Lawyers, the FTX fiasco and other crypto blunders are largely on you, ChristyGRomero said in a speech today. The CFTC commissioner calls on lawyers, accountants and investors to save cryptocurrency firms from themselves. jesseahamilton reports

going on inside crypto firms such as FTX long before they imploded, said Christy Goldsmith Romero, a commissioner with the U.S. Commodity Futures Trading Commission .

At the risk of offending their crypto employers, Goldsmith Romero said the experienced hands – also including the investment firms backing these companies – “need to step up, and call for compliance, controls and other governance, without allowing the promise of riches and the company’s marketing pitch to silence their objections to obvious deficiencies.”

“FTX operated in a manner that simply should not be possible in the presence of appropriate independent governance and gatekeepers, even in an unregulated environment,” she said in remarks prepared for delivery Wednesday at an event examining the FTX bankruptcy, hosted by the Wharton School and the University of Pennsylvania’s Law School. “Gatekeepers should have seriously questioned the operational environment at FTX in the lead up to its meltdown.

Goldsmith Romero, a Democratic appointee who is the lead commissioner for the agency’s technology advisory committee, has previously“There is no shortage of lawyers working for unregulated crypto companies, including former federal government lawyers,” she said Wednesday. One of FTX’s most prominent names was Mark Wetjen, a former CFTC commissioner and acting agency chairman.

Her lengthy remarks also called for a total separation of customer funds from a company’s own assets. That should be part of any future congressional legislation, she said, in addition to better controls on conflicts of interest with companies’ insiders and affiliates, strong cybersecurity demands and wide application of the Bank Secrecy Act that guards against money laundering.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

FTX reports $415 mln in hacked crypto, Bankman-Fried says FTX US is solventBankrupt crypto exchange FTX said in a report to creditors on Tuesday that about $415 million in cryptocurrency had been stolen in hacks.

FTX reports $415 mln in hacked crypto, Bankman-Fried says FTX US is solventBankrupt crypto exchange FTX said in a report to creditors on Tuesday that about $415 million in cryptocurrency had been stolen in hacks.

続きを読む »

Bankman-Fried says claims made by FTX lawyers 'misleading'FTX founder Sam Bankman-Fried in a blog post refuted some claims made by the company's lawyers on Tuesday, saying that they were 'extremely misleading' and that FTX U.S. was and is solvent.

Bankman-Fried says claims made by FTX lawyers 'misleading'FTX founder Sam Bankman-Fried in a blog post refuted some claims made by the company's lawyers on Tuesday, saying that they were 'extremely misleading' and that FTX U.S. was and is solvent.

続きを読む »

SBF says FTX lawyers missed $428m in cash, could pay out US customersSam Bankman-Fried says FTX's lawyers overlooked $428 million in cash – and the bankrupt crypto exchange has the funds to make US customers whole

続きを読む »

FTX debtors identify $5.5 billion of liquid assets in ’Herculean effort’FTX identified $5.5 billion in cash, liquid crypto and liquid securities.

FTX debtors identify $5.5 billion of liquid assets in ’Herculean effort’FTX identified $5.5 billion in cash, liquid crypto and liquid securities.

続きを読む »

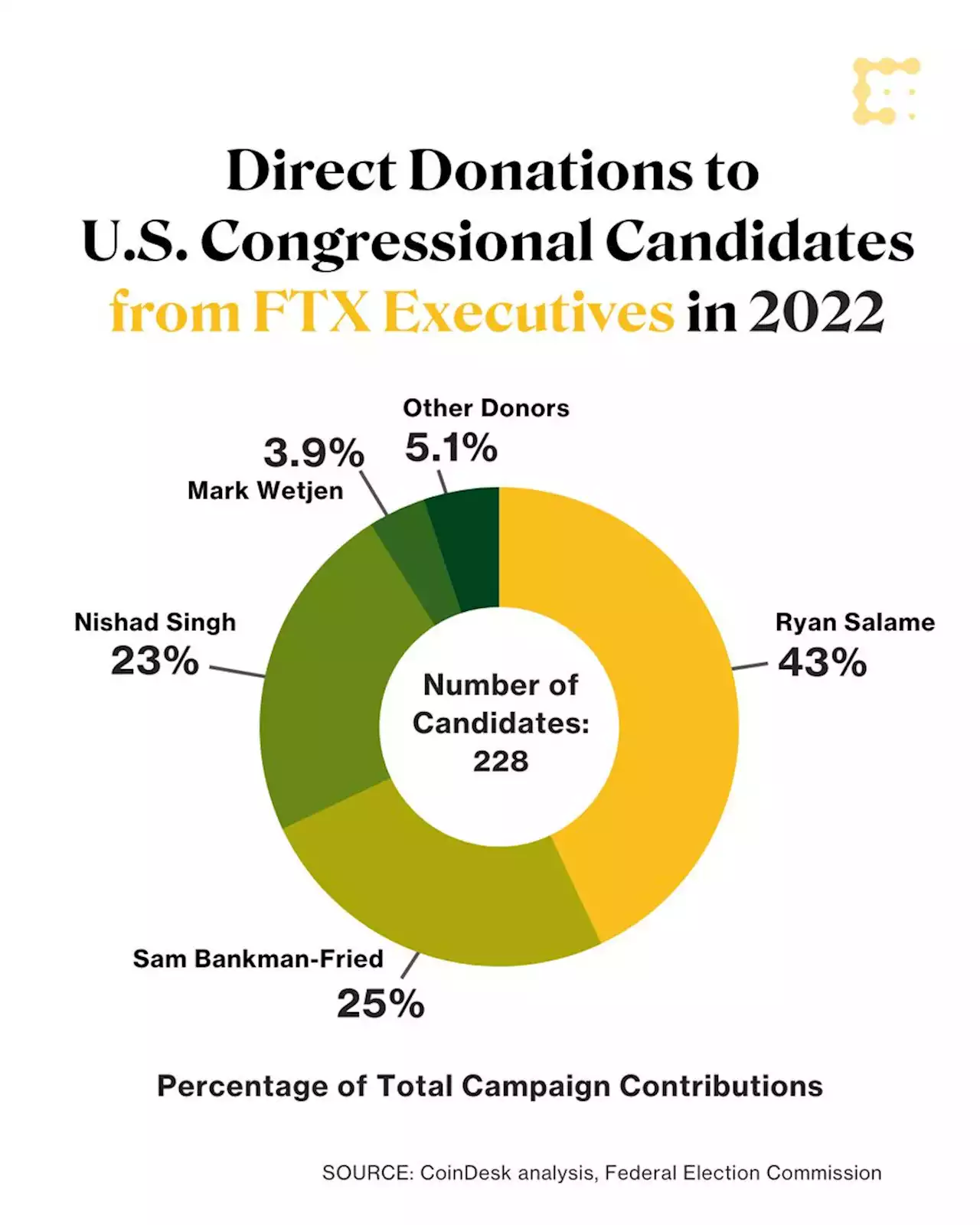

Congress' FTX Problem: 1 in 3 Members Got Cash From Crypto Exchange's BossesThe session began with 196 U.S. lawmakers who took direct contributions from Sam Bankman-Fried and other former FTX executives, and many of them are still trying to get rid of it.

Congress' FTX Problem: 1 in 3 Members Got Cash From Crypto Exchange's BossesThe session began with 196 U.S. lawmakers who took direct contributions from Sam Bankman-Fried and other former FTX executives, and many of them are still trying to get rid of it.

続きを読む »

Anthony Scaramucci Backs Ex-President of FTX US In New Crypto Venture | CoinMarketCapHarrison has not been accused of any wrongdoing in the $10 billion fraud that brought down Bankman-Fried's empire.

Anthony Scaramucci Backs Ex-President of FTX US In New Crypto Venture | CoinMarketCapHarrison has not been accused of any wrongdoing in the $10 billion fraud that brought down Bankman-Fried's empire.

続きを読む »