The Russell 2000 index is on the brink of closing below its 200-day average

Stock market bulls need not be concerned that the Russell 2000 index RUT is on the brink of dropping below its 200-day moving average.

This sanguine assessment may surprise you, since for decades technicians have considered breaking below the 200-day moving average to be a major bear market signal. In fact, though, the moving average never enjoyed much historical support, and what little support it did have disappeared completely starting about 30 years ago.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Nasdaq, S&P 500 Test June Lows; Russell 2000 Near Critical Support: What's Next?Stocks Analysis by Declan Fallon covering: S&P 500, US Small Cap 2000, iShares Core S&P 500 ETF, SPDR® S&P 500. Read Declan Fallon's latest article on Investing.com

Nasdaq, S&P 500 Test June Lows; Russell 2000 Near Critical Support: What's Next?Stocks Analysis by Declan Fallon covering: S&P 500, US Small Cap 2000, iShares Core S&P 500 ETF, SPDR® S&P 500. Read Declan Fallon's latest article on Investing.com

続きを読む »

USD Index Price Analysis: The 200-day SMA near 103.20 holds the downsideDXY faces extra selling pressure and revisits the 103.15/10 band at the beginning of the week. In spite of Monday’s corrective move, the index maintai

USD Index Price Analysis: The 200-day SMA near 103.20 holds the downsideDXY faces extra selling pressure and revisits the 103.15/10 band at the beginning of the week. In spite of Monday’s corrective move, the index maintai

続きを読む »

Mortgage rates hit their highest point since 2000Mortgage rates hit the highest level since the end of 2000, and that is crushing affordability for potential homebuyers.

Mortgage rates hit their highest point since 2000Mortgage rates hit the highest level since the end of 2000, and that is crushing affordability for potential homebuyers.

続きを読む »

Mortgage rates continue to climb, reach highest level since 2000Mortgage rates are pushing even higher this week and are now clocking in at their highest level since the turn of the century.

Mortgage rates continue to climb, reach highest level since 2000Mortgage rates are pushing even higher this week and are now clocking in at their highest level since the turn of the century.

続きを読む »

The 30-year mortgage rate hits 7.48%, the highest level since 2000Mortgage interest rates have nearly tripled in the span of just a couple years amid inflation fears and strong economic growth.

The 30-year mortgage rate hits 7.48%, the highest level since 2000Mortgage interest rates have nearly tripled in the span of just a couple years amid inflation fears and strong economic growth.

続きを読む »

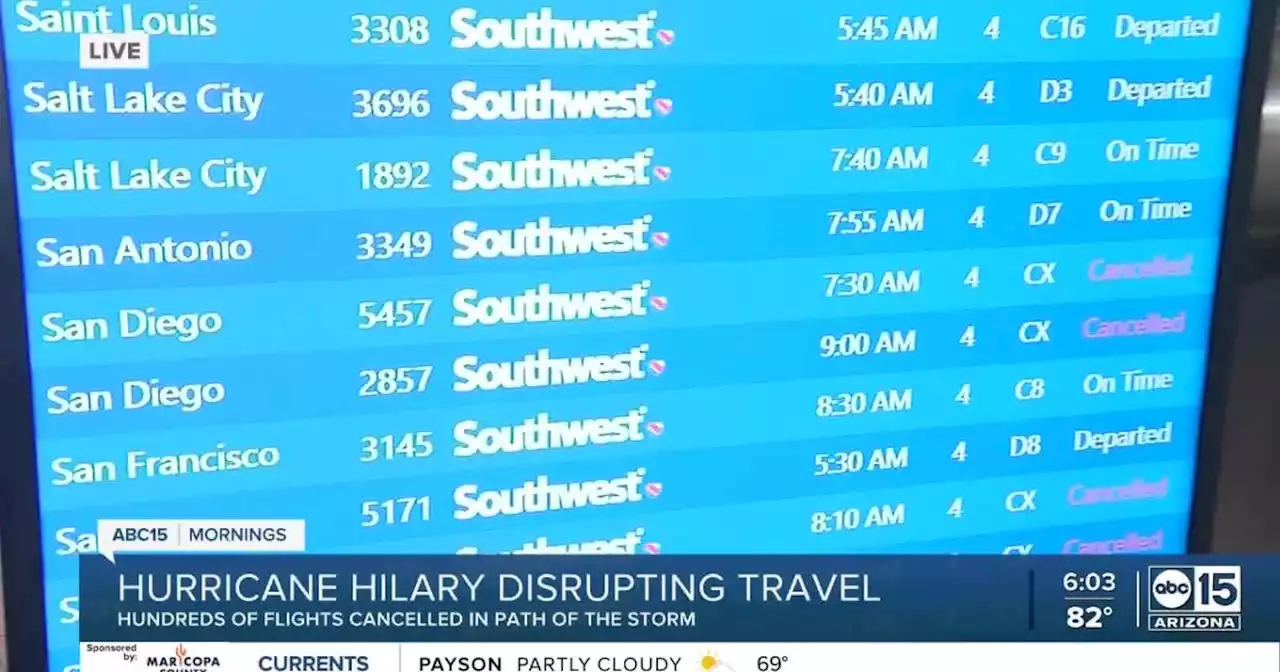

Nearly 200 flights impacted at Sky Harbor this weekend as Hilary approachesNearly 200 flights have been impacted at Phoenix Sky Harbor International Airport this weekend as Tropical Storm Hilary continues churning towards the Southwest.

Nearly 200 flights impacted at Sky Harbor this weekend as Hilary approachesNearly 200 flights have been impacted at Phoenix Sky Harbor International Airport this weekend as Tropical Storm Hilary continues churning towards the Southwest.

続きを読む »