A growing number of Americans are finding it difficult to afford insurance on their homes, a problem only expected to worsen because insurers and lawmakers have underestimated the impact of climate change, a new report says.

“Some places may be impacted very minimally, but other places could see massive increases in insurance premiums in the coming years,” said Jeremy Porter, head of climate implications at First Street and a co-author of the report.

Skyrocketing insurance costs are a serious concern for the small town of Paradise in Northern California, which was nearly wiped out by a deadly 2018 wildfire that killed 85 people. Goodlin, a former dental hygienist who is now executive director of the nonprofit Rebuild Paradise Foundation, said hundreds, if not thousands, of people are being hit by these rate hikes in a town being built with updated fire-safe building codes and little if any fuel to burn. She knows a homeowner whose premium is now $21,000 for a newly constructed home.

In some cases, policymakers have bound the hands of insurance companies, leading to an underpricing of risk. For example, the most a California insurance company can raise a homeowner’s premium by law each year is 7% without involving a public hearing, a process that most insurers want to avoid. Those policies, along with the increased chance of catastrophic events, have led insurers liketo either pull out of the California market or pause underwriting new policies.

There are likely to be more insurance market failures in the future, Porter said, as more insurers simply refuse to underwrite policies in certain communities or go property by property. Comparisons to the National Flood Insurance Program, which is now $22.5 billion in debt, have become common. Reinsurers step in to help cover losses resulting from a catastrophe, so regular insurance companies do not take on all of the risk. In one example of a typical reinsurance contract, a $20 million contract could require the insurance company to cover the first $10 million in claims and the reinsurer to pick up the other $10 million.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

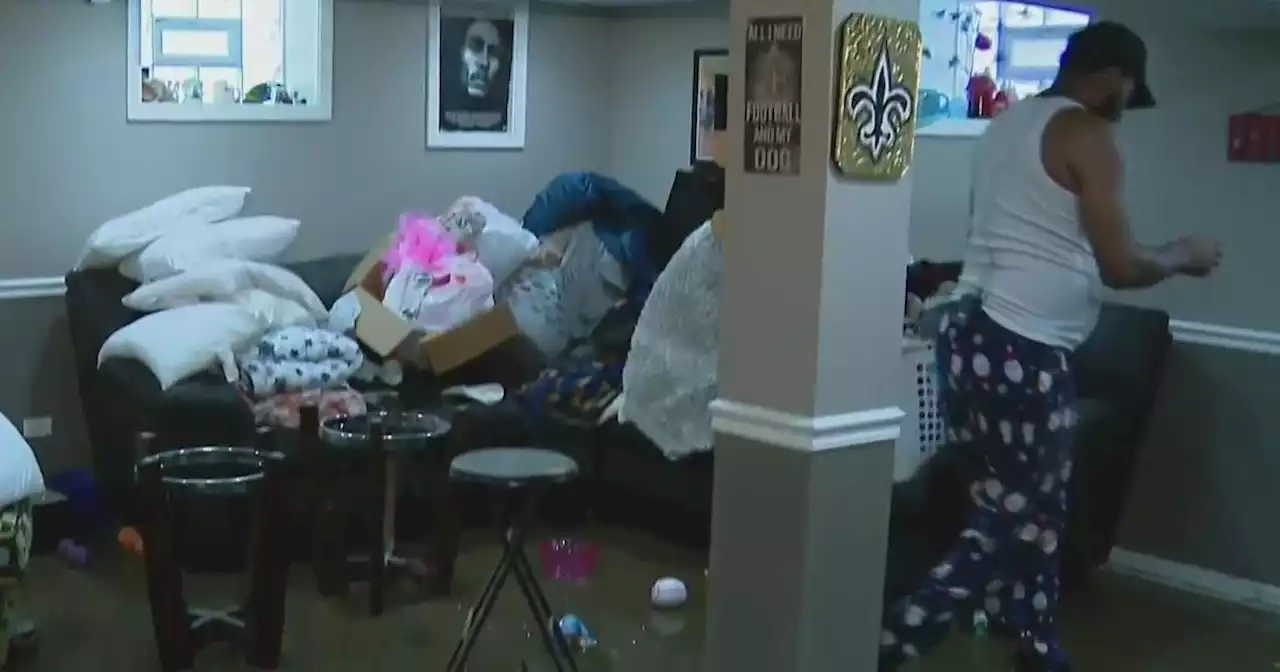

South suburban homeowners left cleaning up after 9 inches of rainWithin just a matter of hours, up to 9 inches of rain drenched Chicago's south suburbs.

South suburban homeowners left cleaning up after 9 inches of rainWithin just a matter of hours, up to 9 inches of rain drenched Chicago's south suburbs.

続きを読む »

25 Autumn Problem-Solving Products For HomeownersSave on energy and water bills this fall.

25 Autumn Problem-Solving Products For HomeownersSave on energy and water bills this fall.

続きを読む »

East Bay residents set to become homeowners in Walnut Creek thanks to Habitat for HumanitySome families in Walnut Creek are getting ready to move into new townhomes that would likely have been out of reach due to their financial circumstances if not for the nonprofit organization Habitat for Humanity.

East Bay residents set to become homeowners in Walnut Creek thanks to Habitat for HumanitySome families in Walnut Creek are getting ready to move into new townhomes that would likely have been out of reach due to their financial circumstances if not for the nonprofit organization Habitat for Humanity.

続きを読む »

South suburban homeowners cleanup, demand help after storm flooding'We've had issues with flooding in our alleys. Our alleys are not paved. Our taxes continue to go up.'

South suburban homeowners cleanup, demand help after storm flooding'We've had issues with flooding in our alleys. Our alleys are not paved. Our taxes continue to go up.'

続きを読む »