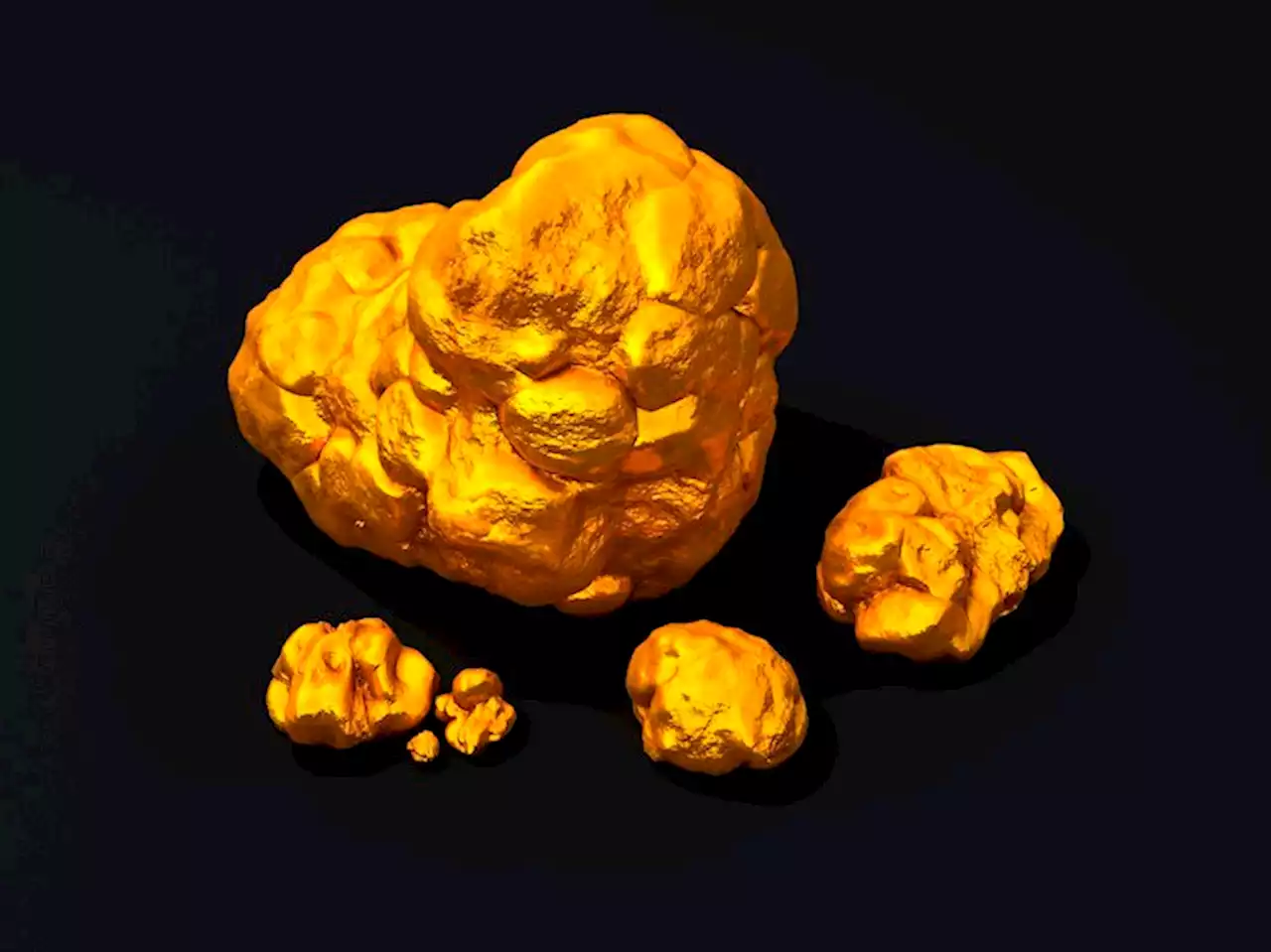

Gold Price Forecast: XAU/USD struggles to capitalize on intraday gains, remains below $1,960 – by hareshmenghani Gold Commodities Fed InterestRate XAUUSD

A modest US Dollar weakenss is seen lending support to the precious metal.builds on the overnight bounce from the $1,946-$1,945 area, or a multi-day low and gains some positive traction during the Asian session on Tuesday. The XAU/USD currently trades around the $1,957-$1,958 region, up just over 0.10% for the day, and remains well within the striking distance of a one-month peak touched last Friday.

The US Dollar remains on the defensive near its lowest level since April 2022 in the wake of firming expectations that the Federal Resreve is nearing the end of its policy tightening cycle. In fact, market participants now seem convinced that the Fed will keep interest rates steady for the rest of this year after the highly-anticipated 25 basis points lift-off in July.

Investors, however, doubt that the Fed will commit to a more dovish policy stance, instead might stick to its forecast for a 50 bps rate hike this year. This helps limit the downside for the US Treasury bond yields and should act as a tailwind for the USD, capping any meaningful upside for the non-yielding Gold price.

Even from a technical perspective, the range-bound price action witnessed over the past four days points to indecision among traders over the near-term trajectory for the Gold price. This further makes it prudent to wait for a sustained strength beyond the $1,963-$1,964 region, or the one-month peak before positioning for any further appreciating move.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Gold Price Forecast: XAU/USD prints bullish consolidation near $1,950 amid Fed blackoutGold Price (XAU/USD) prints mild losses around $1,953 as it extends Friday’s retreat from the short-term key resistance line amid the early hours of M

Gold Price Forecast: XAU/USD prints bullish consolidation near $1,950 amid Fed blackoutGold Price (XAU/USD) prints mild losses around $1,953 as it extends Friday’s retreat from the short-term key resistance line amid the early hours of M

続きを読む »

Gold Price Forecast: XAU/USD consolidates in a range, holds steady above $1,950 levelGold Price Forecast: XAU/USD consolidates in a range, holds steady above $1,950 level – by hareshmenghani Gold Commodities Fed RiskAppetite XAUUSD

Gold Price Forecast: XAU/USD consolidates in a range, holds steady above $1,950 levelGold Price Forecast: XAU/USD consolidates in a range, holds steady above $1,950 level – by hareshmenghani Gold Commodities Fed RiskAppetite XAUUSD

続きを読む »

Gold Price Forecast: XAU/USD loses the momentum above $1,950 following mixed Chinese dataGold price struggles to gain traction and extends Friday’s retracement slide from the $1,965 area. The precious metal currently trades around $1,950 i

Gold Price Forecast: XAU/USD loses the momentum above $1,950 following mixed Chinese dataGold price struggles to gain traction and extends Friday’s retracement slide from the $1,965 area. The precious metal currently trades around $1,950 i

続きを読む »

Gold Price Forecast: XAU/USD retreat appears elusive beyond $1,935 – Confluence DetectorGold Price (XAU/USD) remains on the back foot for the second consecutive day, extending the previous day’s pullback from the highest level in a month,

Gold Price Forecast: XAU/USD retreat appears elusive beyond $1,935 – Confluence DetectorGold Price (XAU/USD) remains on the back foot for the second consecutive day, extending the previous day’s pullback from the highest level in a month,

続きを読む »

Gold Forecast: Gold Markets ConsolidateGold markets displayed limited activity on Friday, with prices maintaining a position above the 50-Day Exponential Moving Average.

Gold Forecast: Gold Markets ConsolidateGold markets displayed limited activity on Friday, with prices maintaining a position above the 50-Day Exponential Moving Average.

続きを読む »

Gold Price Gives Up Some Gains as the US Dollar Steadies. Where to for XAU/USD?The gold price has paused on its recent run higher as the market takes stock of where the US Dollar is headed. The yellow metal has eased to start the week as the ‘big dollar’ ticks slightly higher. Read DanMcCarthyFX 's analysis here 👇

Gold Price Gives Up Some Gains as the US Dollar Steadies. Where to for XAU/USD?The gold price has paused on its recent run higher as the market takes stock of where the US Dollar is headed. The yellow metal has eased to start the week as the ‘big dollar’ ticks slightly higher. Read DanMcCarthyFX 's analysis here 👇

続きを読む »