Insider tells the global tech, finance, markets, media, healthcare, and strategy stories you want to know.

In September 2004, JPMorgan announced an acquisition that would spark envy across Wall Street: A stake in $7 billion hedge fund giant Highbridge Capital Management.

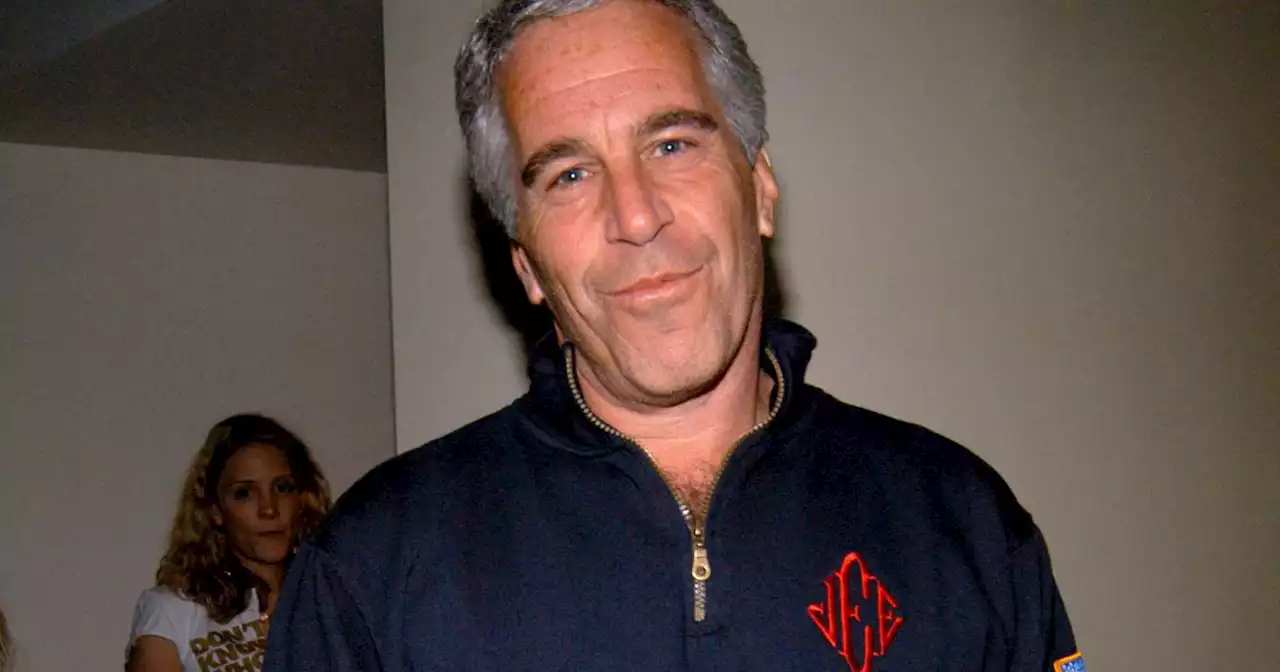

Epstein helped the bank by sending business its way, court documents say, and Staley and others, it has since been alleged, both protected Epstein and enjoyed his company — even as JPMorgan executives raised alarm bells over Epstein's accounts multiple times. Two of Jeffrey Epstein's alleged victims, Michelle Licata and Courtney Wild , exit a New York courthouse on July 8, 2019, the day that federal prosecutors charged Epstein with sex trafficking.$290 million to settle a class-action lawsuit filed by a woman who claims the bank ignored red flags about Epstein's sexual exploitation of young women — some of whom claim he flew them to his private island to have sex with him and other men — because he helped the bank make money.

Patricia Wexler, a JPMorgan spokeswoman, said:"There's no record of this meeting ever being scheduled or proposed." In fact, senior executives had been shouting from the rooftops to cut him off by at least 2011. But Epstein was a constant source of advice and helpful connections to JPMorgan executives, including Staley. In its public statements about the case, the bank has largely put the blame at the feet of Staley, while Staley's defense suggests there were others who knew about Epstein. Now, fingers are being pointed in every direction.

Jeffrey Epstein and Ghislaine Maxwell attend de Grisogono Sponsors The 2005 Wall Street Concert Series Benefitting Wall Street Rising, with a Performance by Rod Stewart at Cipriani Wall Street on March 15, 2005 in New York City.The idea that banks have a role to play in helping to spot criminal activity dates back to at least 1970, when Congress passed the Bank Secrecy Act, or BSA, largely to crack down on money laundering tied to the.

Flagging any suspicious activity uncovered in a review is also fundamental, Haberstroh said. The activity doesn't even need to be current — so long as it is still within the statute of limitations for the purposes of prosecution. Indeed, the 2019 charges against Epstein targeted sex-trafficking activity between 2002 and 2005. "You don't have to be certain about criminal activity as a bank. It only has to be strange enough.

"Lots of smoke. Lots of questions," declared a senior JPMorgan compliance officer reviewing Epstein's accounts as part of that 2011 compliance review, according to court papers filed by the US Virgin Islands. Epstein, the email said,"is alleged to be involved in the human trafficking of young girls and law enforcement is also allegedly investigating his involvement in this activity.

A JPMorgan spokeswoman declined to comment on whether the bank had ever sent a suspicious activity report over Epstein's activity to FinCEN. Over the years, the two men grew close. Epstein brought Staley new clients and, according to an internal JPMorgan investigation conducted in 2019, advised him on his salary negotiations with JPMorgan back in 2008. Staley visited Little Saint James, Epstein's notorious private island where numerous women say they were taken via private jet to be abused by Epstein and other men, the 22-page report shows.

Epstein helped raise Staley's profile at JPMorgan through his introductions to wealthy people and advice, court papers suggest. In addition to Highbridge, Epstein reportedly introduced Staley to Wexner in 2002, leading him to become a client of the private bank. And in 2011, Epstein and Staley had extensive discussions regarding the creation of a"very HIGH profile" investment account to support charitable organizations, according to the US Virgin Island's lawsuit.

During JPMorgan's compliance review of Epstein's account from January 2011, officers recommended that Epstein's account be terminated, court papers reveal:"AML Operations went to a risk meeting late last week requesting that we exit this relationship," according to a compliance email chain submitted to the court.

"So when all hell breaks lose, and the world is crumbling, I will come here, and be at peace," Staley wrote."Presently, I'm in the hot tub with a glass of white wine. This is an amazing place. Truly amazing. Next time, we're here together. I owe you much. And I deeply appreciate our friendship. I have few so profound.

Six months later, another email from Staley to Epstein:"Maybe they're tracking u? That was fun. Say hi to Snow White." Epstein responded by asking him what"character would you like next?" Staley said,"Beauty and the Beast," to which Epstein replied:"well one side is available." Staley sent Epstein internal JPMorgan documents and relied on him for guidance on an array of business and personal dealings, the JPMorgan internal report shows. In the summer of 2012, Staley wrote to Epstein:"I can't tell you how much our friendship has meant to me. Thank you deeply for the last few weeks." He concludes the message:"To my most cherished friend, Jes."

JPMorgan is suing Staley to cover any costs it may incur as a result of its relationship with Epstein. The bank has stopped short of saying whether Staley did anything wrong. Erdoes was one of several JPMorgan executives taking meetings and business advice from Epstein over the years, the 2019 internal JPMorgan document shows.

"These are business people," Dale said."They have to look at what is more profitable: Do I listen to the DOJ, or do I listen to my customers and then just put up with the fines?" The New York City headquarters of JPMorgan Chase.Before JPMorgan agreed to pay Epstein's alleged victims $290 million, Deutsche Bank agreed to$75 million to settle similar claims.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

New Court Documents Reveal More About Epstein’s Relationship With JPMorgan ChaseNew emails show that the disgraced sex trafficker offered business advice and set up a key meeting.

New Court Documents Reveal More About Epstein’s Relationship With JPMorgan ChaseNew emails show that the disgraced sex trafficker offered business advice and set up a key meeting.

続きを読む »

Parties seek court approval of JPMorgan Chase $290 million settlement over Epstein ties | CNN BusinessAttorneys filed a preliminary plan to facilitate a $290 million settlement fund for JPMorgan Chase to compensate victims of Jeffrey Epstein.

Parties seek court approval of JPMorgan Chase $290 million settlement over Epstein ties | CNN BusinessAttorneys filed a preliminary plan to facilitate a $290 million settlement fund for JPMorgan Chase to compensate victims of Jeffrey Epstein.

続きを読む »

SEC levies $4 mln penalty on JPMorgan Chase for deleting 47 mln ‘electronic communications’The Securities and Exchange Commission on Thursday said it’s requiring JPMorgan Chase & Co. to pay a $4 million penalty for allegedly violating rules for...

SEC levies $4 mln penalty on JPMorgan Chase for deleting 47 mln ‘electronic communications’The Securities and Exchange Commission on Thursday said it’s requiring JPMorgan Chase & Co. to pay a $4 million penalty for allegedly violating rules for...

続きを読む »

JPMorgan Chase is fined by SEC after mistakenly deleting 47 million emailsJPMorgan Chase has been fined $4 million by the U.S. Securities and Exchange Commission after about 47 million emails belonging to its retail banking group were mistakenly and permanently deleted.

JPMorgan Chase is fined by SEC after mistakenly deleting 47 million emailsJPMorgan Chase has been fined $4 million by the U.S. Securities and Exchange Commission after about 47 million emails belonging to its retail banking group were mistakenly and permanently deleted.

続きを読む »

JPMorgan Chase names new head of AI unitJPMorgan Chase has moved its global head of securities services into the role of chief data and analytics officer as the bank continues its artificial intelligence-related efforts.

JPMorgan Chase names new head of AI unitJPMorgan Chase has moved its global head of securities services into the role of chief data and analytics officer as the bank continues its artificial intelligence-related efforts.

続きを読む »

Epstein victims seek approval of JPMorgan $290 mln settlementJeffrey Epstein's victims have formally asked a U.S. judge to preliminarily approve JPMorgan Chase's $290 million settlement to resolve claims that the largest U.S. bank turned a blind eye to the disgraced financier's sexual abuses.

Epstein victims seek approval of JPMorgan $290 mln settlementJeffrey Epstein's victims have formally asked a U.S. judge to preliminarily approve JPMorgan Chase's $290 million settlement to resolve claims that the largest U.S. bank turned a blind eye to the disgraced financier's sexual abuses.

続きを読む »