A rush by New York City real-estate investors to yank money out of Signature Bank last week played a significant role in the bank’s collapse, according to building owners and state regulators

.

The withdrawals gained momentum as talk circulated about the exposure Signature had to cryptocurrency firms and that its fate might follow the same path as Silicon Valley Bank, which sufferedContinue reading your article with

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Signature Bank shut down in connection with Silicon Valley Bank collapseFederal regulators said Sunday Signature Bank has been shuttered, marking the second massive bank failure after the collapse of Silicon Valley Bank last week.

Signature Bank shut down in connection with Silicon Valley Bank collapseFederal regulators said Sunday Signature Bank has been shuttered, marking the second massive bank failure after the collapse of Silicon Valley Bank last week.

続きを読む »

Regulators seize Signature Bank in third-largest US bank failureSignature Bank had $110 billion in assets as of Dec. 31, ranking 29th among U.S. banks. It had $88 billion in deposits as of that date, and approximately 89.7% were not insured by the Federal Deposit Insurance Corporation.

Regulators seize Signature Bank in third-largest US bank failureSignature Bank had $110 billion in assets as of Dec. 31, ranking 29th among U.S. banks. It had $88 billion in deposits as of that date, and approximately 89.7% were not insured by the Federal Deposit Insurance Corporation.

続きを読む »

![]() TELL US: How did you do business with Silicon Valley Bank or Signature Bank?U.S. regulators closed Silicon Valley Bank on Friday after it experienced a traditional bank run, where depositors rushed to withdraw funds all at once. New York-based Signature Bank also collapsed.

TELL US: How did you do business with Silicon Valley Bank or Signature Bank?U.S. regulators closed Silicon Valley Bank on Friday after it experienced a traditional bank run, where depositors rushed to withdraw funds all at once. New York-based Signature Bank also collapsed.

続きを読む »

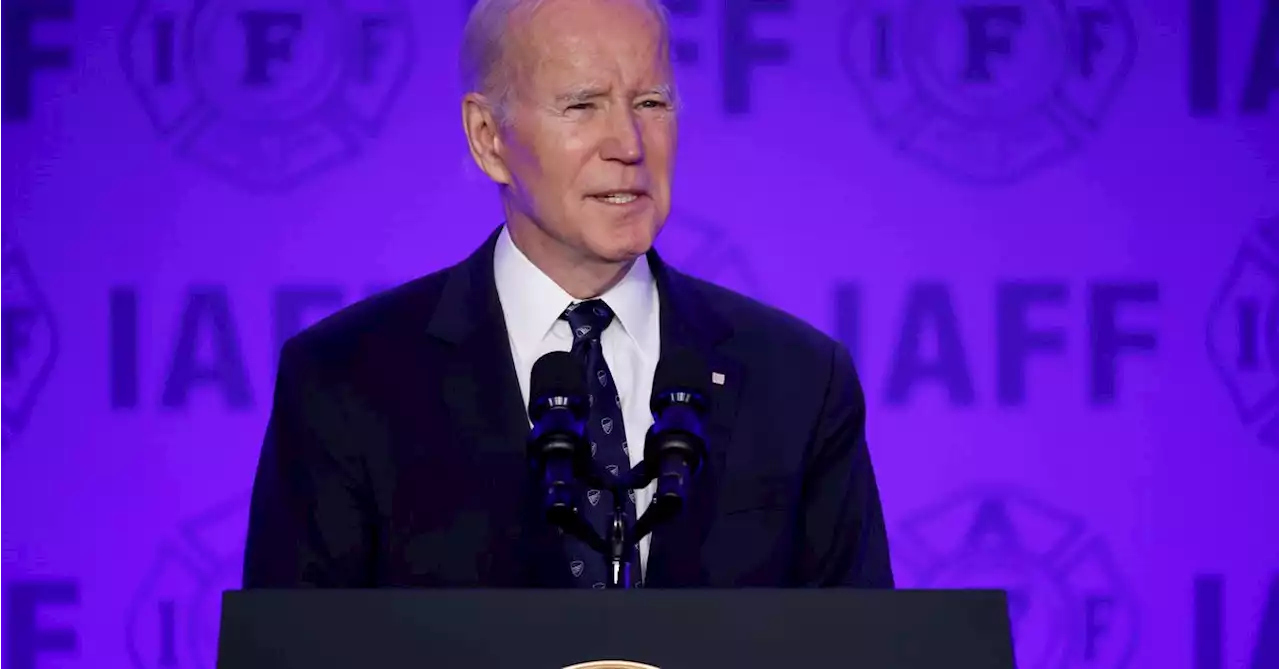

President Biden Calls for Stronger Bank Regulations in Wake of SVB, Signature Bank CollapsesWhile depositors were protected, managements and investors with collapsed lenders SVB and Signature Bank will receive no bailout, said President Biden on Monday morning. nikhileshde reports

President Biden Calls for Stronger Bank Regulations in Wake of SVB, Signature Bank CollapsesWhile depositors were protected, managements and investors with collapsed lenders SVB and Signature Bank will receive no bailout, said President Biden on Monday morning. nikhileshde reports

続きを読む »

![]() What Signature Bank, Silicon Valley Bank Failures Mean for Consumers and InvestorsHere’s how the Silicon Valley Bank and Signature Bank failings, and moves by U.S. regulators may affect your wallet, according to financial advisors.

What Signature Bank, Silicon Valley Bank Failures Mean for Consumers and InvestorsHere’s how the Silicon Valley Bank and Signature Bank failings, and moves by U.S. regulators may affect your wallet, according to financial advisors.

続きを読む »

Why regulators seized Signature Bank in third-biggest bank failure in U.S. historyThe swift move shocked executives of Signature Bank, said board member and former congressman Barney Frank.

Why regulators seized Signature Bank in third-biggest bank failure in U.S. historyThe swift move shocked executives of Signature Bank, said board member and former congressman Barney Frank.

続きを読む »