Indices begun the week well on Monday, and the FTSE 100 is poised to rejoin the fray at new record highs this morning.

Monday saw the index open back above the 50-day SMA for the first time since 4 April. This continues the recovery from the lows of mid-April when the price touched a three-month low. Since then the price has added around 1500 points. Friday’s close above the mid-April high of around 38,600 continues to bolster the case for further upside.

This index also continues to make strong progress, completing a similar pattern to the Dow. It opened and closed above the 50-day SMA for the first time since early April, having similarly closed above its mid-April high .This leaves the index well-placed to target theprevious record highs from March and April around 18,420. Most of the big tech earnings are out of the way, removing one possible risk for the index.

A close back below 17,500 would be needed to negate this bullish view and suggest that another test of the 17,000 low from April could develop.Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Information presented by DailyFX Limited should be construed as market commentary, merely observing economical, political and market conditions. This information is made available for informational purposes only. It is not a solicitation or a recommendation to trade derivatives contracts or securities and should not be construed or interpreted as financial advice.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Trading the Giants: Strategies for the S&P 500, Nasdaq 100, FTSE 100, and DAX 40Stock market indices form the backbone of global investing, providing a way to track the performance of entire economies or sectors. Among the most heavily traded indices are the S&P 500 (US), Nasdaq 100 (US tech), FTSE 100 (UK), and DAX 40 (Germany).

Trading the Giants: Strategies for the S&P 500, Nasdaq 100, FTSE 100, and DAX 40Stock market indices form the backbone of global investing, providing a way to track the performance of entire economies or sectors. Among the most heavily traded indices are the S&P 500 (US), Nasdaq 100 (US tech), FTSE 100 (UK), and DAX 40 (Germany).

続きを読む »

FTSE 100, DAX 40 and Nasdaq 100 Remain Under PressureOutlook on FTSE 100, DAX 40 and Nasdaq 100 as investors await Israeli response to Iran’s attack.

FTSE 100, DAX 40 and Nasdaq 100 Remain Under PressureOutlook on FTSE 100, DAX 40 and Nasdaq 100 as investors await Israeli response to Iran’s attack.

続きを読む »

FTSE 100, DAX 40 and Nasdaq 100 Regain Lost GroundOutlook on FTSE 100, DAX 40 and Nasdaq 100 as US earnings season kicks off.

FTSE 100, DAX 40 and Nasdaq 100 Regain Lost GroundOutlook on FTSE 100, DAX 40 and Nasdaq 100 as US earnings season kicks off.

続きを読む »

FTSE 100, DAX 40 and Nasdaq 100 Await US CPI PrintOutlook on FTSE 100, DAX 40 and Nasdaq 100 ahead of US inflation data and FOMC minutes.

FTSE 100, DAX 40 and Nasdaq 100 Await US CPI PrintOutlook on FTSE 100, DAX 40 and Nasdaq 100 ahead of US inflation data and FOMC minutes.

続きを読む »

FTSE 100, DAX 40 and Nasdaq 100 Regain Some of Last Week’s Lost GroundOutlook on FTSE 100, DAX 40 and Nasdaq 100 amid quiet day on data front.

FTSE 100, DAX 40 and Nasdaq 100 Regain Some of Last Week’s Lost GroundOutlook on FTSE 100, DAX 40 and Nasdaq 100 amid quiet day on data front.

続きを読む »

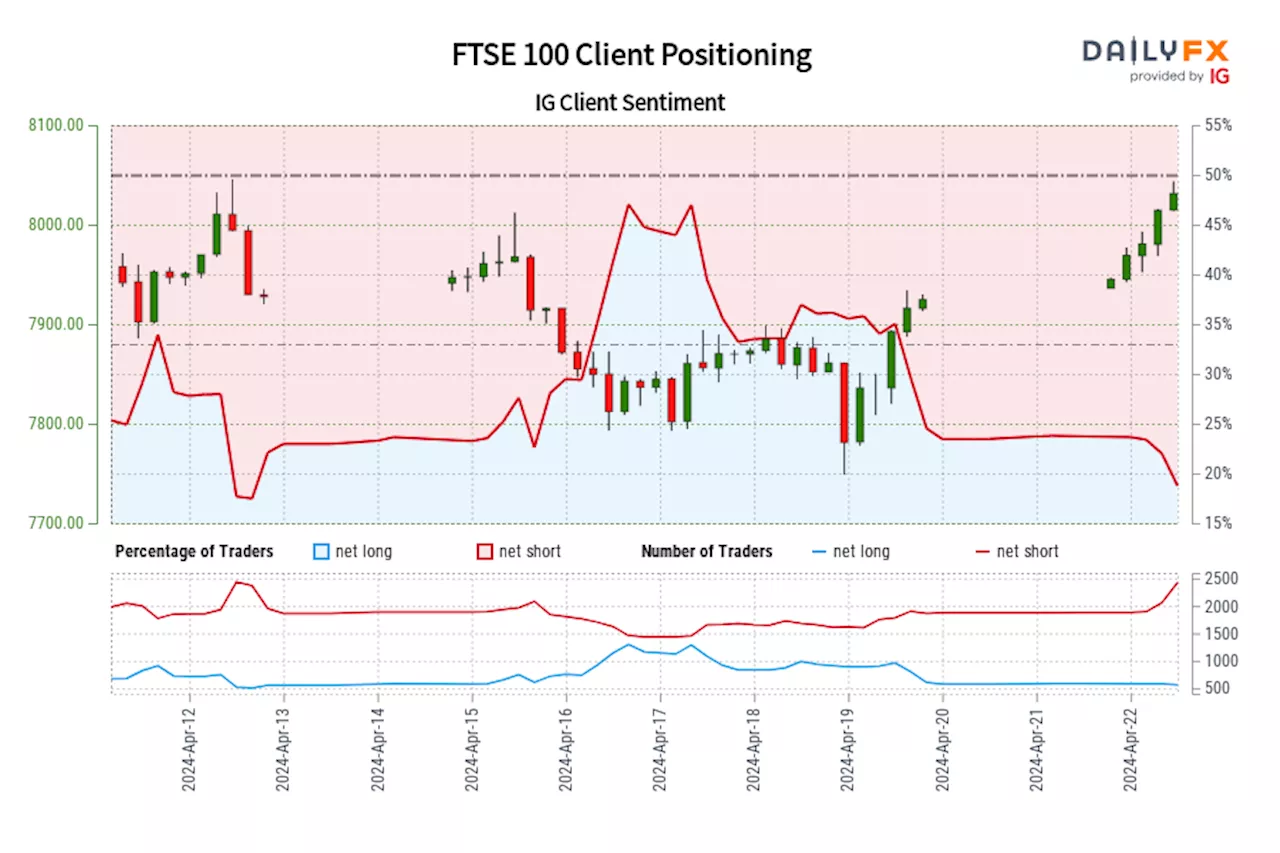

FTSE 100 IG Client Sentiment: Our data shows traders are now at their least net-long FTSE 100 since Apr 12 when FTSE 100 traded near 7,927.50.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger FTSE 100-bullish contrarian trading bias.

FTSE 100 IG Client Sentiment: Our data shows traders are now at their least net-long FTSE 100 since Apr 12 when FTSE 100 traded near 7,927.50.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger FTSE 100-bullish contrarian trading bias.

続きを読む »