New tools surface to help shoppers and owners assess the soundness of homeowners associations.

reports for 2 ½ years to companies such as title firms, iBuyers and property investment groups.

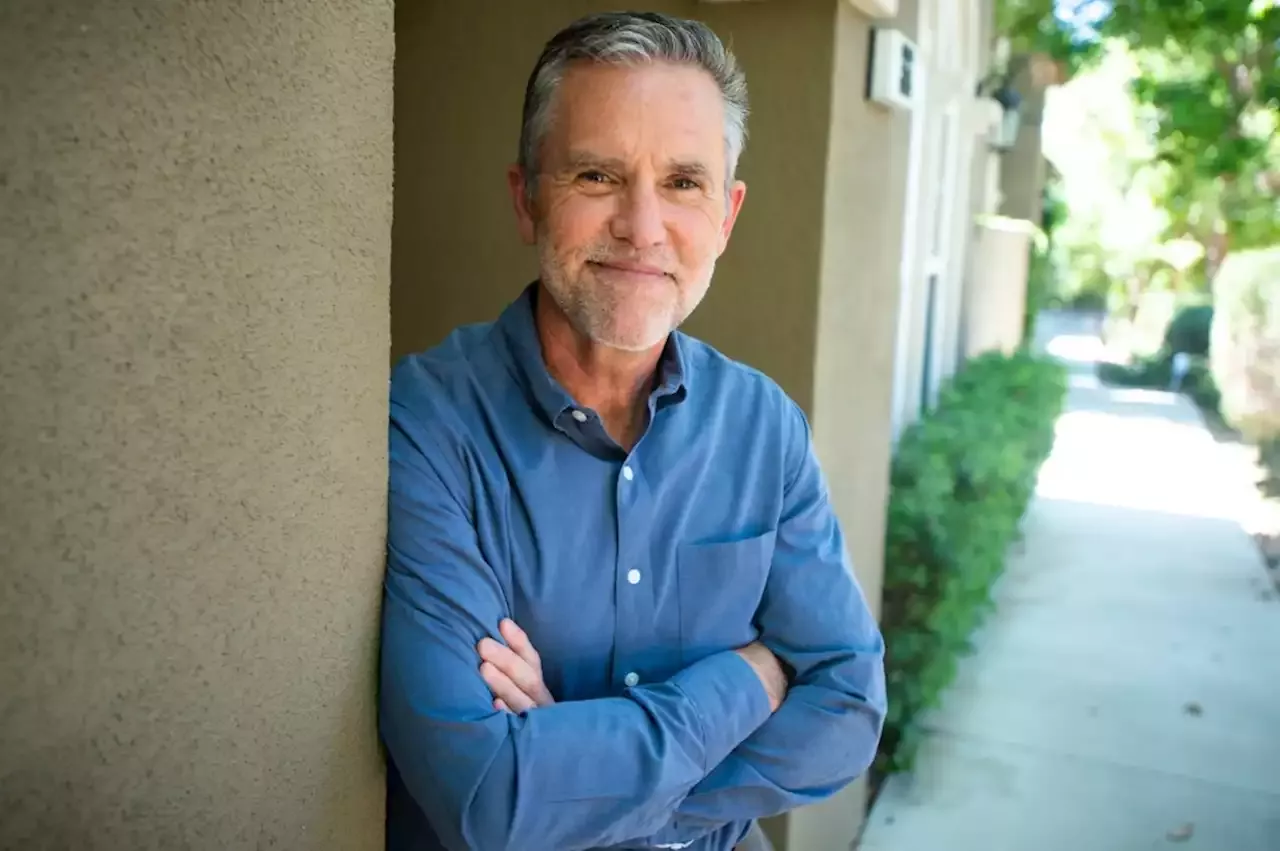

Westlake Village condo complex in Thousand Oaks where Robert Nordlund, founder and CEO of Association Reserves, once lived is seen on Tuesday, June 21, 2022. Nearly a year after the deadly collapse of Champlain Towers South Condos in Florida, Nordlund unveiled a rating system for homeowners associations that functions like a credit score.

But agents and product providers say association documentation, which can range up to 300 pages or more, often comes late in the escrow process and is so daunting, many buyers don’t read it. Report providers say their products can help shoppers assess an association’s risk of a future special assessment, which are paid on top of monthly dues.

Roughly half of HOAs have adequate reserves to pay for necessary maintenance as their buildings age, Nordlund said. Condo owners tend to elect board members who promise to keep monthly dues in check, often undermining an association’s financial soundness.