Fed meeting minutes add to investor unease over the war in Ukraine, coronavirus outbreaks in China and persistent high inflation.

BANGKOK — Asian shares tracked a retreat on Wall Street after details from last month’s Federal Reserve meeting showed the central bank plans to be aggressive in fighting inflation.

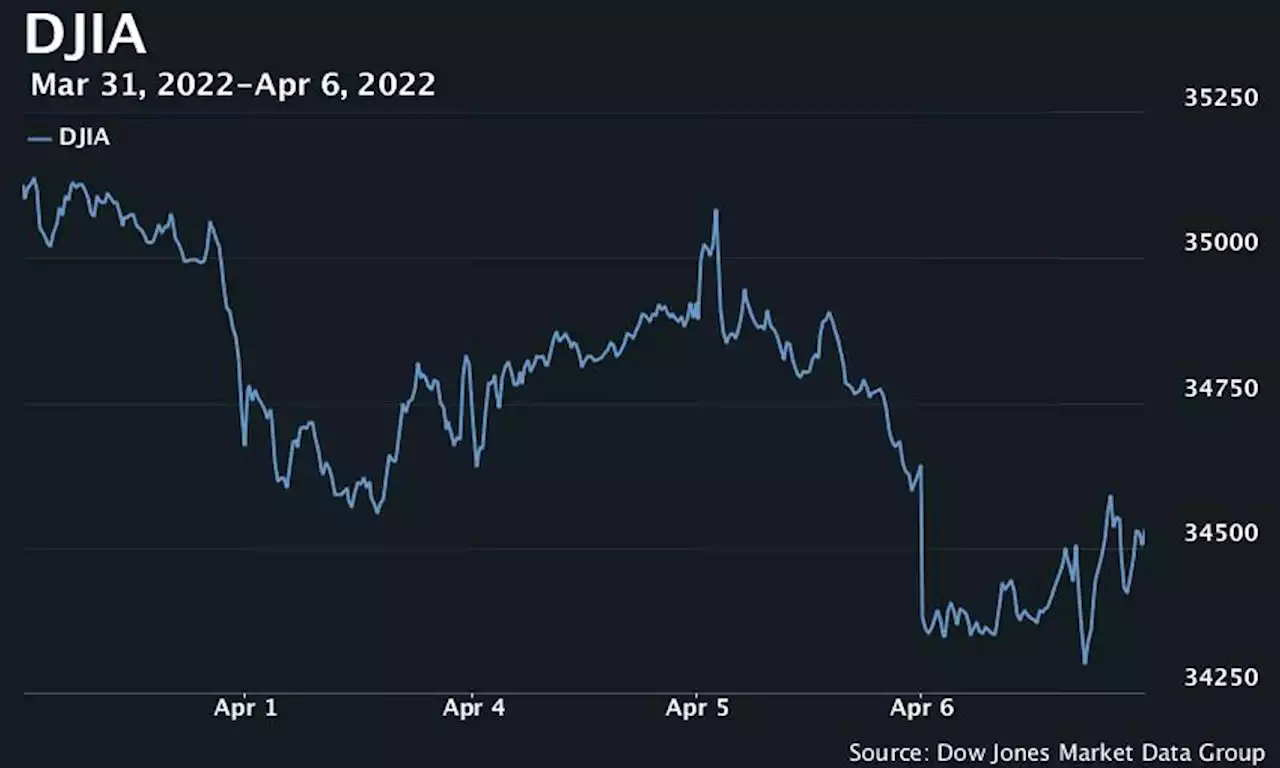

The Fed comments added to investor unease over the war in Ukraine, coronavirus outbreaks in China and persistent high inflation. See: The Fed’s plan to rapidly slash its balance sheet is out. Here’s what happens to money in the system. Overnight, the S&P 500 SPX fell 1% to 4,481.15, adding to its losses from a day earlier. The Dow Jones Industrial Average DJIA dropped 0.4% to 34,496.51 and the tech-heavy Nasdaq COMP lost 2.2% to 13,888.82.Tech stocks were the biggest drag on the benchmark S&P 500. Apple AAPL fell 1.8%, and Microsoft MSFT shed 3.7%.

The yield on the 10-year Treasury note TY00 rose to 2.61% after the release of the minutes, up from 2.54% late Tuesday.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Tech stocks lead indexes lower on Wall Street; eyes on FedStocks fell in morning trading on Wall Street Wednesday and bond yields rose as investors try to estimate how quickly the Federal Reserve will raise interest rates and take other steps to fight inflation

Tech stocks lead indexes lower on Wall Street; eyes on FedStocks fell in morning trading on Wall Street Wednesday and bond yields rose as investors try to estimate how quickly the Federal Reserve will raise interest rates and take other steps to fight inflation

続きを読む »

Nasdaq sinks more than 2% as stocks end lower after Fed minutesStocks ended lower but off their worst levels, with the tech-heavy Nasdaq Composite bearing the brunt of selling pressure for a second session Wednesday. The Dow Jones Industrial Average ended with a loss of around 145 points, or 0.4%, near 34,497.

Nasdaq sinks more than 2% as stocks end lower after Fed minutesStocks ended lower but off their worst levels, with the tech-heavy Nasdaq Composite bearing the brunt of selling pressure for a second session Wednesday. The Dow Jones Industrial Average ended with a loss of around 145 points, or 0.4%, near 34,497.

続きを読む »

Forex Today: Stocks Lower on Hawkish Fed Member BrainerdFOMC Member Brainerd Says Fed to Speed Balance Sheet Shrinking; RBA Signals June Rate Hike; Stocks, Bonds Mostly Lower

Forex Today: Stocks Lower on Hawkish Fed Member BrainerdFOMC Member Brainerd Says Fed to Speed Balance Sheet Shrinking; RBA Signals June Rate Hike; Stocks, Bonds Mostly Lower

続きを読む »

10 South & Southeast Asian Women With Curls Share Their Hair-Care RoutinesWith a mix of traditional ingredients and newer products, these women have found a routine that works to make their natural textures pop, despite a dearth of representation. ⬇️

10 South & Southeast Asian Women With Curls Share Their Hair-Care RoutinesWith a mix of traditional ingredients and newer products, these women have found a routine that works to make their natural textures pop, despite a dearth of representation. ⬇️

続きを読む »