Subscribers: How Fed's bigger, faster rate hikes will affect your credit card, mortgage, savings rates

“Homebuying has become more difficult for many in the market,” says Lending Tree senior economic analyst Jacob Channel. A silver lining, he says, is that it should cool demand for homes, slowing torrid price growth and providing buyers more options and some relief from bidding wars., were close to a two-year low. With mortgage rates continuing to rise, sales are set to fall even further, analysts said.

As Fed rates rise, banks will be able to charge a little more for loans, giving them more profit margin to pay a higher rate on customer deposits. Don’t expect a fast or equivalent increase on most savings account and CD rates, says Ken Tumin, founder of DepositAccounts.com. Since the pandemic, banks have been flush with deposits, and demand for loans has been weak because of the COVID-19-related downturn, Tumin says. In other words, most brick-and-mortar banks don't really need your money.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

US Dollar Index retreats from 20-year high as yields brace for Fed meetingUS Dollar Index (DXY) bulls take a breather after refreshing a two-decade top, dropping back to 105.00 during early Tuesday morning in Europe, amid th

US Dollar Index retreats from 20-year high as yields brace for Fed meetingUS Dollar Index (DXY) bulls take a breather after refreshing a two-decade top, dropping back to 105.00 during early Tuesday morning in Europe, amid th

続きを読む »

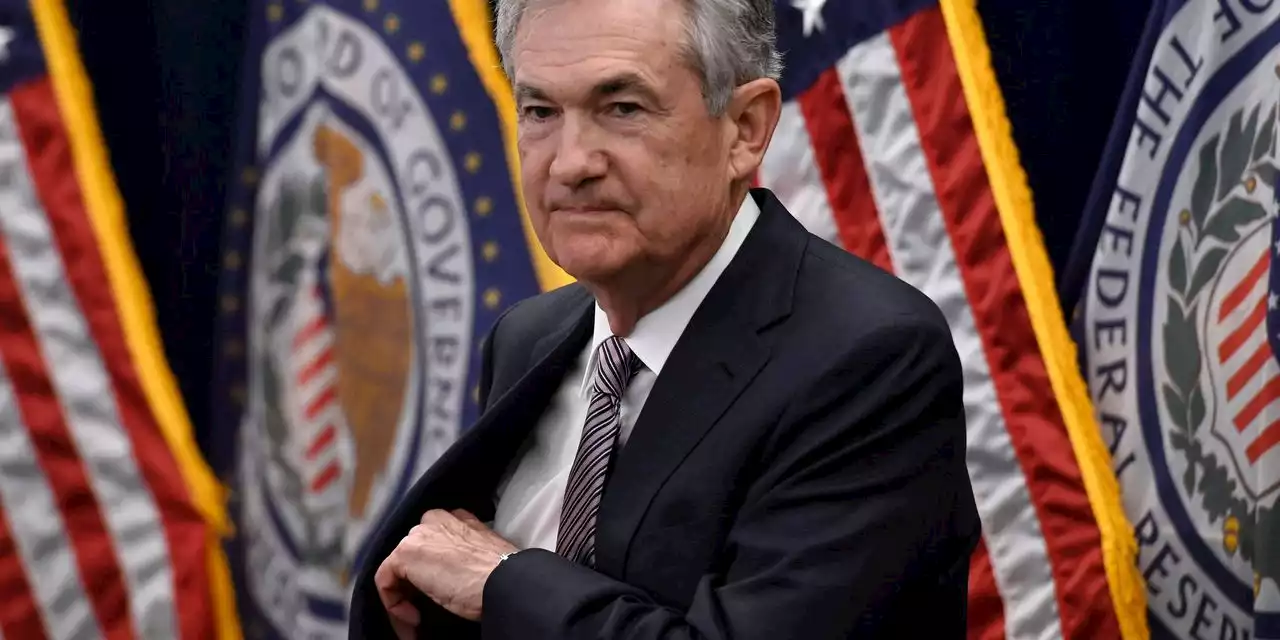

Fed Likely to Consider 0.75-Percentage-Point Rate Rise This WeekA string of troubling inflation reports is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected interest-rate increase at their meeting this week.

Fed Likely to Consider 0.75-Percentage-Point Rate Rise This WeekA string of troubling inflation reports is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected interest-rate increase at their meeting this week.

続きを読む »

EUR/USD sees cushion below 1.0400, downside looks likely ahead of Fed and ECB LagardeThe EUR/USD pair is witnessing a minor cushion marginally below 1.0400 in the Asian session, however, more downside is still favored amid broader stre

EUR/USD sees cushion below 1.0400, downside looks likely ahead of Fed and ECB LagardeThe EUR/USD pair is witnessing a minor cushion marginally below 1.0400 in the Asian session, however, more downside is still favored amid broader stre

続きを読む »

USD/JPY faces barricades around 134.40 as DXY skids, Fed and BOJ in focusThe USD/JPY pair has faced some offers while overstepping the critical resistance of 134.40 in the Asian session. The asset is oscillating in a narrow

USD/JPY faces barricades around 134.40 as DXY skids, Fed and BOJ in focusThe USD/JPY pair has faced some offers while overstepping the critical resistance of 134.40 in the Asian session. The asset is oscillating in a narrow

続きを読む »

Jim Cramer: Why we're buying stocks heading into Wednesday's big Fed decisionOn Tuesday, we will begin to put to the money to work that we have saved on the sidelines.

Jim Cramer: Why we're buying stocks heading into Wednesday's big Fed decisionOn Tuesday, we will begin to put to the money to work that we have saved on the sidelines.

続きを読む »

JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points on WednesdayEconomists at JP Morgan and Goldman Sachs said in client notes Monday that they now expect the Federal Reserve to raise its policy rate by 75 basis points on Wednesday. Or could it even be 100?

JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points on WednesdayEconomists at JP Morgan and Goldman Sachs said in client notes Monday that they now expect the Federal Reserve to raise its policy rate by 75 basis points on Wednesday. Or could it even be 100?

続きを読む »