Subscribers: Bank economists say U.S. heading toward 'soft landing,' may avoid recession with inflation easing

The White House and the Federal Reserve are grappling with how to deal with inflation.A new forecast from bank economists predicts that the U.S. will avoid a recession over the next two and a half years even as economic growth slows and inflation eases, with the Federal Reserve successfully maneuvering toward a "soft landing."

However, interest rates will remain lofty, and gasoline prices could push a bit higher, according to the report.metro Phoenix led large cities with an 11% inflation rate Recessions typically are defined as two straight quarters of negative growth, and real Gross Domestic Product slipped 1.5% in the first quarter. Recession determinations are made by the National Bureau of Economic Research, often many months later.

"Moreover, 2019, 2020 and 2021 were the highest three years on record for gains in inflation-adjusted wealth per household, which will provide a strong tailwind for the consumer economy," he added.President Joe Biden said he does not believe an economic recession is inevitable in the U.S. Biden, in Tokyo, acknowledged the U.S. economy has “problems” but said they were"less consequential than the rest of the world has.

The nation's unemployment rate will remain consistently at around 3.5% over the next year and a half. That implies a scenario in which job seekers will enjoy many opportunities. Arizona's jobless rate is a bit lower, at 3.2% “It looks like the Federal Reserve will successfully bring inflation down to more tolerable levels in the foreseeable future,” DeKaser said.Still, the economists acknowledged that the Fed could overshoot and usher in a recession. The group sees a 40% chance of a recession in 2023, without providing odds for other years.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Cost of living: Food bank shame drives needy away - studyHaving to prove you are struggling to get a food voucher creates more stigma, research suggests.

Cost of living: Food bank shame drives needy away - studyHaving to prove you are struggling to get a food voucher creates more stigma, research suggests.

続きを読む »

Central Bank of Armenia Urged to Regulate Cryptocurrencies – Regulation Bitcoin NewsCalls have been issued in Armenia for the central bank to do its job and put the country’s crypto space in order.

Central Bank of Armenia Urged to Regulate Cryptocurrencies – Regulation Bitcoin NewsCalls have been issued in Armenia for the central bank to do its job and put the country’s crypto space in order.

続きを読む »

Armed Bank Robbery Suspect Killed in San Bernardino Shootout After High-Speed ChaseA high-speed chase following a bank robbery Thursday afternoon in San Bernardino County ended with a deadly shootout involving sheriff’s deputies.

Armed Bank Robbery Suspect Killed in San Bernardino Shootout After High-Speed ChaseA high-speed chase following a bank robbery Thursday afternoon in San Bernardino County ended with a deadly shootout involving sheriff’s deputies.

続きを読む »

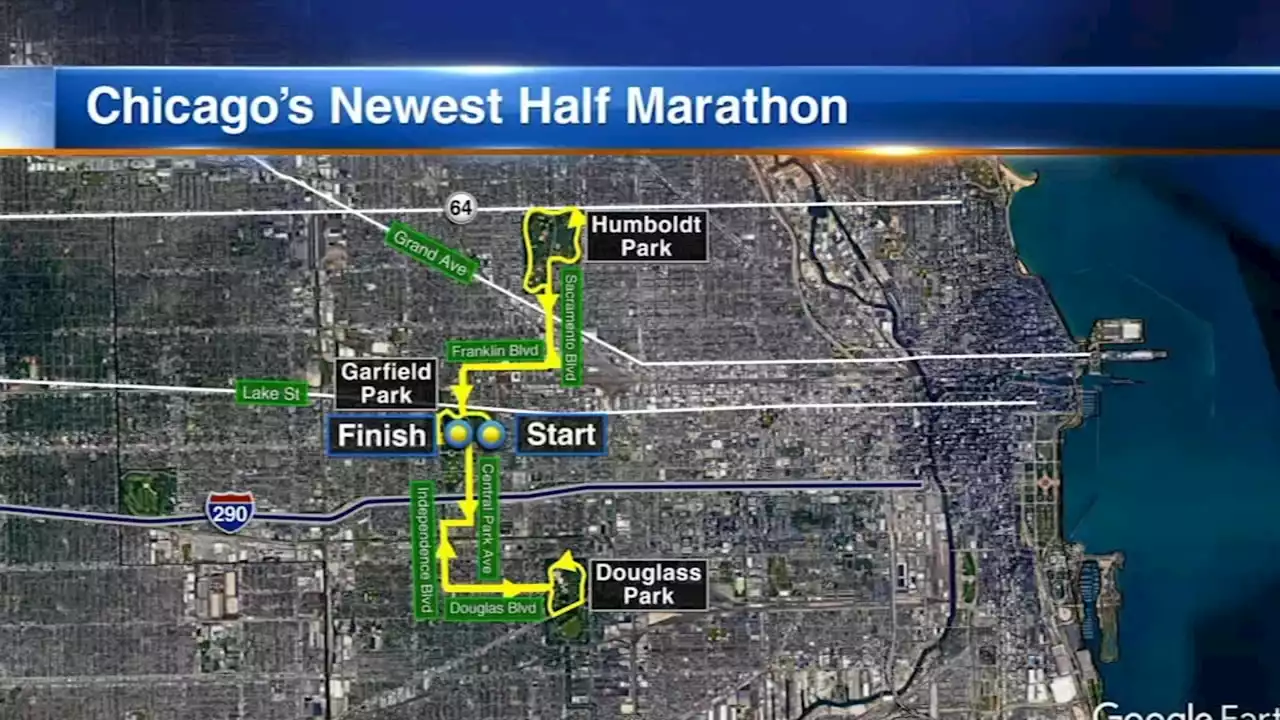

Chicago half marathon 2022: Bank of America 13.1 steps off Sunday in Garfield ParkThe Chicago 13.1 half marathon is this Sunday in Garfield Park.

Chicago half marathon 2022: Bank of America 13.1 steps off Sunday in Garfield ParkThe Chicago 13.1 half marathon is this Sunday in Garfield Park.

続きを読む »

RBI Official: Central Bank Digital Currencies Could Kill Cryptocurrencies – Regulation Bitcoin NewsReserve Bank of India (RBI) Deputy Governor says central bank digital currencies could “kill whatever little case there could be” for cryptocurrencies, like bitcoin and ether.

RBI Official: Central Bank Digital Currencies Could Kill Cryptocurrencies – Regulation Bitcoin NewsReserve Bank of India (RBI) Deputy Governor says central bank digital currencies could “kill whatever little case there could be” for cryptocurrencies, like bitcoin and ether.

続きを読む »

Brazilian central banker describes how CBDC system can halt bank runsCan there be a run on a bank if there are CBDCs? According to an economist at the Central Bank of Brazil, the answer is a bit complicated.

Brazilian central banker describes how CBDC system can halt bank runsCan there be a run on a bank if there are CBDCs? According to an economist at the Central Bank of Brazil, the answer is a bit complicated.

続きを読む »