That two banks went offline because of a technical failure in one data centre shows the vulnerability of critical infrastructure. It’s a warning of what could happen in an intentional attack on Singapore’s systems, says S Rajaratnam School of International Studies’ Benjamin Ang.

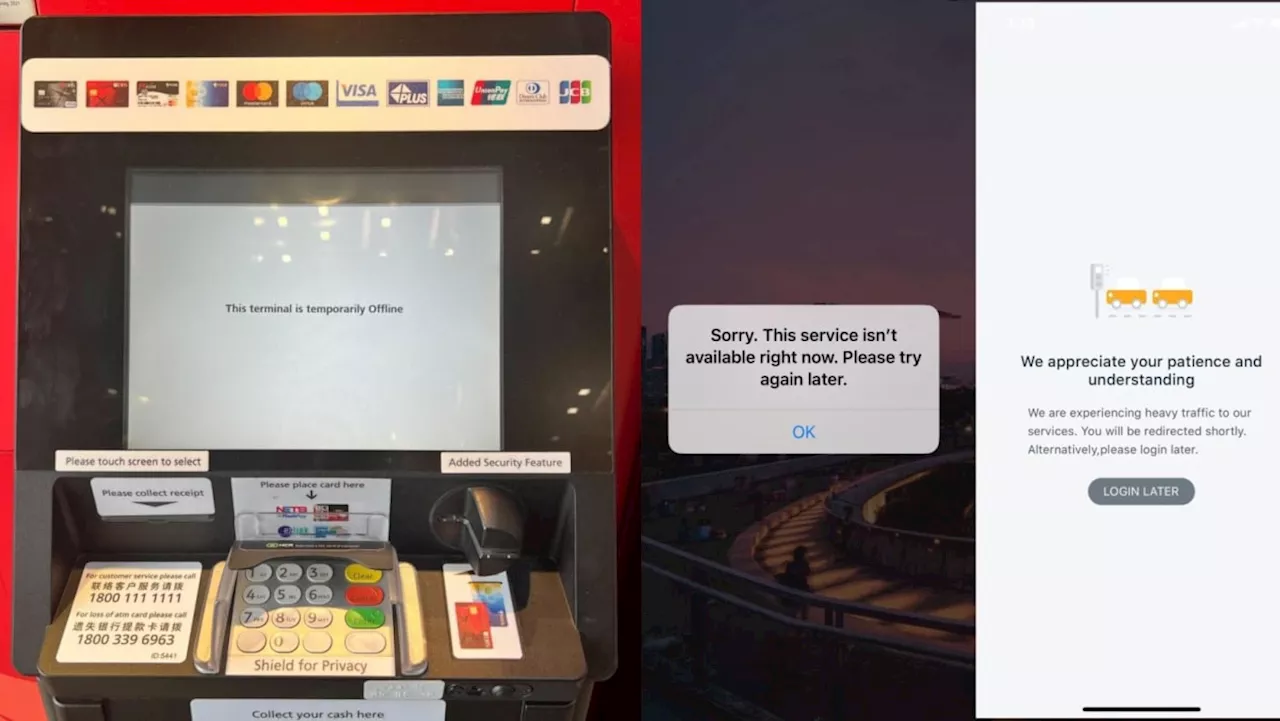

An error message on a DBS ATM at Central Mall and screenshots of the DBS iBanking service page and PayLah! service during the Oct 14, 2023 banking outage that affected DBS and Citibank.SINGAPORE: Oct 14 was an otherwise ordinary Saturday afternoon until many in Singapore found themselves unable to shop, buy food, pay for public transport, or carry out many of their usual weekend activities.

Even this incident will be forgotten - at least until the next time. But one fact from this latest outage that should worry us is that two banks went offline because of aLife quickly returned to normal but these are a warning of what could happen if we were ever hit by an intentional attack on our systems, or a combination of unintended accidents.A cyberattack on our power supply that caused extended blackouts would bring businesses, schools, and daily life to a halt.

can recover quickly from system disruptions, with no more than four hours of unscheduled downtime within a 12-month period. Coof new business ventures for six months and ordered it to pause non-essential IT changes which could cause further disruption. The regulator had already imposed additional capital requirements on Singapore’s largest bank because of previous disruptions.

In the case of critical infrastructure and essential services, these are necessary costs, because issues will still arise despite everyone’s best efforts. More positively, resilience enables business to continue, reduces losses, protects customers and trust, and can be a competitive advantage. That blessing can lead to complacency in society, even while we grow increasingly dependent on technology in many aspects of life. The experiences in Japan and New Zealand show that some basic steps, like having cash on hand, can

Panic and bank runs can ruin an economy, while distrust and polarisation can tear down a country. Other countries have experienced violent protests arising from hostile information campaigns that cause fear, which in turn leads to anger and hate. As a society, we must resist letting others push our buttons and choose courage, calm, and compassion to build resilience and bounce back.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

DBS, Citi outages prevented 2.5 million payment and ATM transactions from being completedAround 810,000 attempts to access DBS and Citibank's digital banking platforms failed during the Oct 14 to Oct 15 disruption, said Minister of State for Trade and Industry Alvin Tan.

DBS, Citi outages prevented 2.5 million payment and ATM transactions from being completedAround 810,000 attempts to access DBS and Citibank's digital banking platforms failed during the Oct 14 to Oct 15 disruption, said Minister of State for Trade and Industry Alvin Tan.

続きを読む »

DBS, Citi outages prevented 2.5 million payment and ATM transactions from being completedSINGAPORE — Around 2.5 million payment and ATM transactions could not be completed during last month’s DBS and Citibank service disruptions, Minister of State for Trade and Industry Alvin Tan said in parliament on Monday (Nov 6).

DBS, Citi outages prevented 2.5 million payment and ATM transactions from being completedSINGAPORE — Around 2.5 million payment and ATM transactions could not be completed during last month’s DBS and Citibank service disruptions, Minister of State for Trade and Industry Alvin Tan said in parliament on Monday (Nov 6).

続きを読む »

DBS had $100m exposure to money laundering bust; Q3 profit of $2.63b beats forecastsSingapore and South-east Asia’s largest lender expects net profit next year to match 2023’s level. Read more at straitstimes.com.

DBS had $100m exposure to money laundering bust; Q3 profit of $2.63b beats forecastsSingapore and South-east Asia’s largest lender expects net profit next year to match 2023’s level. Read more at straitstimes.com.

続きを読む »

DBS net profit up 18%; 48 cents interim dividend announcedpstrongCiti Taiwan contributed S$10b in loans./strong/p pDBS’ net profit rose 18% to S$2.63b in Q3 2023, buoyed by total income reaching a record high $5.19b during the quarter. /p pCompared to the previous quarter, net profit dipped slightly by 2%, as higher expenses and total allowances offset the higher income.

続きを読む »

Singapore bank DBS posts 18% jump in third quarter profit, beating estimatesDBS CEO Piyush Gupta also addressed the recent banking disruptions.

Singapore bank DBS posts 18% jump in third quarter profit, beating estimatesDBS CEO Piyush Gupta also addressed the recent banking disruptions.

続きを読む »

Alvin Tan on fixing DBS and Citibank digital banking disruptions on Oct 14The impact of the disruption of digital banking services of DBS and Citibank on Oct 14 was “wide”, said Minister of State for Trade and Industry Alvin Tan. Up to 810,000 attempts to access the digital banking platforms of both banks are estimated to have failed between 2.54pm on Oct 14 and 4.47am on Oct 15.

Alvin Tan on fixing DBS and Citibank digital banking disruptions on Oct 14The impact of the disruption of digital banking services of DBS and Citibank on Oct 14 was “wide”, said Minister of State for Trade and Industry Alvin Tan. Up to 810,000 attempts to access the digital banking platforms of both banks are estimated to have failed between 2.54pm on Oct 14 and 4.47am on Oct 15.

続きを読む »