From Breakingviews - TSMC foots the bill for global chip supremacy

. Notably, operating profit margin for the period is forecast to be as low as 41.5%, higher than rivals but more than 10 percentage points less than in the three months to December.

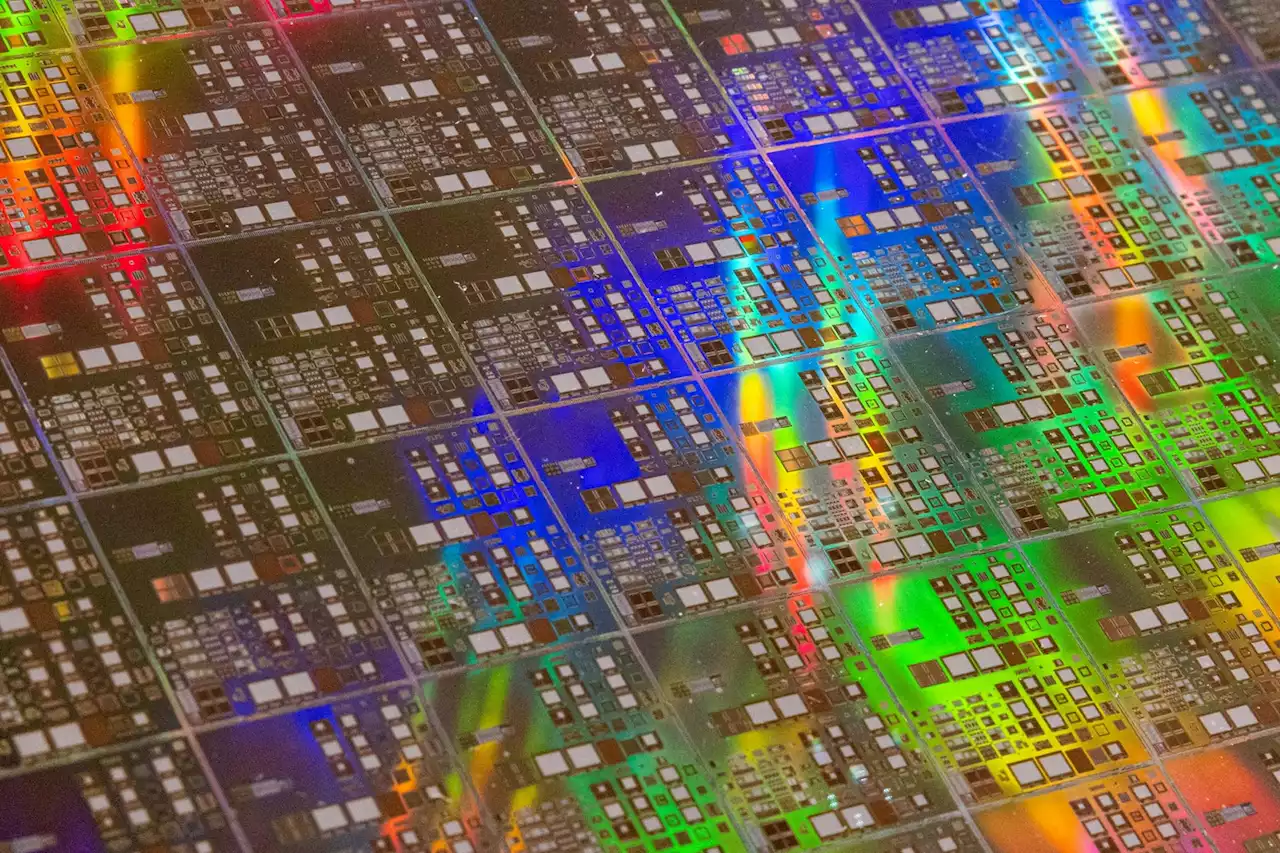

Fewer customer orders, cost inflation and unfavourable exchange-rate movements are factors. But TSMC also flagged R&D expenses will rise by a fifth this year, as developing next-generation technology gets pricier. Moreover, the company's new factories in the United States are adding to TSMC's expenses: executives said that construction costs are five times higher in America than in Taiwan.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Breakingviews - Breakingviews: Microsoft’s AI bet: heads I win, tails I also winMicrosoft is mulling a heads-I-win, tails-I-also win, AI deal. A mooted $10 billion investment, reported by Semafor, in the maker of the popular ChatGPT, could reshape Microsoft’s software business. Even if it flops, CEO Satya Nadella will slow a rival, and possibly regain much of its investment.

Breakingviews - Breakingviews: Microsoft’s AI bet: heads I win, tails I also winMicrosoft is mulling a heads-I-win, tails-I-also win, AI deal. A mooted $10 billion investment, reported by Semafor, in the maker of the popular ChatGPT, could reshape Microsoft’s software business. Even if it flops, CEO Satya Nadella will slow a rival, and possibly regain much of its investment.

続きを読む »

![]() Taiwan Semiconductor warns of falling revenue, deteriorating marginsContract chipmaker Taiwan Semiconductor Manufacturing Co. on Thursday warned weak macroeconomic conditions and inventory adjustments would result in falling...

Taiwan Semiconductor warns of falling revenue, deteriorating marginsContract chipmaker Taiwan Semiconductor Manufacturing Co. on Thursday warned weak macroeconomic conditions and inventory adjustments would result in falling...

続きを読む »

TSMC Q4 profit rises 78%, helped by advanced chip salesTaiwanese chipmaker TSMC posted a 78% rise in fourth-quarter net profit on Thursday, posting yet another quarterly record, as strong sales of advanced chips helped it defy a broader industry downturn that battered cheaper commodity chips.

TSMC Q4 profit rises 78%, helped by advanced chip salesTaiwanese chipmaker TSMC posted a 78% rise in fourth-quarter net profit on Thursday, posting yet another quarterly record, as strong sales of advanced chips helped it defy a broader industry downturn that battered cheaper commodity chips.

続きを読む »

Breakingviews - Sunken oil tanker merger leaves CEO adriftPromising to lock his main shareholder in a “gilded prison” may not have been the best way to win support for a controversial merger. So now Euronav Chief Executive Hugo De Stoop will not head the $6 billion oil tanker empire that would have resulted from a deal with rival Frontline . The slightly smaller suitor on Monday called off an all-share deal that dated back to last April, when the parties agreed to merge. Shares in Frontline jumped 25% on the cancellation news, while Euronav sank 15%.

Breakingviews - Sunken oil tanker merger leaves CEO adriftPromising to lock his main shareholder in a “gilded prison” may not have been the best way to win support for a controversial merger. So now Euronav Chief Executive Hugo De Stoop will not head the $6 billion oil tanker empire that would have resulted from a deal with rival Frontline . The slightly smaller suitor on Monday called off an all-share deal that dated back to last April, when the parties agreed to merge. Shares in Frontline jumped 25% on the cancellation news, while Euronav sank 15%.

続きを読む »

Breakingviews - First Abu Dhabi and StanChart may have second actTahnoon bin Zayed al-Nahyan may not be done with Standard Chartered . First Abu Dhabi Bank (FAB) , the $50 billion Gulf lender that the brother of the United Arab Emirates’ president chairs, last week said it had considered a bid for the $23 billion UK-listed bank. With StanChart shares still above their pre-speculation level it’s not impossible FAB, 38% owned by state investment fund Mubadala, tries again.

Breakingviews - First Abu Dhabi and StanChart may have second actTahnoon bin Zayed al-Nahyan may not be done with Standard Chartered . First Abu Dhabi Bank (FAB) , the $50 billion Gulf lender that the brother of the United Arab Emirates’ president chairs, last week said it had considered a bid for the $23 billion UK-listed bank. With StanChart shares still above their pre-speculation level it’s not impossible FAB, 38% owned by state investment fund Mubadala, tries again.

続きを読む »

Can the U.S. Bring Chip Manufacturing Home?Microchips are a matter of national security. Is the Biden administration’s $280 billion bill enough to level the chip playing field?

Can the U.S. Bring Chip Manufacturing Home?Microchips are a matter of national security. Is the Biden administration’s $280 billion bill enough to level the chip playing field?

続きを読む »