Technology giants are used to wielding power and influence. Now comes the axe. From Meta Platforms to Snap to Twitter there is a realization that the size of the workforce has gotten too big as an economic slump settles in. Some companies need more of a reset. But mass layoffs in other industries suggests that firms should be careful not to over-fire.

business is notorious for its ruthless firing practices, only to turn around and rapidly overpay for junior analysts when the market returns.

Advertising will snap back and tech giants want to be prepared. Zuckerberg, if he fires too quickly, could lose the edge in employee efficiency. Even Musk, who is in a different boat, was so hasty cutting staff on Friday that managers had to ask dozens to return, according to Bloomberg on Monday. Being mean and lean may sacrifice future growth.Meta Platforms is planning wide-scale layoffs impacting thousands of employees, the Wall Street Journal reported on Nov.

Twitter on Nov. 4 laid off half of its staff, or around 3,700 people, Reuters reported. The company owned by Elon Musk reached out to dozens of employees who lost their jobs to return, Bloomberg reported on Nov. 6, citing people familiar with the matter.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

WSJ News Exclusive | Goldman Sachs, Eager to Grow Cards Business, Courted Credit-Card Technology FirmsExecutives of the Wall Street firm expressed interest in buying a fintech that could help it win more credit card programs.

WSJ News Exclusive | Goldman Sachs, Eager to Grow Cards Business, Courted Credit-Card Technology FirmsExecutives of the Wall Street firm expressed interest in buying a fintech that could help it win more credit card programs.

続きを読む »

Breakingviews - Primark’s price freeze is risky inflation gambitPrimark is breaking with the pack to navigate soaring inflation. The UK high street retailer best known for its throwaway fashion, which is owned by 12 billion pound Associated British Foods , on Tuesday promised to freeze prices over the next year despite rising costs. Its largest rival Inditex , owner of Zara, is taking a different approach by hiking prices over the next year.

Breakingviews - Primark’s price freeze is risky inflation gambitPrimark is breaking with the pack to navigate soaring inflation. The UK high street retailer best known for its throwaway fashion, which is owned by 12 billion pound Associated British Foods , on Tuesday promised to freeze prices over the next year despite rising costs. Its largest rival Inditex , owner of Zara, is taking a different approach by hiking prices over the next year.

続きを読む »

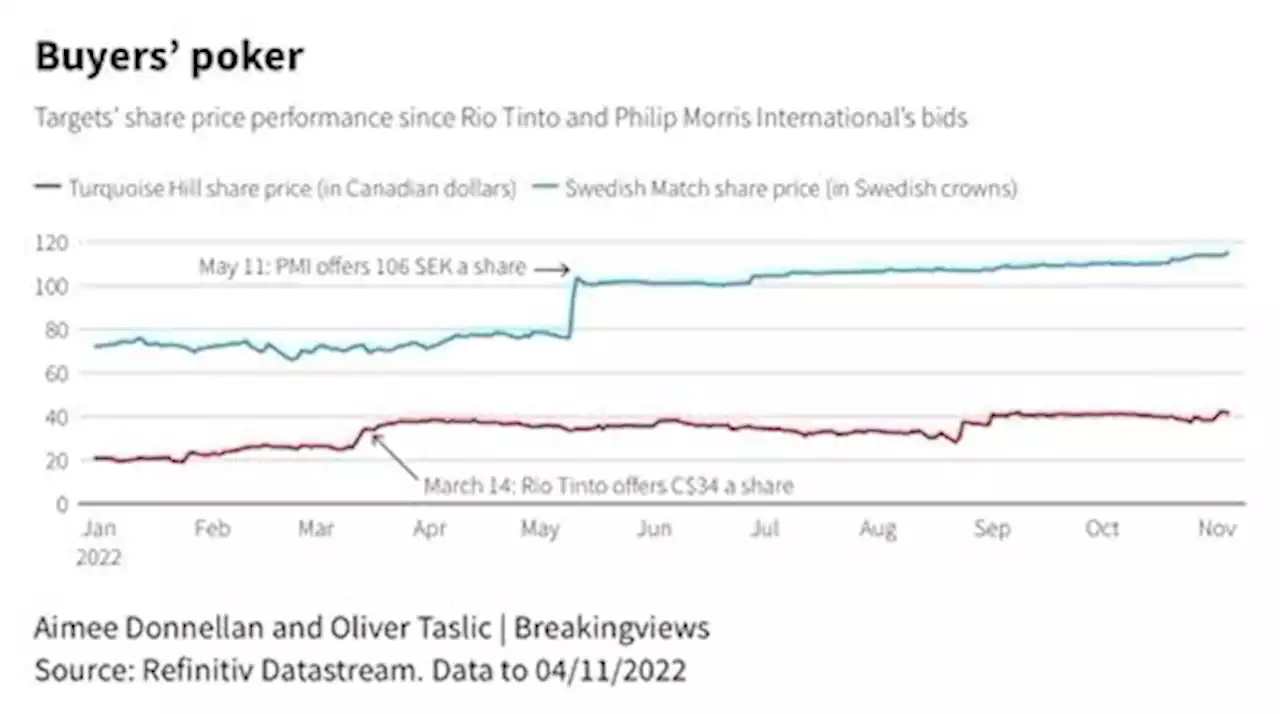

Breakingviews - Philip Morris and Rio’s poker faces need some workJacek Olczak and Jakob Stausholm should probably play more poker. The respective chief executives of $139 billion Philip Morris International and $95 billion Rio Tinto are attempting takeovers that are central to their strategies. They may eventually get what they want, but only after investors have called their bluff.

Breakingviews - Philip Morris and Rio’s poker faces need some workJacek Olczak and Jakob Stausholm should probably play more poker. The respective chief executives of $139 billion Philip Morris International and $95 billion Rio Tinto are attempting takeovers that are central to their strategies. They may eventually get what they want, but only after investors have called their bluff.

続きを読む »

Breakingviews - IPhone plant woes are least of Apple’s problemsThere are many ways to slice Apple . The $2.2 trillion technology giant has warned that woes caused by a Covid-19 outbreak at its supplier, Foxconn , could cut into production. But problems there look pale in comparison to other issues caused by Apple’s own consumers.

Breakingviews - IPhone plant woes are least of Apple’s problemsThere are many ways to slice Apple . The $2.2 trillion technology giant has warned that woes caused by a Covid-19 outbreak at its supplier, Foxconn , could cut into production. But problems there look pale in comparison to other issues caused by Apple’s own consumers.

続きを読む »

Breakingviews - China’s foreign customers leave at worst timeChinese exports shrank 0.3% in October for the first time since May 2020, as softening demand in key U.S. and European markets finally took their toll on a sector that had done much to offset weak domestic demand and tanking property. Officials in Beijing now have the choice between easing up on harsh Covid-19 controls or risking an accelerating downward spiral.

Breakingviews - China’s foreign customers leave at worst timeChinese exports shrank 0.3% in October for the first time since May 2020, as softening demand in key U.S. and European markets finally took their toll on a sector that had done much to offset weak domestic demand and tanking property. Officials in Beijing now have the choice between easing up on harsh Covid-19 controls or risking an accelerating downward spiral.

続きを読む »