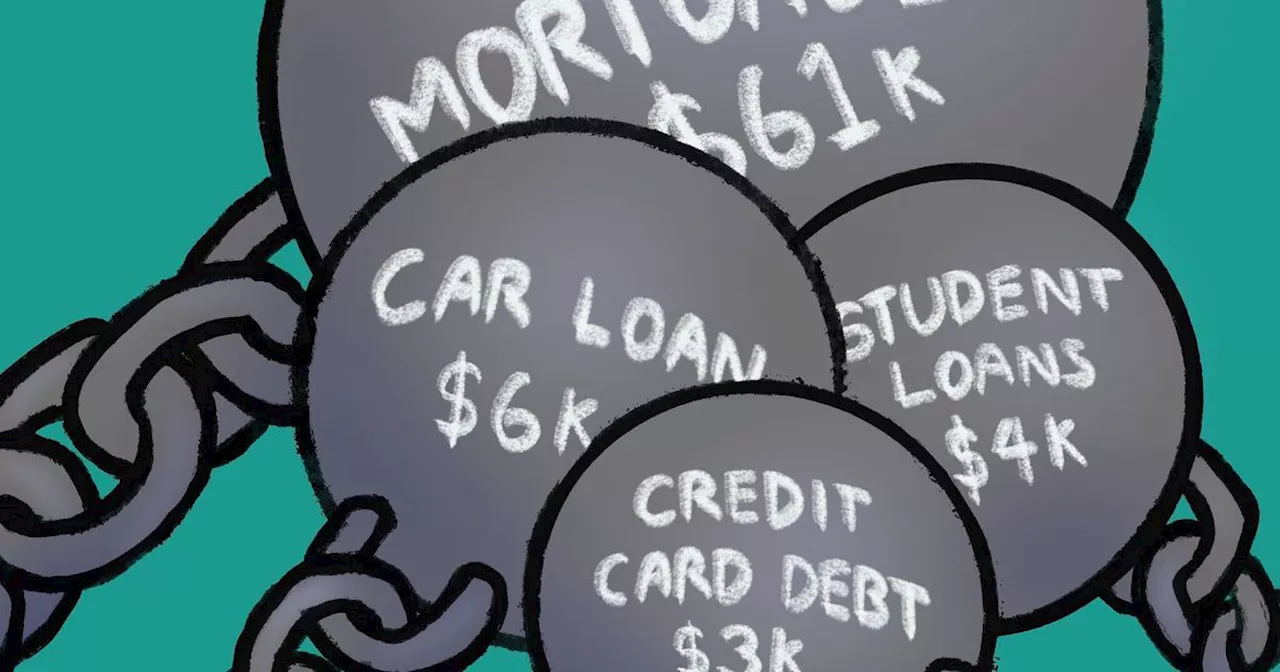

4 tips for Utahns managing mortgages, student loans and other debtUtah households have nearly $80,000 of personal debt, on average, and that figure is growing. The Salt Lake Tribune talked to two experts about advice for managing personal debt. Here are four tips and places to look for help

4 tips for Utahns managing mortgages, student loans and other debtUtah households have nearly $80,000 of personal debt, on average, and that figure is growing. The Salt Lake Tribune talked to two experts about advice for managing personal debt. Here are four tips and places to look for help

続きを読む »

LISTEN: 'Similar to ISIS...the Nazis': Doctoral student facing 'cancellation' after slamming HamasAfter speaking out against Hamas' horrific terror attack, Yoni Michanie is being accused of making Muslim and Palestinian students feel uncomfortable on campus.

LISTEN: 'Similar to ISIS...the Nazis': Doctoral student facing 'cancellation' after slamming HamasAfter speaking out against Hamas' horrific terror attack, Yoni Michanie is being accused of making Muslim and Palestinian students feel uncomfortable on campus.

続きを読む »

Manvel Junior High School student asking for sidewalks may be kickstarting changeRetton spent weeks in the hospital battling a rare form of pneumonia and her daughter said she was 'fighting for her life' earlier this month.

Manvel Junior High School student asking for sidewalks may be kickstarting changeRetton spent weeks in the hospital battling a rare form of pneumonia and her daughter said she was 'fighting for her life' earlier this month.

続きを読む »