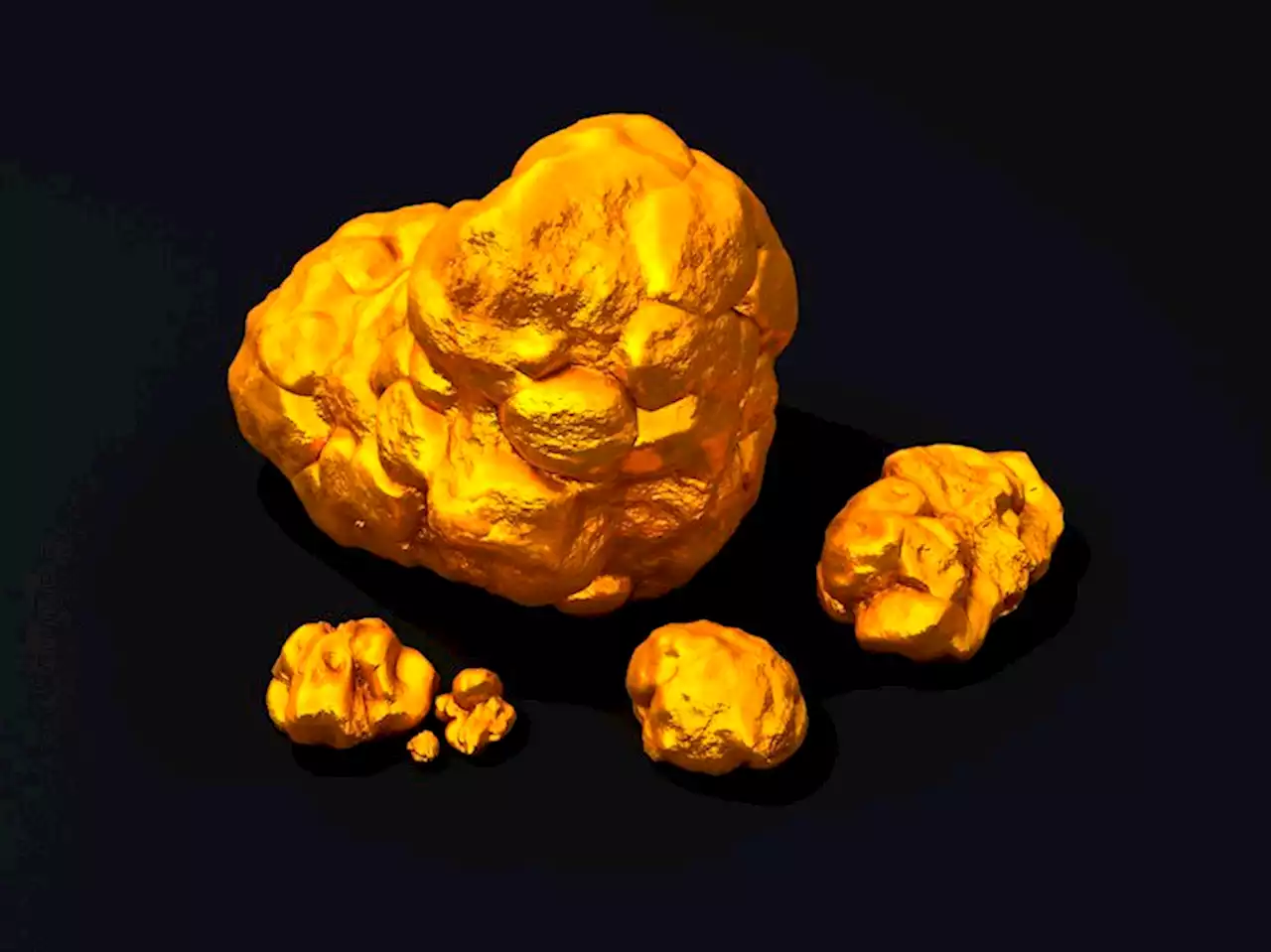

Gold Price Forecast: XAU/USD to rebound slightly next year as Fed easing starts – ING Gold XAUUSD Banks

“We expect Gold to remain on a downward trend during the Fed’s ongoing tightening cycle. But while in the short term we see more downside foramid monetary tightening, any hints from the Fed of an easing in its aggressive hiking cycle should start to provide support to prices. For this to happen, we would likely need to see signs of a significant decline in inflation.”

“We should see inflation coming off quite drastically over 2023 and this will then open the door for the“Under the assumption that we see easing over 2H23, we expect Gold to move higher over the course of 2023 with XAU/USD reaching $1,850 in 4Q23.”Information on these pages contains forward-looking statements that involve risks and uncertainties.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

US: Swift fall in inflation will allow the Fed to cut rates in 2023 – INGIn the view of economists at ING, recession will accelerate inflation's slide and allow the Federal Reserve to respond with rate cuts before 2023 is o

US: Swift fall in inflation will allow the Fed to cut rates in 2023 – INGIn the view of economists at ING, recession will accelerate inflation's slide and allow the Federal Reserve to respond with rate cuts before 2023 is o

続きを読む »

Gold Price Forecast: XAU/USD stays firmer on easing hawkish Federal Reserve bets, optimism surrounding ChinaGold Price Forecast: XAU/USD stays firmer on easing hawkish Federal Reserve bets, optimism surrounding China – by anilpanchal7 Gold SEO Coronavirus China Fed

Gold Price Forecast: XAU/USD stays firmer on easing hawkish Federal Reserve bets, optimism surrounding ChinaGold Price Forecast: XAU/USD stays firmer on easing hawkish Federal Reserve bets, optimism surrounding China – by anilpanchal7 Gold SEO Coronavirus China Fed

続きを読む »

Gold Price Forecast: XAU/USD bulls still eye $1,825 amid year-end trading – Confluence DetectorGold price is extending the previous week’s uptrend, as a holiday-thinned light trading offers buyers conducive conditions. The main catalyst, however

Gold Price Forecast: XAU/USD bulls still eye $1,825 amid year-end trading – Confluence DetectorGold price is extending the previous week’s uptrend, as a holiday-thinned light trading offers buyers conducive conditions. The main catalyst, however

続きを読む »

Gold Price Forecast: XAU/USD aims to hold itself above $1,800 as market mood soarsGold price (XAU/USD) has overstepped Friday’s high around $1,804.00 and is expected to shift its auction profile above the psychological resistance of

Gold Price Forecast: XAU/USD aims to hold itself above $1,800 as market mood soarsGold price (XAU/USD) has overstepped Friday’s high around $1,804.00 and is expected to shift its auction profile above the psychological resistance of

続きを読む »

Gold Price Forecast: XAU/USD set to test critical resistance at $1,825Gold price extends previous gains above $1,800. Will XAU/USD recapture $1,825 heading into 2023? FXStreet’s Dhwani Mehta analyzes the pair’s technical

Gold Price Forecast: XAU/USD set to test critical resistance at $1,825Gold price extends previous gains above $1,800. Will XAU/USD recapture $1,825 heading into 2023? FXStreet’s Dhwani Mehta analyzes the pair’s technical

続きを読む »

Copper: Near-term headwinds but upside risks to dominate long-term – INGCopper (LME) prices are now down around 30% from their peak in February. The short-term demand outlook for the red metal remains weak, but economists

Copper: Near-term headwinds but upside risks to dominate long-term – INGCopper (LME) prices are now down around 30% from their peak in February. The short-term demand outlook for the red metal remains weak, but economists

続きを読む »