First Republic handed out billions in ultra-low-rate mortgages to the wealthy. It backfired horribly.

One of the causes of First Republic's troubles is a strategy to woo rich clients with huge mortgages that offer sweet terms, as detailed inIn particular, First Republic would offer interest-only mortgages, where the borrower didn't have to pay back any principal for the first decade of the loan. In 2020 and 2021, it extended close to $20 billion of these loans in San Francisco, Los Angeles, and New York alone, per Bloomberg's analysis.

Many of these loans went to ultra wealthy types in finance, tech, and media. For example, one of the most senior executives at Goldman Sachs took out an $11.2 million mortgage with First Republic with no principal payments in the first 10 years and an interest rate below 3%, per Bloomberg.

And these loans are hard to sell to other lenders, given Fannie Mae and Freddie Mac are limited to onlyup to just over $1 million. Should they successfully sell, it would also create a hole in First Republic's balance sheet. The bank would be forced to recognize the current value of these loans, and what are currently unrealized losses could suddenly wipe out the bank's capital.

First Republic is now backtracking from this strategy, saying it will focus on writing loans that are guaranteed by Fannie and Freddie. More immediately, the bank is trying to find a way to convince buyers to take on some of its assets, including finding ways to sweeten the deal with equity-like instruments so buyers pay a higher price for the loans, according to Tan and Monks at Bloomberg.Sign up for notifications from Insider! Stay up to date with what you want to know.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

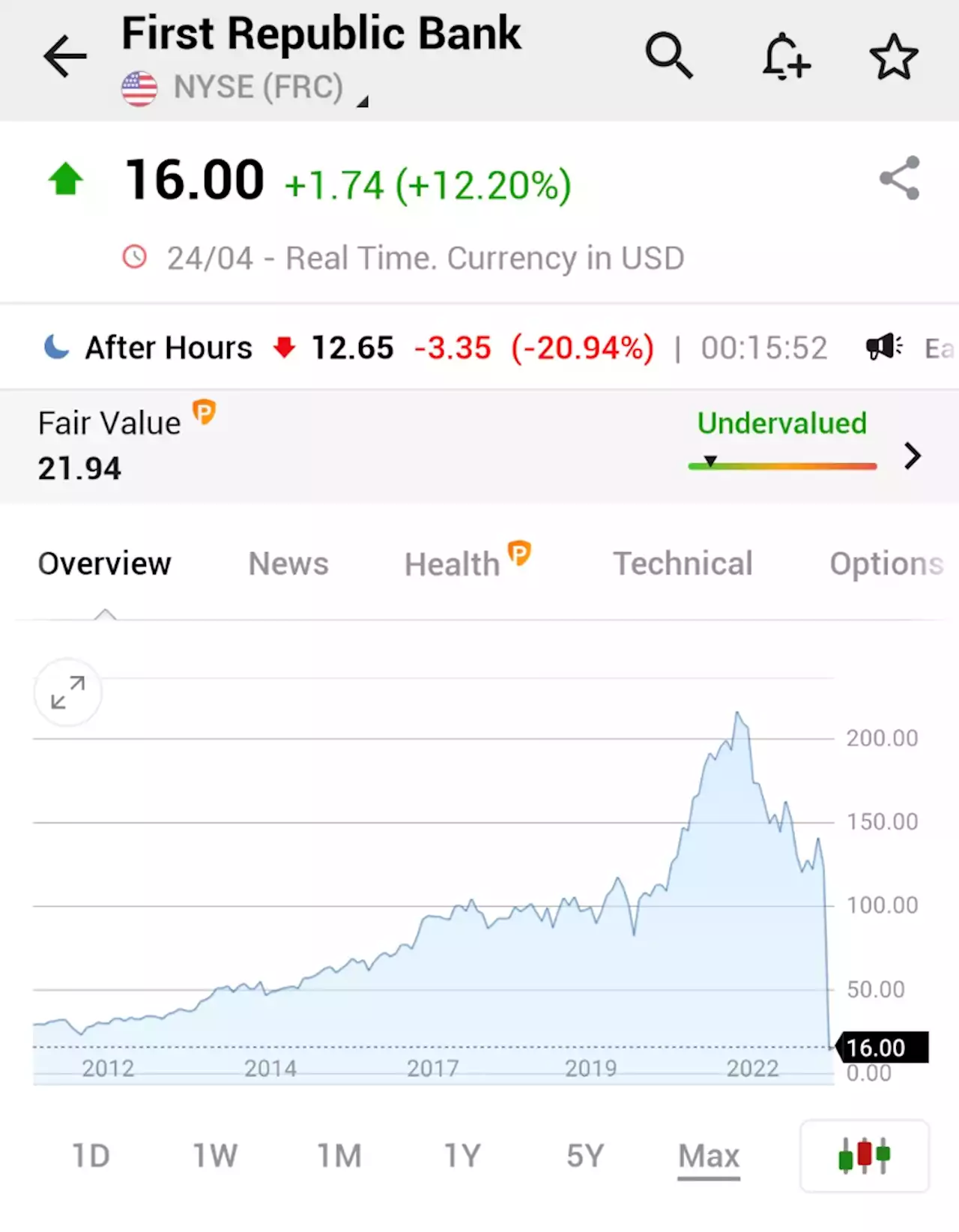

First Republic bank says deposits tumbled 40% to $104.5 billion in the first quarterThe lender said things have stabilized since last month's banking emergency, but it will still reduce headcount by 20% to 25% in the second quarter.

First Republic bank says deposits tumbled 40% to $104.5 billion in the first quarterThe lender said things have stabilized since last month's banking emergency, but it will still reduce headcount by 20% to 25% in the second quarter.

続きを読む »

First Republic Bank slashing up to a quarter of its workforceThe bank expects to cut its workforce by 20-25%, the embattled lender said Monday.

First Republic Bank slashing up to a quarter of its workforceThe bank expects to cut its workforce by 20-25%, the embattled lender said Monday.

続きを読む »

First Republic Bank to slash up to a quarter of its workforce | CNN BusinessFirst Republic Bank expects to cut its workforce by 20-25% this quarter, the embattled lender said late Monday.

First Republic Bank to slash up to a quarter of its workforce | CNN BusinessFirst Republic Bank expects to cut its workforce by 20-25% this quarter, the embattled lender said late Monday.

続きを読む »

First Republic Bank deposits fall by $72 billion, announces layoffsFirst Republic Bank's deposits fell by $72 billion in the first quarter, overshadowing market-beating profit and sending its shares down 15% in extended trading on Monday.

First Republic Bank deposits fall by $72 billion, announces layoffsFirst Republic Bank's deposits fell by $72 billion in the first quarter, overshadowing market-beating profit and sending its shares down 15% in extended trading on Monday.

続きを読む »

First Republic Bank deposits tumble more than $100 billion as it explores options By Reuters*FIRST REPUBLIC BANK LOST OVER $100 BILLION IN CUSTOMER DEPOSITS IN Q1 FOLLOWING SILICON VALLEY BANK'S COLLAPSE $FRC

First Republic Bank deposits tumble more than $100 billion as it explores options By Reuters*FIRST REPUBLIC BANK LOST OVER $100 BILLION IN CUSTOMER DEPOSITS IN Q1 FOLLOWING SILICON VALLEY BANK'S COLLAPSE $FRC

続きを読む »

First Republic Bank Stock Price Today | NYSE FRC Live Ticker - Investing.comView today's First Republic Bank stock price and latest FRC news and analysis. Create real-time notifications to follow any changes in the live stock price.

First Republic Bank Stock Price Today | NYSE FRC Live Ticker - Investing.comView today's First Republic Bank stock price and latest FRC news and analysis. Create real-time notifications to follow any changes in the live stock price.

続きを読む »