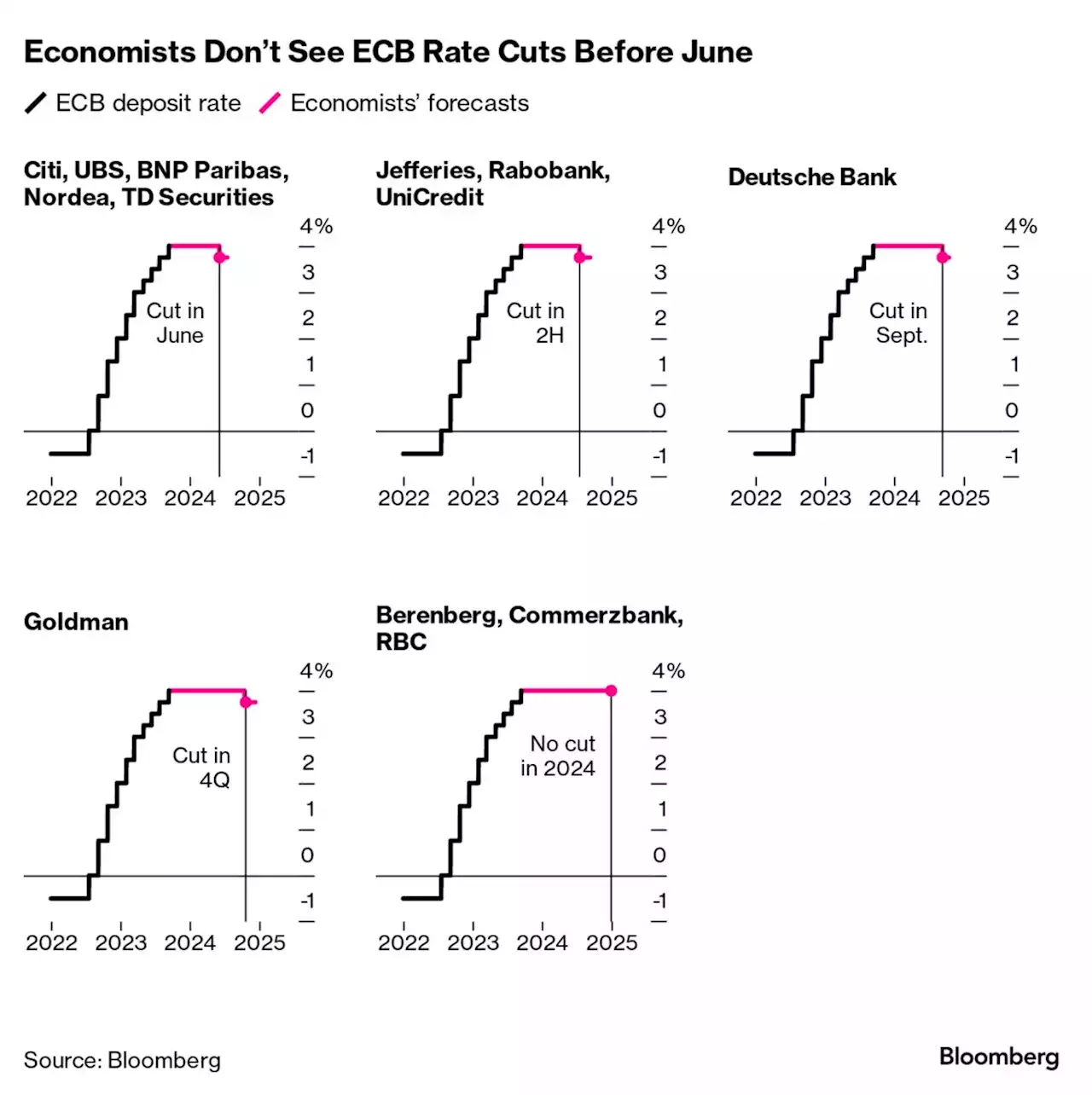

Economists are united in their assessments that the European Central Bank’s campaign of interest-rate increases reached its peak with Thursday’s 10th consecutive move.

European Central BankSome — including those at Commerzbank — expect borrowing costs to stay at 4% through 2024. Others — such as UBS and Citi — predict cuts starting as early as June.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

EUR/USD to stage a short-lived rally up towards 1.08 if the ECB hikes ratesEconomists at MUFG Bank outline their thoughts on the likely impact of today’s ECB policy meeting on the Euro. Two reasons why support from a hike is

EUR/USD to stage a short-lived rally up towards 1.08 if the ECB hikes ratesEconomists at MUFG Bank outline their thoughts on the likely impact of today’s ECB policy meeting on the Euro. Two reasons why support from a hike is

続きを読む »

ECB Hikes Rates as Fed Expected to Take Another PauseEconomists were divided on whether the ECB decision this time would be an increase or a pause in interest rates.

ECB Hikes Rates as Fed Expected to Take Another PauseEconomists were divided on whether the ECB decision this time would be an increase or a pause in interest rates.

続きを読む »

ECB Analysis: Euro set to fall as Lagarde fails to convince markets of more rate hikesThat's all, folks – that is the message markets have understood, overshadowing the fact that interest rates have risen once again. The European Centra

ECB Analysis: Euro set to fall as Lagarde fails to convince markets of more rate hikesThat's all, folks – that is the message markets have understood, overshadowing the fact that interest rates have risen once again. The European Centra

続きを読む »

Europe stocks set to extend gains after ECB hikes to record level, hints at peak ratesEuropean markets were set to open higher Friday as investors in the region assessed the European Central Bank’s rate decision.

Europe stocks set to extend gains after ECB hikes to record level, hints at peak ratesEuropean markets were set to open higher Friday as investors in the region assessed the European Central Bank’s rate decision.

続きを読む »

ECB may need to react to sticky core inflation with rate hikes next yearECB delivered a 25 bps rate hike. Economists at Société Générale do not exclude further rate hikes. A dovish ECB hike that may raise the need of furth

ECB may need to react to sticky core inflation with rate hikes next yearECB delivered a 25 bps rate hike. Economists at Société Générale do not exclude further rate hikes. A dovish ECB hike that may raise the need of furth

続きを読む »

Europe stocks extend gains after ECB hikes to record level, hints at peak ratesEuropean markets opened higher Friday as investors in the region assessed the European Central Bank’s rate decision.

Europe stocks extend gains after ECB hikes to record level, hints at peak ratesEuropean markets opened higher Friday as investors in the region assessed the European Central Bank’s rate decision.

続きを読む »