Raise the debt ceiling and pay our bills. Then, to address the elephant in the room. We need to have a frank discussion on what exactly is an acceptable amount of debt for the US government.

I say, “American style” capitalism because there is no such thing as a pure capitalist system, except on paper. Adam Smith and Milton Friedman are probably turning in their graves at the way our capitalist system operates – full of money in politics pulling all sorts of levers resulting in government’s hands interfering with the “free” market. But no lever is bigger than the lever of debt, how it is accessed, utilized and taxed.

Debt can be a powerful instrument of leverage, increasing potential return and/or reducing the cost of capital. The government knows this, which is why interest on debt is tax deductible for businesses. The interest on your mortgage debt is tax deductible. Sales taxes are deductible. Why? To encourage businesses and you to spend. I even remember when interest we paid on our credit card debt was tax deductible. We love debt.

But there is really no way to scientifically prove that any of this happens. It all works fine on paper, but it is impossible to create a controlled experiment in a world where everything is constantly changing. There is no way to do an accurate “after-action” analysis. We try, but there are always countless caveats and variables.Submit a Letter to the Editor

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

![]() Biden rushes to bail out Silicon Valley, continues to ignore East PalestineIn an uncharacteristic move, President Biden woke up early Monday morning to address the nation about the collapse of Silicon Valley Bank (SVB).

Biden rushes to bail out Silicon Valley, continues to ignore East PalestineIn an uncharacteristic move, President Biden woke up early Monday morning to address the nation about the collapse of Silicon Valley Bank (SVB).

続きを読む »

Commentary: 50 years ago, Supreme Court decided Texas school finance caseWe should learn our lessons from a flawed U.S. Supreme Court decision 50 years ago in San Antonio ISD v. Rodriguez and give all students a fair chance in education. Vouchers threaten that possibility.

続きを読む »

Lawmakers grilled Fed chair about plan to raise bank capital rules just before SVB collapseDays before the collapse of Silicon Valley Bank, Federal Reserve Chairman Jerome H. Powell took heat from lawmakers in both parties worried about the central bank’s possible plan to raise capital requirements for banks.

Lawmakers grilled Fed chair about plan to raise bank capital rules just before SVB collapseDays before the collapse of Silicon Valley Bank, Federal Reserve Chairman Jerome H. Powell took heat from lawmakers in both parties worried about the central bank’s possible plan to raise capital requirements for banks.

続きを読む »

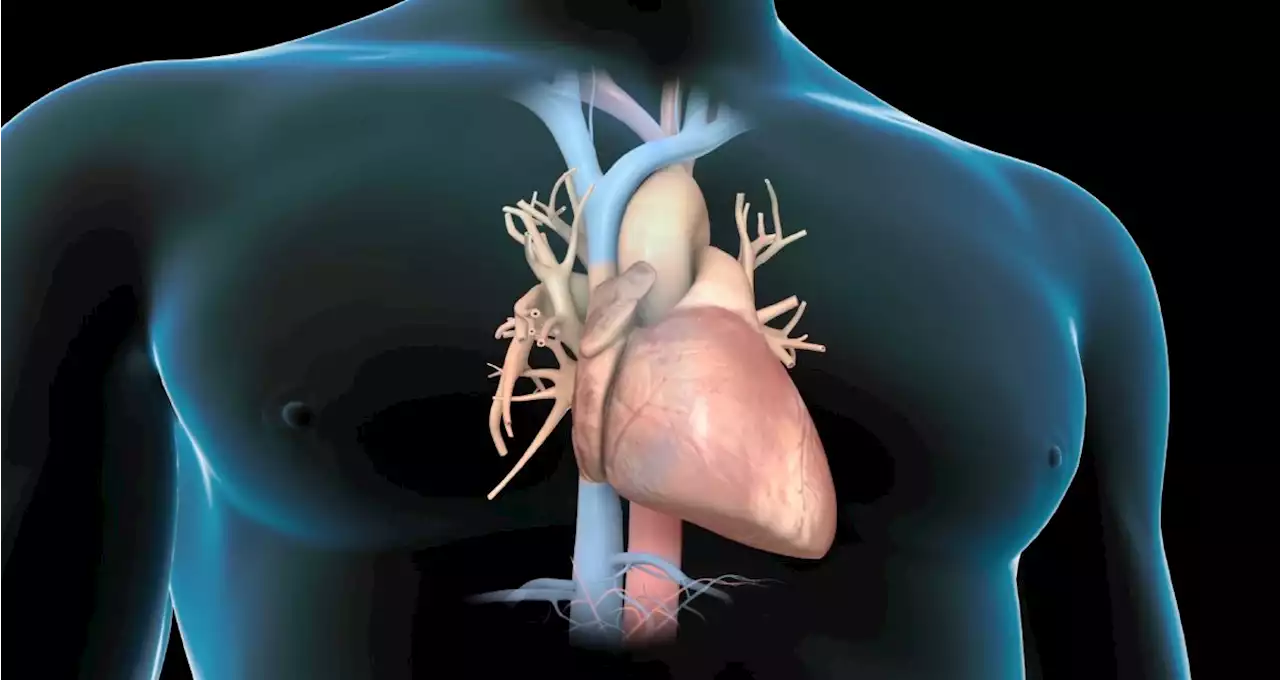

Having A-Fib Might Raise Odds for DementiaResearchers found that people newly diagnosed with a-fib had a 13% higher risk of developing dementia, the progressive loss of memory and thinking skills.

Having A-Fib Might Raise Odds for DementiaResearchers found that people newly diagnosed with a-fib had a 13% higher risk of developing dementia, the progressive loss of memory and thinking skills.

続きを読む »

SVB collapse: Bank failures raise odds of 2008-style recessionThe collapse of Silicon Valley Bank has led to a surge in signs that a recession is likely.

SVB collapse: Bank failures raise odds of 2008-style recessionThe collapse of Silicon Valley Bank has led to a surge in signs that a recession is likely.

続きを読む »

See the pitch deck a fintech startup used to raise $10 millionInsider tells the global tech, finance, markets, media, healthcare, and strategy stories you want to know.

続きを読む »