EUR/USD Price Analysis: Bears eye a break of 1.0960s for prospects of fresh cycle lows By ross_burland EURUSD Technical Analysis

As illustrated, the price is correcting the last bearish impulse and bears are moving in.EUR/USD has broken below trendline support but has since formed a sideways channel following a restest of the counter trendline. The bears will need to break support at which point, there will be prospects of a downside continuation and fresh cycle lows.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

AUD/USD bears move in on the 0.75 area, eyes on a significant correctionAfter moving up from a low of 0.7494, AUD/USD ended on Friday in the 0.75 area during markets that were mixed on Friday. AUD continues to benefit from

続きを読む »

First-Time Home Buyers, Inventory Expected To Rebound In 2024The housing market is expected to return to pre-pandemic, 2019 norms — at least in terms of inventory and the share of purchases made by first-time home buyers — by 2024, according to a panel of housing market experts

First-Time Home Buyers, Inventory Expected To Rebound In 2024The housing market is expected to return to pre-pandemic, 2019 norms — at least in terms of inventory and the share of purchases made by first-time home buyers — by 2024, according to a panel of housing market experts

続きを読む »

First-Time Home Buyers, Inventory Expected To Rebound In 2024The housing market is expected to return to pre-pandemic, 2019 norms — at least in terms of inventory and the share of purchases made by first-time home buyers — by 2024, according to a panel of housing market experts

First-Time Home Buyers, Inventory Expected To Rebound In 2024The housing market is expected to return to pre-pandemic, 2019 norms — at least in terms of inventory and the share of purchases made by first-time home buyers — by 2024, according to a panel of housing market experts

続きを読む »

Gold Price Forecast: XAU/USD finishes the week with gains near 1.80%, around $1950sGold (XAU/USD) is set to finish Friday’s session on a lower note, but the week reclaimed some of its brightness, gaining 1.79% as market sentiment flu

Gold Price Forecast: XAU/USD finishes the week with gains near 1.80%, around $1950sGold (XAU/USD) is set to finish Friday’s session on a lower note, but the week reclaimed some of its brightness, gaining 1.79% as market sentiment flu

続きを読む »

Dogecoin signals bottoming out as DOGE rebounds 30% in two weeks — What's next?DOGE's price could swell by more than 150% on a classic bullish reversal setup known as the falling wedge.

Dogecoin signals bottoming out as DOGE rebounds 30% in two weeks — What's next?DOGE's price could swell by more than 150% on a classic bullish reversal setup known as the falling wedge.

続きを読む »

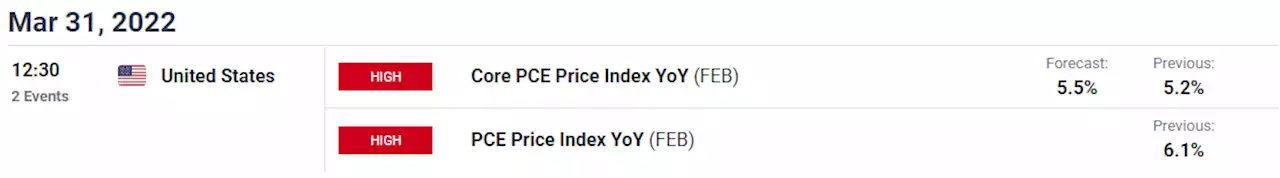

Gold Price Eyes Yearly High with US PCE Price Index on TapData prints coming out of the US may fuel the recent advance in the price of gold as the Fed’s preferred gauge for inflation is expected to increase for the sixth consecutive month. Get your weekly gold forecast from DavidJSong here:

Gold Price Eyes Yearly High with US PCE Price Index on TapData prints coming out of the US may fuel the recent advance in the price of gold as the Fed’s preferred gauge for inflation is expected to increase for the sixth consecutive month. Get your weekly gold forecast from DavidJSong here:

続きを読む »